EDOGE Token Value Calculator

Calculate Your Token Value

See how much your ElonDoge tokens are worth today based on the current market price.

Your Token Value

Note: EDOGE is worth less than a penny today. The 2021 airdrop offered $20,000 worth of tokens. Your current value depends on the price you entered.

What This Means

The ElonDoge airdrop was a short-lived campaign from 2021. Most tokens are now worth less than a penny. The price you see here is based on current market conditions (as of late 2023).

Remember: Airdrop tokens don't automatically have value. They're marketing tools for projects that often disappear after the airdrop. Always check if a project has active development, community engagement, and clear utility before holding tokens long-term.

EDOGE tokens are still listed on CoinMarketCap and PancakeSwap, but the project is inactive with no real-world utility. This calculator shows you the current market value, but remember that many airdrop tokens become worthless over time.

Back in June 2021, if you were checking CoinMarketCap for crypto updates, you might’ve seen a pop-up offering free EDOGE tokens. It wasn’t a scam. It was the ElonDoge x CoinMarketCap Mission airdrop - a short-lived but flashy campaign that promised $20,000 worth of tokens to users who completed a few simple tasks. Five days. No deposit. Just sign up, learn a bit, and get paid in meme coins. At the time, it felt like free money. Today? Most of those tokens are worth less than a penny - literally.

What Was the ElonDoge Airdrop?

The ElonDoge (EDOGE) airdrop was a partnership between a then-new memecoin project and CoinMarketCap, the biggest crypto data site in the world. The goal? Get people to notice EDOGE. CoinMarketCap, known for tracking prices and volumes, used its massive audience to push this obscure token into the spotlight. The campaign ran for five days and required users to complete a short quiz about ElonDoge, then confirm their wallet address. In return, they got a slice of the $20,000 EDOGE token pool. It wasn’t unique. Back in 2021, every other week, a new meme coin dropped an airdrop through CoinMarketCap. Dogecoin had just hit $0.70. Shiba Inu was exploding. And suddenly, every Elon Musk tweet had a new token attached to it. ElonDoge was one of dozens. But it had one thing others didn’t: CoinMarketCap’s seal of approval. That made it feel legit.How Did EDOGE Tokens Work?

ElonDoge wasn’t just one token. It had two: EDOGE and EDAO. EDOGE was the main memecoin - the one handed out in the airdrop. It had a total supply of 1 quadrillion tokens. That’s 1,000,000,000,000,000. The idea? Low price per token = high perceived value. If one token costs $0.000000004163 today, you’d need over 240 billion of them to make a single dollar. Sounds ridiculous? That’s the meme. Then there’s EDAO - the governance token. This one was never airdropped. Only 100,000 were created at launch, and 2% went into liquidity on PancakeSwap. EDAO gave holders voting rights on things like NFT auctions, partnerships, and which new tokens got listed on the ElonFuel launchpad. It was supposed to be the backbone of a real ecosystem - not just a joke coin. But here’s the problem: no one used it. The DAO never held a real vote. The NFT marketplace never launched. The ElonFuel launchpad? Still dormant. EDAO exists as a ghost token - listed, but inactive.Why Did CoinMarketCap Do This?

CoinMarketCap didn’t just hand out free money. They were running a learning campaign. The quiz wasn’t filler - it was designed to teach users what memecoins were, how blockchain wallets worked, and why decentralization mattered. That’s part of their broader "learn and earn" strategy. They’ve done similar things with USDT, NFTs, and even their own "CoinMarketCap Diamonds." For them, it was marketing. For ElonDoge, it was survival. Without CoinMarketCap’s traffic, EDOGE would’ve vanished in weeks. With it, they got thousands of wallets, a listing, and a brief moment in the sun. But here’s what they didn’t say: CoinMarketCap doesn’t endorse projects. They don’t vet them. They just list them. And in 2021, they listed everything.What Happened After the Airdrop?

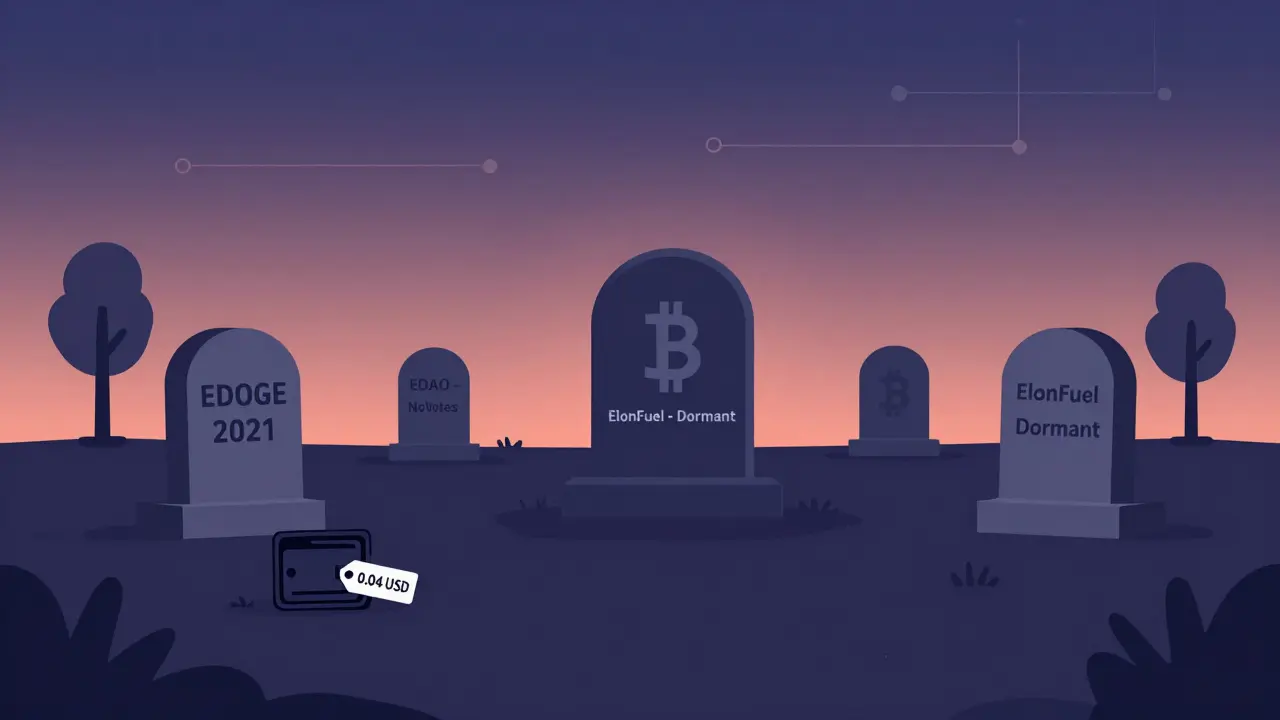

The hype died fast. Within two months, trading volume for EDOGE dropped below $500 per day. By early 2022, it was under $100. Today, the 24-hour volume hovers around $12. That’s not a market. That’s a graveyard. Compare it to other Doge-style tokens from the same era. MOONDOGE still trades with $2,400 in daily volume. Doge-1 Mission to the Moon has over 2,000 holders and a $124,000 market cap. EDOGE? It has fewer than 500 active wallets. And the price? So low that even if you held 10 billion tokens, you’d still only have 4 cents. The reason? No utility. No team updates. No roadmap. No community building. Just a one-time airdrop and silence. Most people who got EDOGE in 2021 sold it within days. A few held on, hoping for a comeback. That hope is gone now. The token isn’t dead - it’s still listed on CoinMarketCap and PancakeSwap - but it’s functionally irrelevant.

Is There Any Value Left in EDOGE or EDAO?

Technically? Yes. You can still trade it. You can still send it. You can still check its price. But practically? No. EDOGE has no use case. No exchange lists it for fiat pairs. No wallet supports it for payments. No merchant accepts it. It doesn’t even have a website anymore - the original domain expired in 2023. EDAO is even worse. It was meant to be the governance engine of the ElonDoge ecosystem. But there’s no voting portal. No proposals. No treasury. No activity. It’s just a token with a name and a supply. If you still have EDOGE or EDAO in your wallet? You’re holding digital dust. Not a scam, exactly - you got what was promised. But the promise was never to build something lasting. It was to get attention.What Can You Learn From This Airdrop?

This isn’t just a story about a failed memecoin. It’s a lesson in how crypto airdrops work - and why most of them fail. First: Free tokens don’t equal value. Airdrops are marketing tools, not investments. If a project gives you tokens for free, they’re not trying to reward you - they’re trying to get you to spread the word. Second: Always check the team. Was there a whitepaper? A GitHub? Real names? ElonDoge had none. Just a Twitter account and a CoinMarketCap listing. Third: Look at volume, not price. A token at $0.000000001 might sound cheap. But if no one’s buying or selling it, it’s worthless. Real markets move. Ghost tokens just sit. Fourth: Don’t trust CoinMarketCap’s listings as endorsements. They list thousands of tokens. Most are trash. Their job is to show data - not judge quality. And finally: If a project doesn’t update for more than 90 days after an airdrop, walk away. No updates = no future.Where Is ElonDoge Now?

As of December 2025, ElonDoge exists only as a listing on CoinMarketCap and PancakeSwap. No team posts. No community groups. No new features. The last social media update was in March 2022. The EDAO token still has a contract address. The EDOGE token still has a blockchain record. But the project? It’s gone. It’s not unusual. Over 80% of meme coin airdrops from 2021 have faded into obscurity. Most never had a plan beyond the first tweet. ElonDoge was just one of them.

Should You Still Claim EDOGE Tokens?

No. The airdrop ended in June 2021. The claim window closed. Even if you find a site claiming to still distribute EDOGE, it’s a scam. The real campaign is long over. If someone tells you they can send you free EDOGE now? It’s fake. Don’t click. Don’t connect your wallet. Don’t send any crypto to "unlock" it. You’ll lose everything. The only way to get EDOGE today is to buy it on PancakeSwap - and even then, you’re paying for a token with no future. The price is so low, you’ll pay more in gas fees to trade it than the token is worth.What Are Better Alternatives Today?

If you’re looking for real airdrops in 2025, don’t chase meme coins. Look for projects with:- Active development teams

- Public GitHub repositories

- Clear tokenomics and utility

- Partnerships with established platforms (like Coinbase, Kraken, or Ledger)

- Regular updates and community engagement

Author

Ronan Caverly

I'm a blockchain analyst and market strategist bridging crypto and equities. I research protocols, decode tokenomics, and track exchange flows to spot risk and opportunity. I invest privately and advise fintech teams on go-to-market and compliance-aware growth. I also publish weekly insights to help retail and funds navigate digital asset cycles.