Iran Bitcoin Import Calculator

Mining Input

Result Summary

- 1 BTC = 1,000 kWh energy (approximate)

- 1 household = 20 kWh/day (typical)

- Bitcoin price = $27,000 (current estimate)

When international sanctions cut off Iran from global banking systems, the country didn’t just sit back. It built a new financial pipeline-using Bitcoin.

How Bitcoin Became Iran’s Workaround for Sanctions

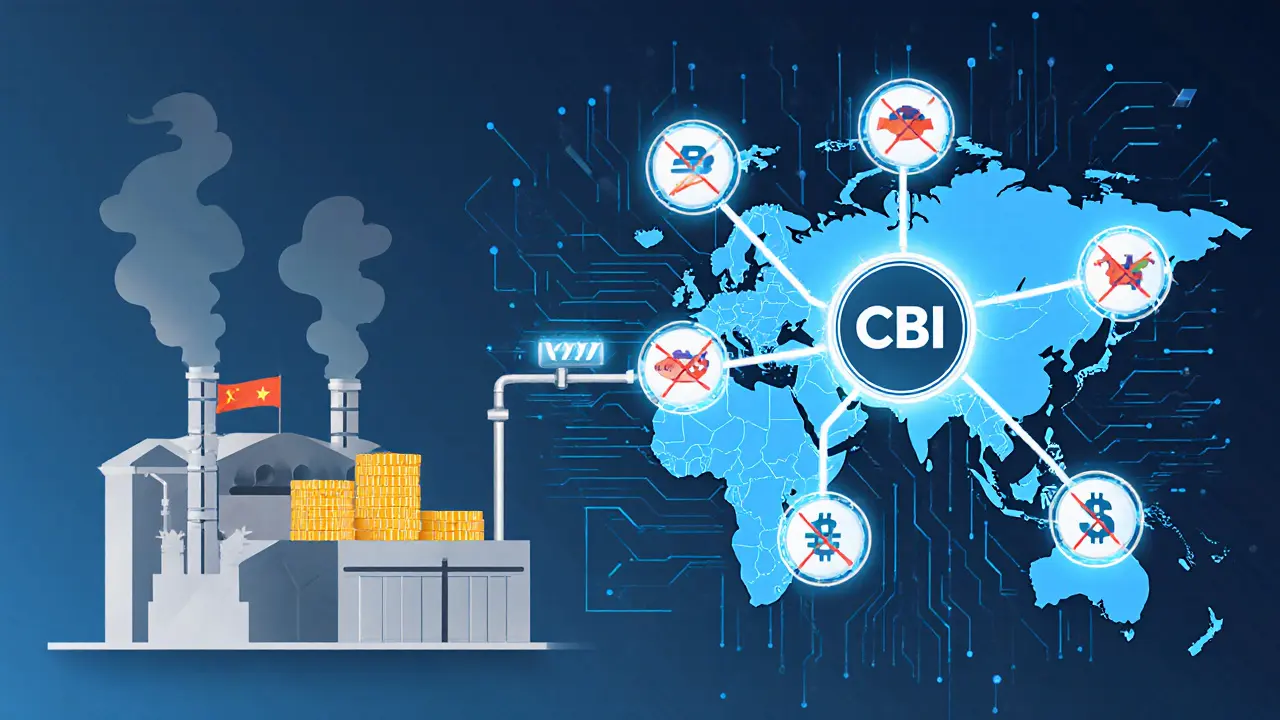

Iran’s economy has been under heavy sanctions for years. Banks in Europe, the U.S., and even parts of Asia refused to process transactions involving Iranian companies. Imports of medicine, machinery, and even food became harder to pay for. Traditional methods-wire transfers, letters of credit, dollar-based trade-were blocked. So Iran turned to something no one expected: Bitcoin. It wasn’t about speculation. It wasn’t about replacing the rial. It was about survival. Starting in 2018, Iran began legalizing cryptocurrency mining. Why mining? Because it didn’t require foreign currency. All you needed was electricity and hardware. Iran had cheap power-especially in remote areas where electricity was underpriced or unmonitored. Mining Bitcoin became a way to turn excess energy into a tradable asset. By 2022, over 10,000 licensed mining farms were operating. Some were small. Others were massive. One 175-megawatt facility in Rafsanjan, run by an IRGC-linked company and Chinese partners, used as much power as a small city. These weren’t hobbyists. These were state-backed operations. The twist? The Central Bank of Iran (CBI) still bans Bitcoin for domestic payments. You can’t buy a phone or pay your electricity bill with it. But here’s the loophole: miners can sell their Bitcoin to state-approved channels. And those channels? They’re used to pay for imports.The Two-Tier System: Mine Here, Pay Abroad

Iran didn’t just let anyone trade crypto. It built a controlled system. Miners must register with the Ministry of Industry and get electricity quotas from the Iran Power Generation Company. They can’t mine in homes. Only industrial-scale farms are allowed. The coins they mine go to state-approved pools. Then, the CBI authorizes the export of those coins to foreign counterparties. This isn’t peer-to-peer trading. It’s a pipeline: electricity → Bitcoin → import payments. In August 2023, Iran made its first documented import using cryptocurrency: a $10 million order for industrial equipment. The payment was sent via a crypto exchange, bypassing SWIFT and U.S.-controlled banks. Since then, Iranian firms have moved over $8 billion through Binance alone to buy goods from Russia, Turkey, and China. The goal? To trade without dollars. To settle deals using digital assets that can’t be frozen by foreign governments.Who’s Really Running the Mining Farms?

The Islamic Revolutionary Guard Corps (IRGC) didn’t just participate in crypto mining-they took control of it. By 2020, reports showed that IRGC-linked entities, religious foundations like Astan Quds Razavi, and other state-affiliated groups were operating the largest mining farms. These groups got priority access to electricity. They ignored bills. They used protected infrastructure-sometimes even military bases-to run their servers. These aren’t private businesses. They’re state enterprises with armed protection. When the government cracked down on illegal miners in 2021, it didn’t shut down the big ones. It arrested small-time operators using subsidized home power. The real players? They kept running. This created a hidden tax on Iranian citizens. While factories in Tehran shut down due to blackouts, crypto farms kept humming. In 2024, nationwide power outages lasted up to 12 hours in major cities. The government blamed drought and mismanagement. Independent investigators pointed to crypto mining as the real culprit.

Trade Partners: Who’s Buying Iran’s Bitcoin?

Iran didn’t build this system alone. It made alliances. In 2018, Iran signed a bilateral crypto cooperation agreement with Russia. The two countries started trading oil, grain, and weapons using Bitcoin and other cryptocurrencies. Russia, itself under sanctions, had the same problem: no access to Western banking. Bitcoin became the bridge. Iran also negotiated with seven other countries-including Germany, Switzerland, and South Africa-to use crypto for trade. These weren’t just talks. They led to actual transactions. Iranian exporters received payments in Bitcoin. Foreign suppliers received Bitcoin. No banks. No intermediaries. No sanctions. The system works because it’s not about anonymity. It’s about control. Iran doesn’t want untraceable crypto. It wants traceable, state-approved crypto. Every transaction must be documented. Every miner must follow KYC rules. The CBI keeps a ledger of every coin that leaves the country.The Energy Crisis: A Hidden Cost

Bitcoin mining uses a lot of electricity. Iran’s grid was never built for this. The country’s power plants, mostly gas and coal, were already stretched thin. Now, mining farms were pulling 5-7% of the national grid’s output. In some provinces, up to 15% of electricity went to crypto operations. The result? Daily blackouts. Factories stopped. Hospitals ran on generators. Families waited hours for lights to come back on. The government tried to fix it. They raised electricity prices for miners. They cut quotas. But enforcement was uneven. State-linked farms kept getting priority. Private miners? They got fined or shut down. By 2025, experts estimate that crypto mining consumes as much energy as 12 million households. That’s more than the entire population of New Zealand.

Is This Sustainable? The Risks and Limits

Bitcoin isn’t magic. It doesn’t erase sanctions. It just moves the friction. For Iranian importers, the process is slow. Getting CBI approval for a crypto transaction can take days. The exchange rate fluctuates wildly. One day, $1 million in Bitcoin buys 500 machines. The next day, it buys 400. There’s also the risk of being cut off from exchanges. Binance, once Iran’s main gateway, has faced pressure from Western regulators. In 2024, it temporarily froze accounts linked to Iranian entities. Iran had to scramble to find alternatives-private over-the-counter (OTC) desks, decentralized exchanges, even blockchain-based smart contracts. And then there’s the long-term problem: Bitcoin’s energy use. As mining gets harder, the power needed per coin goes up. Iran’s cheap electricity won’t last forever. The government knows this. That’s why they’re now investing in solar-powered mining farms in desert regions.What This Means for Global Trade

Iran’s experiment isn’t just about survival. It’s a blueprint. Other sanctioned nations-Venezuela, North Korea, Belarus-are watching. If Bitcoin can help Iran import medicine and spare parts, why not them? This isn’t about crypto becoming the new dollar. It’s about bypassing the dollar’s gatekeepers. Iran proved you can trade without SWIFT. You can pay without banks. You can import without permission. The world thought sanctions were ironclad. Iran showed they’re not.What Comes Next?

Iran isn’t planning to abandon crypto. It’s doubling down. By 2025, the country expects to generate $1.9 billion in revenue from mining. It’s building new mining zones with dedicated power lines. It’s negotiating with China and Russia to create a regional crypto trade network. It’s even exploring blockchain-based smart contracts to automate import payments. But the biggest question remains: can Iran keep the lights on? If the power grid collapses, the whole system falls. If global exchanges cut ties, the pipeline dries up. If the U.S. cracks down harder, Bitcoin becomes harder to move. For now, Iran’s Bitcoin trade works. Not because it’s perfect. But because it’s the only thing that does.Can Iranians use Bitcoin to buy things locally?

No. The Central Bank of Iran bans Bitcoin for domestic payments. You can’t use it to pay for groceries, rent, or phone bills. The government allows mining and cross-border trade, but not everyday use. This is to prevent capital flight and protect the value of the rial.

Why does Iran allow Bitcoin mining but not spending?

Because mining turns cheap electricity into a foreign currency asset. Iran can’t earn dollars through oil exports due to sanctions, so it mines Bitcoin instead. Then, it sells that Bitcoin to buy imports. Allowing local spending would risk inflation and undermine the state’s control over the financial system.

How much Bitcoin does Iran mine each year?

Iran produces nearly 5% of all new Bitcoin globally. By 2024, the country was mining over $1 billion worth of Bitcoin annually. That’s more than most nations’ entire GDP. Most of this Bitcoin is exported, not held domestically.

Is Iran’s crypto system legal under international law?

International law doesn’t ban cryptocurrency use. But U.S. sanctions prohibit U.S. entities from engaging in transactions with Iranian entities. So while Iran’s system isn’t illegal per se, it violates U.S. sanctions. That’s why exchanges like Binance have faced fines and pressure to cut off Iranian accounts.

Can other countries copy Iran’s model?

Yes, but only if they have cheap energy and strong state control. Countries like Russia and Venezuela are testing similar systems. But without state-backed mining farms and centralized control over crypto flows, the model won’t work. It’s not just about Bitcoin-it’s about who controls the infrastructure.

Author

Ronan Caverly

I'm a blockchain analyst and market strategist bridging crypto and equities. I research protocols, decode tokenomics, and track exchange flows to spot risk and opportunity. I invest privately and advise fintech teams on go-to-market and compliance-aware growth. I also publish weekly insights to help retail and funds navigate digital asset cycles.