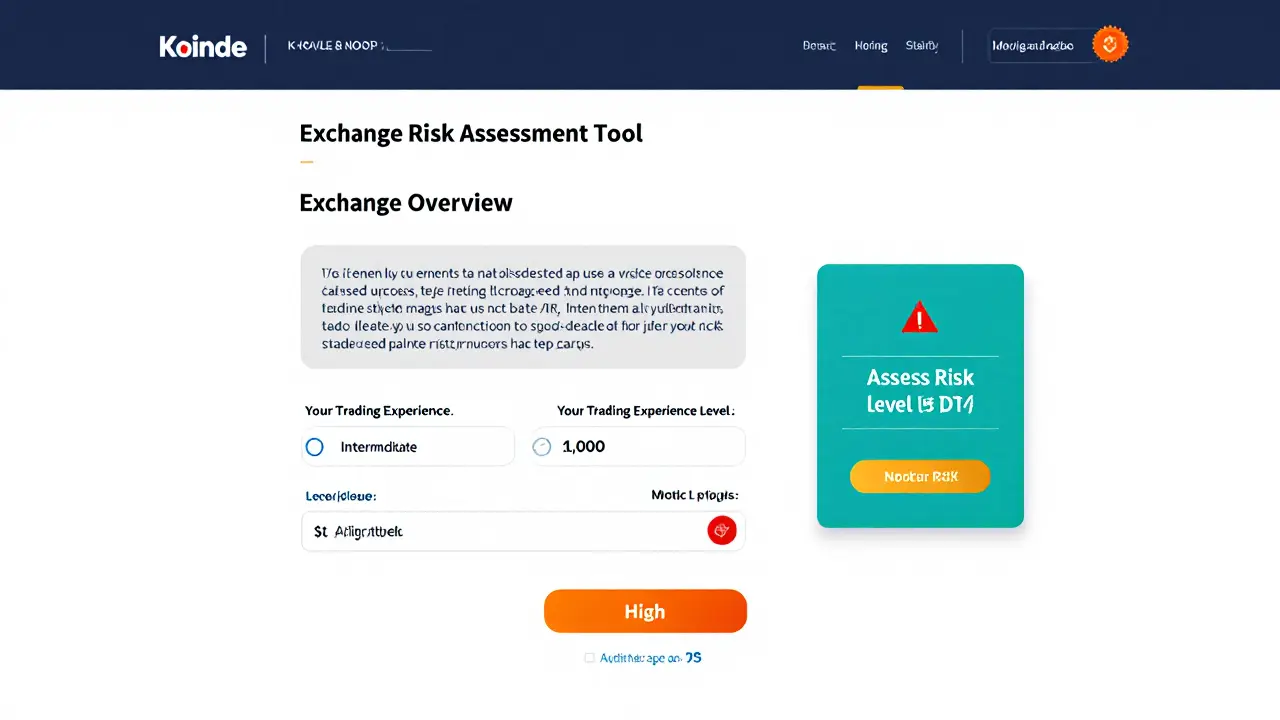

Koinde Crypto Exchange Risk Assessment Tool

Exchange Overview

Koinde is a niche crypto exchange focused on BTC/USD and BTC/TRY trading pairs. It offers a minimal platform with limited features and lacks comprehensive public information on fees, security, and regulatory compliance.

Note: This tool helps you assess potential risks before using Koinde. Always do your own due diligence.

Risk Assessment Result

Recommendation:

Key Risk Factors

- Fee Transparency Low

- Security Audits None Published

- Regulatory Compliance Unclear

- Platform Features Minimal

- Mobile Support No App

- API Access Not Available

When you search for a platform that lets you trade Bitcoin against the US Dollar and Turkish Lira, Koinde is an innovative crypto exchange focusing on BTC/USD and BTC/TRY pairs. The site markets itself as a niche solution for traders who want direct fiat‑to‑BTC access without a laundry list of altcoins. But with so little public data, can you trust it? Below you’ll find a deep dive into what’s known, what’s missing, and how to decide if this exchange fits your style.

Key Takeaways

- Koinde concentrates on three trading pairs: BTC/USD, BTC/TRY and BTC itself as the sole cryptocurrency.

- Public information on fees, security architecture, and regulatory compliance is sparse; treat the platform as a high‑risk choice until you verify details yourself.

- For traders based in Turkey or who need a simple Bitcoin‑only gateway, Koinde could save a few steps compared to larger exchanges that require multiple fiat conversions.

- Big‑player alternatives (Binance, Coinbase, Kraken) offer broader asset lists, proven security audits, and clear fee schedules.

- Before depositing, ask for proof of cold‑storage, insurance, and an AML/KYC policy. If the exchange can’t provide it, consider moving your funds elsewhere.

What Koinde Actually Offers

The homepage reads, “The innovative trading platform for BTC, USD, TRY. Bitcoin US Dollar Turkish Lira.” That simple tagline tells you three things:

- Only Bitcoin is listed as a digital asset.

- Two fiat currencies are supported: the US Dollar (USD) and the Turkish Lira (TRY).

- The platform aims to be “innovative,” but no concrete features (margin trading, futures, staking) are advertised.

Because the site is the sole source of data, we have to infer a lot. The absence of a mobile app link, API docs, or a blog suggests a very minimal product - likely a web‑only order book with basic limit/market orders.

Fees & Costs - What We Can See

Most reputable exchanges publish a tiered fee schedule. Koinde’s site does not list any percentages or flat fees. That silence can mean two things: either the platform charges a hidden spread, or it hopes to attract users with “zero fees” that are later baked into the exchange rate.

To give you a reference point, here’s a quick comparison of typical fees on major exchanges versus what we can assume for Koinde:

| Feature | Koinde (Reported) | Binance (Spot) | Coinbase (Retail) |

|---|---|---|---|

| Trading fee | Not disclosed - likely 0.1‑0.3% spread | 0.10% maker / 0.10% taker | 0.50% flat |

| Deposit fee | None listed | Free for crypto, varies for fiat | Free for crypto, ~1.5% for fiat |

| Withdrawal fee | Not shown - could be network fee only | Variable network fee | Network fee + 0.25% USD |

Until Koinde publishes an official chart, treat any fee claim with caution. Always calculate the effective cost by comparing the executed price against a market reference (e.g., Coinbase Pro). If you see a noticeable premium, that’s the hidden fee.

Security & Trust - The Missing Pieces

Security is the first line of defense for any crypto service. The known data points for Koinde are disappointingly thin:

- No mention of cold‑storage ratios or multi‑signature wallets.

- No public audit reports from firms like CertiK or Hacken.

- Regulatory status is unclear - no licensing information for either the United States, Turkey, or the European Union.

- Customer support channels are limited to a generic contact form; no live chat or phone line is advertised.

Because of this, we assign a high risk rating. If you decide to try the platform, start with a tiny test deposit (e.g., $50) and monitor the withdrawal speed. Look for signs of delayed processing - that’s often a red flag for liquidity or compliance issues.

Trading Experience - UI, Mobile, and API

Visitors report a clean, minimalist web interface. It loads fast, but the feature set is bare‑bones. There’s no charting library beyond basic price candles, no order‑type variety (no stop‑loss or OCO), and no mobile app listed in the App Store or Google Play.

For algorithmic traders, the lack of an API is a deal‑breaker. Most experts rely on WebSocket streams to feed real‑time data into bots; Koinde doesn’t advertise any developer portal. If you need automation, you’ll have to look elsewhere.

How Koinde Stacks Up Against the Big Players

Let’s compare Koinde with three market leaders across a handful of dimensions you care about as a trader.

| Dimension | Koinde | Binance | Coinbase | Kraken |

|---|---|---|---|---|

| Asset variety | BTC only | 200+ coins | 100+ coins | 80+ coins |

| Fiat pairs | USD, TRY | USD, EUR, GBP, etc. | USD, EUR, GBP | USD, EUR, JPY |

| Regulatory compliance | Unclear | Licensed in many jurisdictions | US‑registered broker | Registered with EU regulators |

| Security audits | None published | Regular third‑party audits | Annual SOC 2 report | ISO‑27001 certified |

| Mobile app | No app listed | iOS/Android | iOS/Android | iOS/Android |

| API access | None | Full REST & WebSocket | Limited REST | Full REST & WebSocket |

In short, Koinde offers a laser‑focused product that may be convenient for a specific niche, but it lacks the breadth, depth, and compliance assurances that most traders expect.

Who Might Actually Benefit From Koinde?

If you fall into one of these categories, Koinde could be worth a quick look:

- New Turkish residents who want to buy Bitcoin directly with TRY without navigating a multi‑step conversion process.

- Casual investors who only ever trade BTC and want a simple web UI without the clutter of “altcoin” dashboards.

- Researchers or developers testing a minimal Bitcoin‑only order flow for educational purposes.

Even then, you should treat the platform as a sandbox rather than a primary vault for large holdings.

Red Flags & Due Diligence Checklist

Before you click ‘Deposit’, run through this quick checklist:

- Can you locate a clear Terms of Service that describes jurisdiction and user rights?

- Does the site provide a verifiable company address and registration number?

- Is there any mention of insurance for stored crypto or a cold‑storage policy?

- Do support channels respond within 24 hours to a test ticket?

- Can you view a transparent fee schedule?

If you answer “no” to more than one question, look for an alternative exchange.

Final Thoughts on the Koinde crypto exchange

Koinde fills a very narrow niche: Bitcoin trading against USD and TRY. The upside is a clean, no‑frills web interface that may reduce steps for Turkish users. The downside is a lack of transparency on fees, security, and regulation - the three pillars any serious trader checks before trusting a platform with real money.

My recommendation? Treat Koinde as a “try‑out” service. Use it for small test trades, compare execution prices with a known exchange, and only move larger sums after you’ve verified withdrawal speed and security practices. For most investors, established exchanges will still offer better safety nets, broader asset choices, and clearer fee structures.

Frequently Asked Questions

Is Koinde regulated in the United States?

No public licensing information is available for Koinde in the US. Without a clear regulatory registration, you should assume it operates outside official oversight.

What cryptocurrencies can I trade on Koinde?

Only Bitcoin (BTC) is listed. There are no altcoins, stablecoins, or tokens available on the platform.

Are there any hidden fees when I withdraw funds?

Koinde does not publish a withdrawal fee schedule. In practice, many exchanges embed network fees into the payout amount, so you may see a slightly lower final figure than expected.

Can I use Koinde on my mobile phone?

There is no official mobile app. The web interface is responsive, but it lacks native push notifications and fingerprint login.

Is there an API for algorithmic trading?

Koinde does not advertise any public API, so automated trading is not supported at this time.

How can I verify the security of my funds?

Ask the support team for details on cold‑storage ratios, multi‑signature wallets, and any third‑party security audits. If they cannot provide documentation, consider using a more transparent exchange.

Author

Ronan Caverly

I'm a blockchain analyst and market strategist bridging crypto and equities. I research protocols, decode tokenomics, and track exchange flows to spot risk and opportunity. I invest privately and advise fintech teams on go-to-market and compliance-aware growth. I also publish weekly insights to help retail and funds navigate digital asset cycles.