Infinitar (IGT) was supposed to be the next big thing in blockchain gaming - a MOBA where you earn real money by playing 3v3 or 5v5 battles, just like Mobile Legends but with crypto rewards. Launched in October 2024 after a $9 million funding round, it promised players a way to turn skill into income. Today, that dream is nearly gone. The IGT token, which once hit $0.68, is now trading around $0.00025. That’s a 99.96% drop. If you bought in at launch, you’d need to win over 400 matches just to break even on your time - and even then, you’d earn less than a dollar a day.

What exactly is Infinitar (IGT)?

Infinitar is a multiplayer online battle arena (MOBA) game built on Ethereum. Its native token, IGT (Infinitar Governance Token), is an ERC-20 token used for voting on game updates, staking for rewards, and paying for in-game items. Unlike traditional games, Infinitar uses a dual-token system: IGT for governance and INF for everyday gameplay like buying skins, battle passes, or upgrading your hero.

The total supply of IGT is fixed at 1 billion tokens. Here’s how they were distributed at launch:

- 40% - 400 million tokens for Play-to-Earn rewards

- 30% - 300 million for ecosystem development

- 15% - 150 million for private investors

- 12.5% - 125 million for the development team

- 2.5% - 25 million for advisors

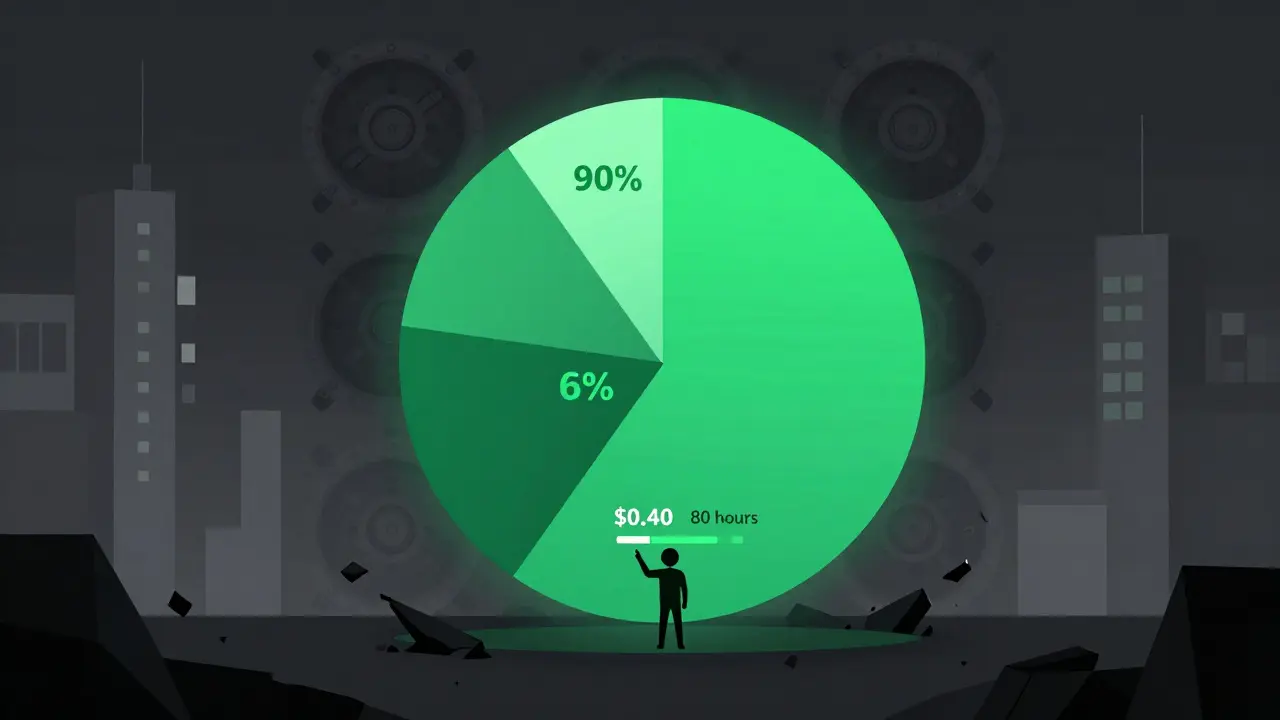

Only about 61-75 million IGT tokens were in circulation at launch. That means over 90% of the supply was locked up, waiting to be released over time - mostly as rewards to players. The idea was simple: keep players engaged, and as they earned more tokens, the value would grow.

Why did IGT crash so hard?

The crash wasn’t random. It was baked into the design.

Infinitar promised players they could earn IGT by winning matches. But the math never worked. At its peak, a player might earn 10-20 IGT per win. At $0.68, that was $6-$13 in value - enough to make it worth playing after work. By late 2025, the same reward was worth less than $0.01. Players weren’t quitting because the game was bad - they quit because it paid nothing.

Then there’s the team’s token holding. The developers still control 125 million IGT tokens - over 12% of the entire supply. That’s more than the entire circulating supply at launch. With no clear vesting schedule made public, players have no way to know when those tokens might hit the market. And when they do? More selling pressure.

On top of that, the token has no real utility outside the game. You can’t use IGT to buy anything else. It doesn’t pay dividends. It doesn’t stake into a liquid pool with high APY. The only reason to hold it was the hope that the game would get popular. And it didn’t.

How does Infinitar compare to other GameFi games?

Compare Infinitar to Axie Infinity. At its peak, Axie had over 1 million monthly players. Infinitar never cracked 50,000. Axie had a clear economy: players bred Axies, sold them, and earned tokens. Infinitar just had battles - and no real way to scale earnings.

Even The Sandbox, which lets you buy virtual land and build games, has 200,000 active landowners. Infinitar has no land, no NFTs you can trade, no metaverse. Just a MOBA with a crypto wallet attached.

And the numbers tell the story. As of January 2026:

- IGT market cap: $109,596 (Binance) - down from $17.7 million in 2024

- 24-hour trading volume: $5,260 - barely enough to move the price

- Ranking: #3519 on LiveCoinWatch - below 99.9% of all crypto projects

For context, a single popular NFT collection can have more daily volume than IGT. This isn’t a failing project. It’s a dead one.

What’s the current state of the Infinitar community?

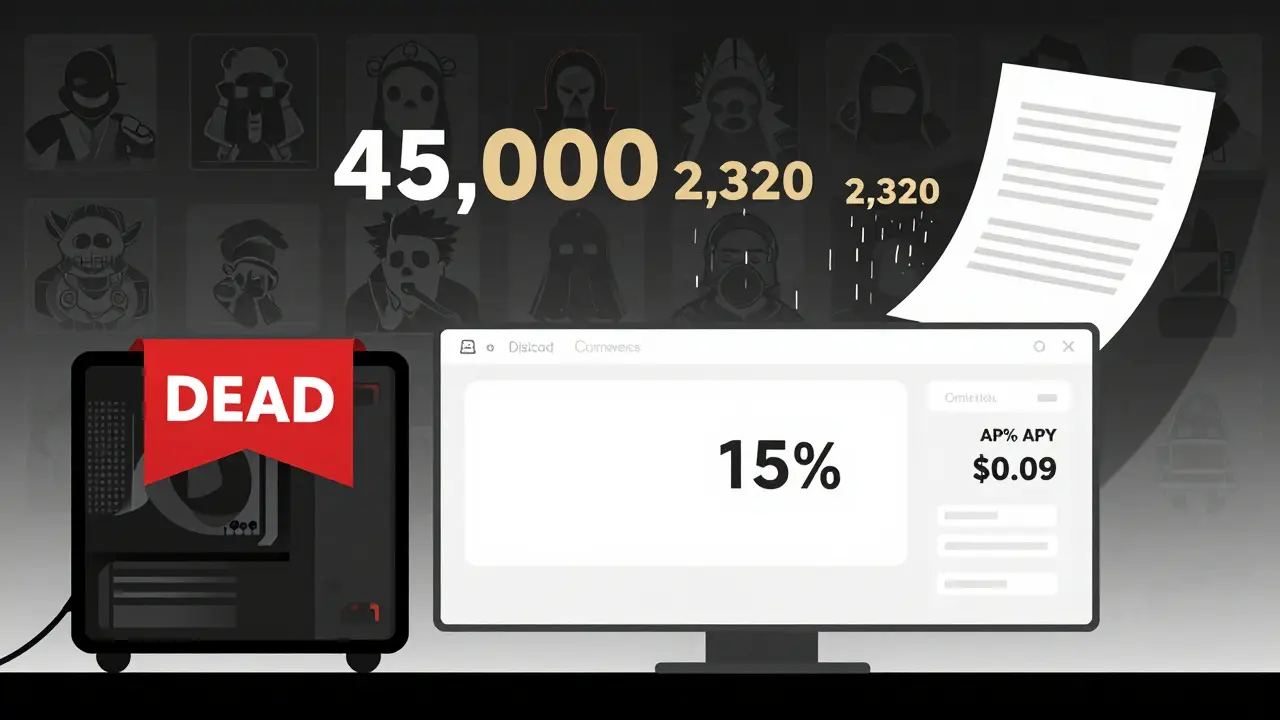

The Discord server, which had 45,000 members at launch, now has under 2,300 active users. That’s a 95% drop. Reddit threads are filled with complaints: “I played 80 hours and earned $0.40.” “The whitepaper promised rewards. They didn’t deliver.” “The devs are silent.”

On Trustpilot, the rating is 2.1/5 based on just 17 reviews - but every single one mentions token value loss. One user wrote: “I believed the hype. I bought IGT. I lost everything. Don’t trust GameFi that doesn’t show real player numbers.”

Even early adopters who got Genesis NFTs - which gave them bonus tokens - say it’s pointless now. “I got 500 IGT at launch,” said one user on Discord. “Worth $340 then. Worth $0.13 now. I keep it as a reminder of how not to invest.”

Is staking IGT still worth it?

Yes, you can stake IGT. The platform says you earn rewards by locking your tokens. But here’s the catch: the APY is meaningless when the token is worth pennies.

Let’s say you stake 10,000 IGT. At $0.00025 each, that’s $2.50. Even if you earned 15% APY - which is generous - you’d make about 375 IGT in a year. That’s $0.09. You’d need to stake $1,000 worth of IGT to make $3.60 a year. And you’d have to trust the team won’t dump their 125 million tokens next week.

Plus, the token has a burning mechanism - meaning a small portion of fees are destroyed. That sounds good on paper. But if no one is trading, no one is paying fees. So the burn doesn’t happen. The deflationary promise is just a line in the whitepaper.

Can Infinitar recover?

Technically, yes. But realistically? No.

To get back to just $0.01 per IGT - still far below its peak - the token would need to rise 40x. To restore the original play-to-earn value, it would need to go up 400x. That’s not a recovery. That’s a miracle.

And there’s no sign of a miracle. The GitHub repo hasn’t had a major update since November 2025. The team hasn’t posted a roadmap update. No partnerships. No new features. No marketing. Just silence.

Even the funding round that was supposed to be their lifeline - $9 million - has vanished. There’s no public accounting of how that money was spent. No breakdown of salaries, server costs, or marketing spend. That’s not just bad. It’s suspicious.

Should you buy IGT now?

No.

Not if you’re looking to play. The rewards are worthless. The game isn’t fun enough to justify the time without earning. And if you’re looking to invest? You’re betting on a team that’s gone quiet, a token with no demand, and a project that’s lost 99.96% of its value.

There are hundreds of crypto games with better economics, active communities, and real traction. Infinitar isn’t one of them. It’s a cautionary tale - not a play-to-earn opportunity.

If you already own IGT, your only real options are to hold it (and accept the loss) or sell it and cut your losses. Staking won’t save you. Waiting won’t help. The game is over. The only question left is whether you want to admit it.

Author

Ronan Caverly

I'm a blockchain analyst and market strategist bridging crypto and equities. I research protocols, decode tokenomics, and track exchange flows to spot risk and opportunity. I invest privately and advise fintech teams on go-to-market and compliance-aware growth. I also publish weekly insights to help retail and funds navigate digital asset cycles.