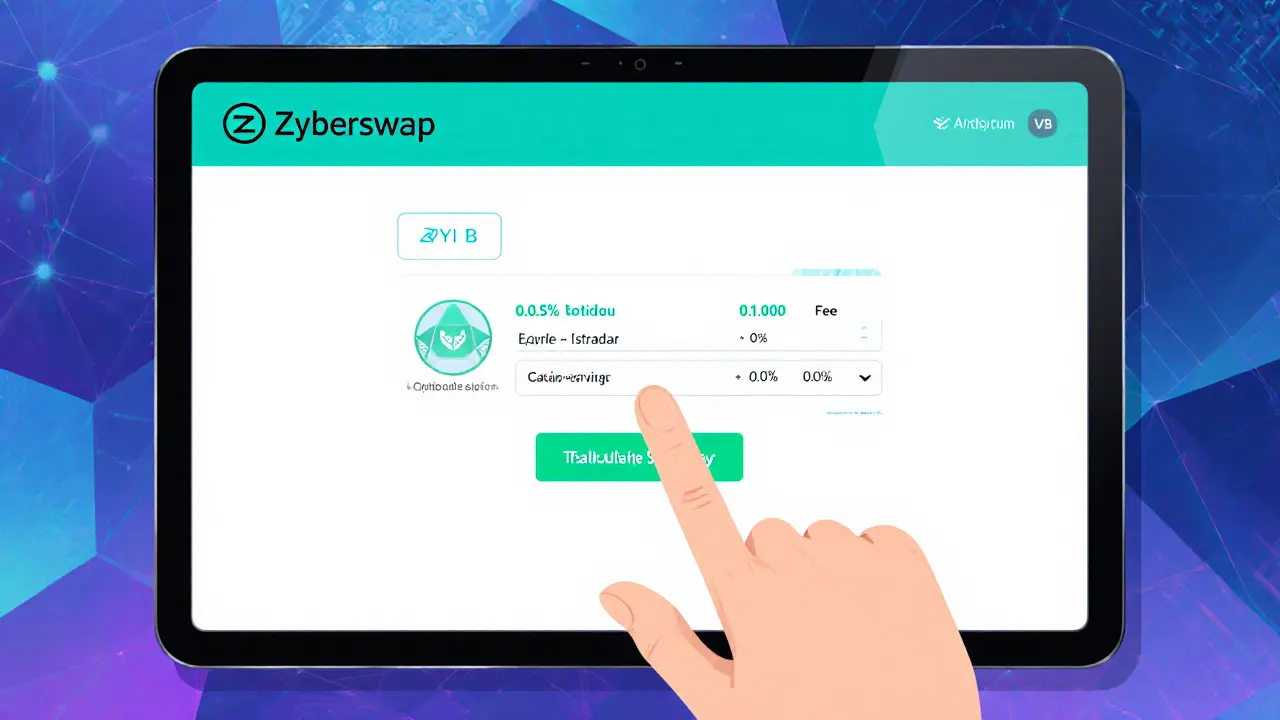

Zyberswap v3 Fee Calculator

Estimated Weekly Savings

Zyberswap v3: 0.05% total fee (0.04% + 0.01% protocol fee)

Uniswap v3: 0.30% standard fee

SushiSwap: 0.30% fee

PancakeSwap: 0.25% fee

With Zyberswap v3

Weekly fees: $0.00

Annual fees: $0.00

With Uniswap v3

Weekly fees: $0.00

Annual fees: $0.00

Potential Annual Savings

By switching to Zyberswap v3, you could save approximately $0.00 per year.

Quick Takeaways

- Runs on Arbitrum, offering fast, cheap trades.

- Charges some of the lowest fees in the DEX space.

- Native token ZYB powers staking and governance.

- 24‑hour volume is modest (≈$24K), limiting liquidity.

- Interface is beginner‑friendly, but token pairs are limited.

When you hear the name Zyberswap v3 is a decentralized exchange (DEX) that uses an automated market‑maker (AMM) model on the Arbitrum Layer‑2 chain. It launched as a fair‑launch platform with its own governance token, ZYB, and markets itself as the lowest‑fee DEX for Arbitrum users. Below you’ll get a deep dive into how the platform actually performs, what you get for your money, and whether it’s worth a spot in your trading toolbox.

What Zyberswap v3 Is Built On

The core of Zyberswap v3 is an AMM contract suite that mirrors the logic of early Uniswap versions but is optimized for Arbitrum’s roll‑up technology. Arbitrum processes transactions off‑chain and posts compressed proofs to Ethereum, slashing gas costs dramatically-often under $0.01 per trade. This makes Zyberswap v3 a good fit for traders who want Ethereum‑level security without the exorbitant fees.

Key technical components include:

- Smart contracts that enforce trade execution and liquidity pool rules.

- Liquidity pools that hold pairs of ERC‑20 tokens on Arbitrum.

- A native governance token, ZYB, used for voting on protocol upgrades and for staking rewards.

- Integration with popular Web3 wallets (MetaMask, Trust Wallet, etc.) for seamless connectivity.

Feature Set at a Glance

Beyond the basics of swapping, Zyberswap v3 offers a handful of add‑ons that aim to differentiate it from the crowded DEX landscape:

- Low‑fee model: The protocol claims a base fee of 0.04% (plus a 0.01% protocol fee), which is noticeably lower than Uniswap’s 0.30% standard rate.

- Staking & yield farming: Users can lock ZYB or LP tokens to earn rewards advertised as “among the most lucrative on Arbitrum.” Exact APY numbers vary by pool.

- Community governance: Token‑holder votes decide on fee adjustments, new token listings, and contract upgrades.

- Arbitrum‑native routing: Trades stay on the Layer‑2 network, avoiding cross‑chain bridges that add latency and risk.

Trading Volume and Liquidity

As of the latest snapshot (Oct2024), Zyberswap v3’s 24‑hour trading volume hovered around $24,334 with virtually no BTC‑equivalent activity. By contrast, Uniswap routinely processes $1‑2billion daily. This volume gap translates into thinner order books and higher slippage on larger trades.

Unfortunately, publicly available Total Value Locked (TVL) figures are sparse. The platform’s own UI reports “high liquidity for a variety of cryptocurrencies,” but without concrete numbers it’s hard to benchmark against rivals. For traders moving small amounts (under $5,000), the liquidity is usually sufficient; for institutional‑sized orders, the risk of price impact grows sharply.

Fee Structure Compared to Other DEXs

Here’s a quick rundown of fee tiers across popular DEXs (base fee + protocol fee, where applicable):

- Zyberswap v3: 0.04% + 0.01% = 0.05% total

- Uniswap v3: 0.05%‑0.30% (depends on pool fee tier)

- SushiSwap: 0.30% (0.25% LP fee + 0.05% treasury)

- PancakeSwap (BSC): 0.25% (0.17% LP + 0.08% platform)

If you’re swapping modest amounts, Zyberswap v3’s fee advantage can add up to several dollars per week-a tangible saving for active traders.

Tokenomics and Governance

The ZYB token currently sits around rank #3466 on CoinMarketCap, with a circulating supply of roughly 100million tokens. Distribution was a “fair launch,” meaning no pre‑minted allocation for founders or venture backers. Holders can stake ZYB directly on the platform to earn a share of protocol fees, or they can provide liquidity in ZYB‑paired pools for higher yields.

Governance proposals are submitted through a simple UI and require a quorum of 1% of total supply to pass. Recent proposals have focused on adding new token pairs and tweaking fee parameters, indicating an active, though relatively small, community.

Pros and Cons

Every platform has trade‑offs. Below is a concise list to help you decide if Zyberswap v3 fits your strategy.

- Pros

- Ultra‑low fees ideal for frequent, small‑scale trading.

- Fast, cheap Arbitrum transactions keep costs predictable.

- Simple UI that welcomes newcomers to DeFi.

- Fair‑launch token model aligns with decentralization ethos.

- Cons

- Limited token listings (≈30 pairs) restrict diversification.

- Low daily volume leads to higher slippage on larger orders.

- TVL and liquidity metrics are not transparently disclosed.

- No fiat on‑ramps; you must already hold crypto on Arbitrum.

Getting Started in 5 Steps

- Install a Web3 wallet (MetaMask recommended) and add the Arbitrum network.

- Bridge ETH or USDC from Ethereum to Arbitrum using the official bridge.

- Visit zyberswap.io and click “Connect Wallet.”

- Select your desired token pair, set slippage tolerance (usually 0.5‑1%), and confirm the swap.

- If you hold ZYB, navigate to the “Stake” tab to begin earning protocol fee rewards.

Keep an eye on gas prices during peak network usage; even on Arbitrum, congestion can push fees higher than the quoted 0.01%.

How Zyberswap v3 Stacks Up Against the Big Guys

| Platform | Chain | 24h Volume (USD) | Base Fee | Token Listings | TVL (USD) |

|---|---|---|---|---|---|

| Zyberswap v3 | Arbitrum | 24,334 | 0.04% | ≈30 | ~$2M (estimate) |

| Uniswap v3 | Ethereum L1 | 1.3B | 0.05‑0.30% | ≈5,000 | ~$5B |

| SushiSwap | Multi‑chain | 210M | 0.30% | ≈2,800 | ~$1B |

| PancakeSwap | Binance Smart Chain | 190M | 0.25% | ≈1,500 | ~$800M |

Numbers illustrate why Zyberswap v3 excels on price but lags on depth. If your strategy hinges on tight spreads and low fees, Zyberswap shines. If you need deep order books for large positions, a bigger DEX may be safer.

Frequently Asked Questions

Is Zyberswap v3 safe to use?

The platform runs on audited smart‑contract code and has not suffered any major hacks to date. However, as with any DeFi protocol, there is inherent smart‑contract risk, so only deploy funds you can afford to lose.

Do I need to hold ZYB to trade?

No. ZYB is only required for staking and governance. Swaps can be performed with any ERC‑20 token on Arbitrum.

How do I add a new token pair?

New pairs are added through community proposals. Token holders submit a proposal, and if it reaches quorum, it is voted on. Successful proposals trigger a contract call that creates the liquidity pool.

What gas fees should I expect?

On Arbitrum, typical transaction fees range from $0.001 to $0.01, far lower than Ethereum L1. Peaks can push fees up to $0.03, still cheap compared to mainnet.

Can I withdraw my liquidity at any time?

Yes. Liquidity providers can remove their LP tokens whenever they wish, but they may incur a small withdrawal fee (usually 0.01%). The value returned depends on pool performance and price movement.

Overall, Zyberswap v3 delivers a niche but compelling proposition: ultra‑low fees on a fast Layer‑2 network. Its modest volume and limited token roster keep it from being a one‑stop shop, yet for traders focused on cost‑effective swaps and community governance, it’s worth a look.

Author

Ronan Caverly

I'm a blockchain analyst and market strategist bridging crypto and equities. I research protocols, decode tokenomics, and track exchange flows to spot risk and opportunity. I invest privately and advise fintech teams on go-to-market and compliance-aware growth. I also publish weekly insights to help retail and funds navigate digital asset cycles.