As of 2026, owning or trading cryptocurrency in China is illegal. Not just discouraged. Not just unregulated. Illegal. If you’re holding Bitcoin, Ethereum, or any other digital token inside China, you’re doing so without legal protection - and risking serious consequences.

This wasn’t always the case. Back in 2017, China was one of the biggest crypto markets in the world. Miners ran massive farms in Sichuan and Inner Mongolia. Traders flooded platforms like Huobi and OKEx. The government watched, experimented, and even launched its own blockchain research projects. But by June 1, 2025, everything changed. A new rule, Circular No.237, made every form of cryptocurrency activity - trading, mining, owning, even promoting - a criminal offense.

What’s Actually Banned?

The 2025 ban doesn’t just shut down exchanges. It targets every single link in the crypto chain. Here’s what’s illegal now:

- Buying, selling, or exchanging any cryptocurrency for yuan or foreign currency

- Operating or using cryptocurrency exchanges, even if they’re based overseas

- Mining Bitcoin or other coins - all hardware must be shut down or removed

- Providing price data, wallet services, or trading advice for crypto

- Accepting crypto as payment for goods or services

- Running marketing campaigns, YouTube channels, or social media accounts promoting crypto in China

- Issuing or participating in token sales (ICOs, NFTs, etc.)

Even if you’re just holding crypto in a wallet - say, a few Bitcoin you bought before the ban - you’re not breaking the law by simply owning it. But if you try to trade it, cash it out, or use it to pay someone, you’re in violation. And if authorities find out, your assets can be seized. Courts won’t help you recover lost funds from scams. In fact, they’ll refuse to hear your case because the underlying transaction was illegal from the start.

Why Did China Go So Far?

China didn’t wake up one day and decide to ban crypto because it didn’t like the idea. It was a calculated move tied to control.

First, there’s the digital yuan - the state-backed central bank digital currency (e-CNY). Launched in pilot form in 2020, it’s now active in over 200 cities. Unlike Bitcoin, the digital yuan is fully traceable. Every transaction is logged. The government knows who paid whom, when, and for what. It’s the opposite of privacy-focused crypto. And China wants everyone using it.

Second, crypto was seen as a threat to financial stability. Authorities feared people would move money out of the banking system, bypass capital controls, or use anonymous tokens to launder money. In 2021, a single mining operation in Sichuan used more electricity than the entire country of Belgium. That kind of energy drain was unacceptable - especially with China’s carbon neutrality goals.

Third, crypto challenged the state’s monopoly on money. In China, the People’s Bank of China controls the currency. Crypto, by design, doesn’t answer to anyone. That’s not just inconvenient - it’s dangerous in a system built on top-down control.

So China made a choice: crush private digital money. And replace it with a state-controlled version.

What About Blockchain?

Here’s the twist: blockchain is still encouraged. The government doesn’t hate the technology. It just hates the decentralized part.

State-backed blockchain projects are everywhere. Shanghai’s data exchange launched the first data asset-backed financing instrument (RDA) in late 2024 - a blockchain-based system where companies can use their data as collateral for loans. Beijing is testing blockchain for supply chain tracking in agriculture. Hangzhou uses it for land registry records.

The message is clear: “Use blockchain for control. Not for freedom.”

What Happens If You Get Caught?

Penalties vary depending on scale and intent.

If you’re a regular person who bought a few thousand dollars’ worth of crypto and held it - you might get a warning, a fine, or have your bank account frozen. Banks are required to flag any crypto-related transactions. If you try to transfer money to a foreign exchange, the system blocks it automatically.

If you’re running a mining farm or operating a crypto trading bot - you’re looking at criminal charges. In 2023, a miner in Inner Mongolia was sentenced to three years in prison for “illegal business operations.” His equipment was confiscated, and his profits were seized as “illicit gains.”

Foreigners aren’t exempt. If you’re a tourist with crypto in your wallet, you won’t be arrested on the spot. But if you try to use it to pay for a hotel, or open a local crypto exchange account, you could be detained. Visa renewals and residency permits may be denied. And if you’re caught laundering money through crypto, you’ll face serious jail time.

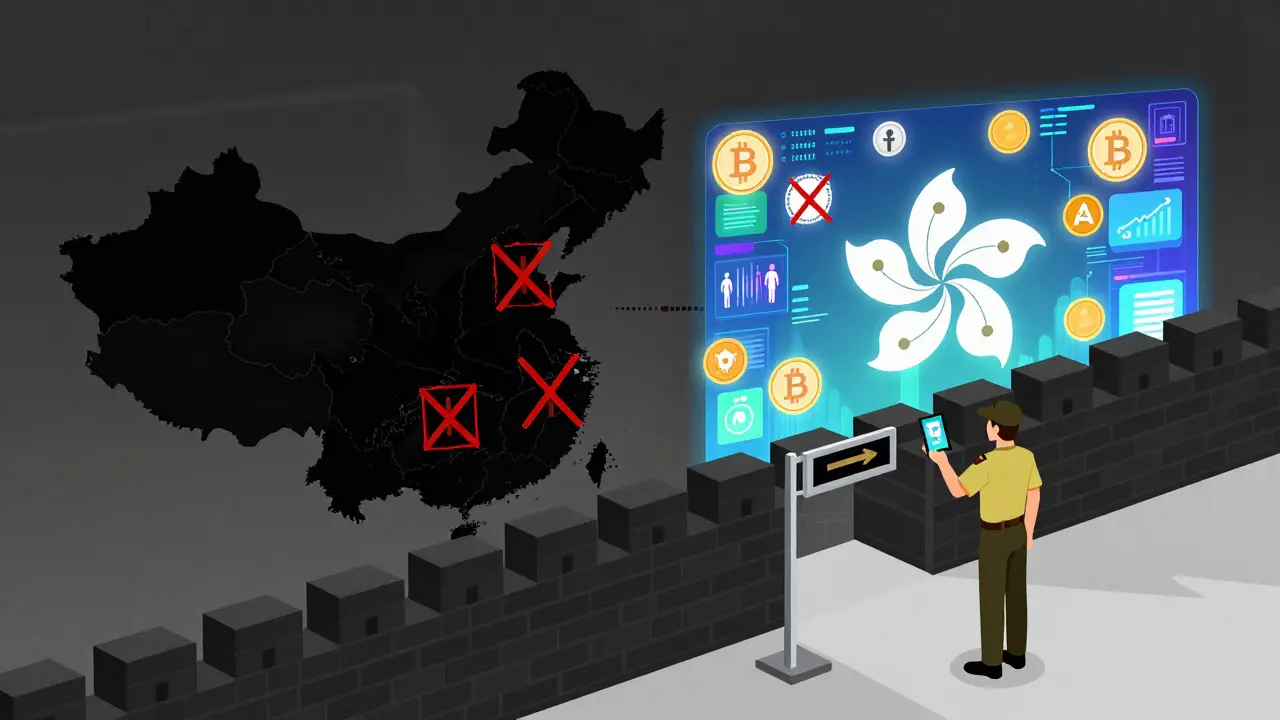

What About Hong Kong?

Hong Kong is different. It’s part of China, but it operates under its own legal system. In May 2025, Hong Kong passed the Stablecoin Bill, creating a licensing regime for stablecoin issuers. Companies like Circle and Tether can now legally operate there - as long as they follow strict reserve and audit rules.

This isn’t a loophole. It’s a strategy. China is letting Hong Kong serve as a controlled gateway for international finance - while keeping the mainland completely closed. It’s a two-tier system: one for global business, one for total control.

Is There Any Hope for Change?

Not anytime soon.

There’s been no sign of policy reversal. No official statements suggesting relaxation. The government’s narrative hasn’t changed: crypto = financial risk. Digital yuan = national progress.

Even the tech sector - once a hub for crypto innovation - has fully pivoted. Alibaba, Tencent, and Baidu all shut down their crypto research teams by 2023. Developers now work on blockchain for logistics, not DeFi. Startups that once raised millions in crypto now pitch to state-backed venture funds using digital yuan.

China’s goal isn’t to regulate crypto. It’s to erase it.

What Should You Do?

If you live in China: Don’t touch crypto. Not even as a curiosity. Don’t buy. Don’t trade. Don’t mine. Don’t even download a wallet app. The risk isn’t worth it.

If you’re a foreign business: Don’t market crypto services to Chinese customers. Even if your website is hosted overseas, if it’s accessible in China and targets Chinese users, you’re violating the law. No license exists for this. No gray area. No exceptions.

If you’re an investor: Understand that China’s ban isn’t temporary. It’s structural. It’s tied to the future of money in the world’s second-largest economy. Any strategy that assumes China will open up again is based on wishful thinking, not reality.

China didn’t just ban cryptocurrency. It redefined the rules of money. And it’s not backing down.

Author

Ronan Caverly

I'm a blockchain analyst and market strategist bridging crypto and equities. I research protocols, decode tokenomics, and track exchange flows to spot risk and opportunity. I invest privately and advise fintech teams on go-to-market and compliance-aware growth. I also publish weekly insights to help retail and funds navigate digital asset cycles.