Namibia Crypto Licensing Explorer

Provisional License

A six-month sandbox period during which VASPs can operate internally but cannot serve Namibian customers.

- No customer onboarding

- Internal testing only

- Proof of funding required

- Quarterly internal audits

Full License

Issued after successful completion of the provisional period, allowing full operations and customer service.

- Full KYC/AML checks

- Real-time transaction monitoring

- Minimum N$5 million net worth

- Annual external audit

Active Provisional License Holders

| Company | License Extension Until | Status |

|---|---|---|

| Landifa Bitcoin Trade CC | 31 July 2025 | Extension Requested |

| United PayPoint (Pty) Ltd | 13 May 2025 | Extension Requested |

| Mindex Virtual Asset Exchange | 21 November 2025 | Extension Granted |

Travel Rule Compliance

For transactions exceeding NAD 20,000, VASPs must collect and share:

- Full sender name

- Sender identification number

- Sender account details

- Full recipient name

- Recipient identification number

- Recipient account details

This information is shared with NAMFISA for monitoring purposes.

For Individuals

- Ownership: You can own crypto in personal wallets

- Banking: Banks may restrict accounts due to crypto activity

- Transactions: Local banks typically block crypto payments

- Legal Protection: No recourse if crypto investments go wrong

For VASPs

- Registration: Must register with NAMFISA

- Compliance: Implement AML/CTF procedures

- Infrastructure: Secure systems for handling trades

- Capital: Minimum N$5 million net worth required

Key Takeaways

- Individuals face banking restrictions due to crypto activity

- Licensed VASPs operate under strict supervision

- The regulatory environment remains uncertain but evolving

- Foreign exchanges are banned from serving Namibian residents

If you’ve ever tried to move Bitcoin through a Namibian bank, you’ve probably hit a wall. The Bank of Namibia (the country’s central bank) has built a framework that simultaneously opens a door for licensed firms and slams it shut for everyday crypto users. Below is a plain‑English walk‑through of the rules that matter to investors, fintech startups, and anyone wondering whether a Namibian bank will let you pay a bill with crypto.

How the regulatory story unfolded

Back in May2018 the Bank of Namibia issued a bold warning: cryptocurrencies are not legal tender, and anyone trading them has "no recourse to the Bank in the event of financial loss." That absolute stance kept most banks from even mentioning Bitcoin on their websites.

Fast forward to 2022, BON softened its tone just enough to say merchants could accept Bitcoin at their own discretion. The change didn’t turn crypto into cash, but it created a gray area-payment was optional, not officially endorsed.

The real turning point came in June2023 when the National Assembly passed the Virtual Assets Act 2023 (Act No.10 of2023). The act introduced a licensing regime for Virtual Asset Service Providers (VASPs) and imposed strict AML/CTF rules. It also banned foreign crypto exchanges from operating in Namibia.

Since then, the central bank has been handing out provisional licenses, monitoring compliance, and deciding whether to grant full operating permission. The latest batch of provisional authorisations was issued in January2025.

What a provisional license means

A provisional licence is a six‑month sandbox. Holders can set up offices, hire staff, and build compliance systems, but they cannot serve Namibian customers until they pass a final inspection.

- Landifa Bitcoin Trade CC - requested extension to31July2025.

- United PayPoint (Pty) Ltd - requested extension to13May2025.

- Mindex Virtual Asset Exchange - granted extension until21Nov2025.

During this period, the entities operate behind the scenes. They must demonstrate:

- Robust AML/CTF procedures aligned with the Travel Rule (transactions over NAD20,000 must include full sender and receiver details).

- Real‑time transaction monitoring and risk‑scoring tools.

- Secure infrastructure capable of handling the expected volume of digital‑asset trades.

- Financial capacity to cover potential operational risks.

If the regulator is satisfied, the provisional holder receives a full licence and can finally open accounts for Namibian users.

Banking restrictions that affect individuals

Even if you’re not running a crypto exchange, you can feel the impact. Legal practitioners have reported that customers of investment clubs found their accounts at major banks-such as NedBank and Standard Bank-placed under restriction after the bank flagged crypto‑related activity.

The central bank’s stance is that because crypto is not recognized as legal tender, banks can treat crypto‑related transactions as high‑risk and suspend services without a court order. Critics argue BON oversteps its mandate, but the practical effect is clear: many Namibian citizens find it harder to keep a regular bank account if they’re known to trade Bitcoin, Ether, or other tokens.

Key compliance requirements for VASPs

Any firm that wants to operate legally must register with the NAMFISA (Namibia Financial Institutions Supervisory Authority). The registration checklist includes:

| Requirement | Provisional License | Full License |

|---|---|---|

| Customer onboarding | Not permitted | Full KYC/AML checks required |

| Transaction monitoring | Internal testing only | Real‑time monitoring and reporting to NAMFISA |

| Travel Rule compliance | Sandbox data collection | Mandatory data sharing for >NAD20,000 |

| Capital adequacy | Proof of funding | Minimum N$5million net worth |

| Audit & reporting | Quarterly internal audit | Annual external audit submitted to NAMFISA |

Meeting these conditions is a heavy lift for startup teams, which explains why extensions are common. The regulator stresses that any deviation can result in immediate revocation of the provisional status.

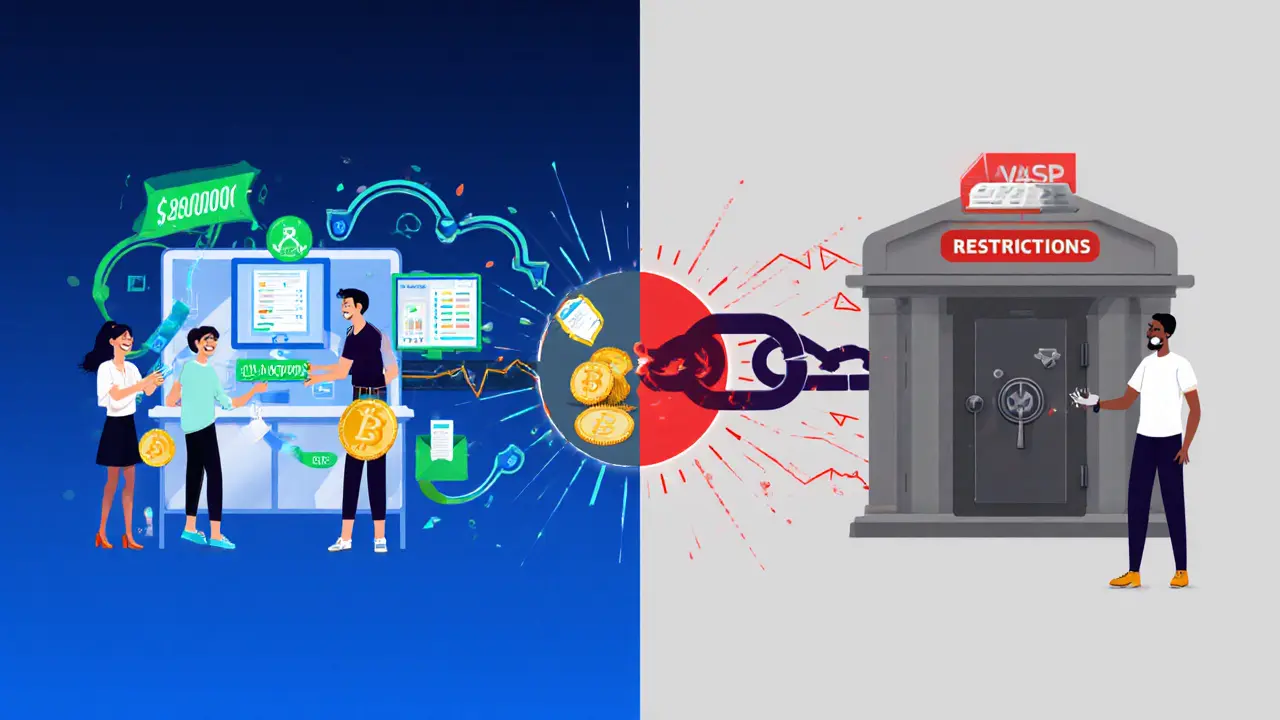

Why the paradox matters for you

On paper, Namibia appears progressive: it has a dedicated act, a supervising authority, and a clear licensing path. In practice, the country still declares cryptocurrency trading illegal for the general public. That paradox creates two distinct worlds:

- Licensed entities: Operate under strict oversight, can offer services once fully authorized, but cannot serve customers until that point.

- Everyday users: Face bank account restrictions and no legal protection if a crypto investment goes sour.

For investors, the safest route today is to keep crypto holdings in non‑Namibian wallets and avoid using local bank accounts for purchases. For fintech founders, the advice is to focus on compliance infrastructure now-once the sandbox closes, the market opens quickly.

What’s likely to happen next?

Industry observers expect two possible trajectories:

- Gradual opening: If the provisional firms pass their inspections, BON could issue a handful of full licences by the end of 2025, turning Namibia into a modest regional hub for regulated crypto services.

- Continued restriction: If compliance gaps persist, the regulator may keep tightening the sandbox, leaving the broader public in limbo and pushing traders to offshore platforms.

Watch for updates from BON and NAMFISA, especially any public statements about extending the Travel Rule threshold or adjusting the capital requirements for VASPs.

Quick checklist for anyone dealing with crypto in Namibia

- Do not expect your local bank to process crypto payments-most will block the transaction.

- If you run a crypto business, register with NAMFISA and prepare for a six‑month provisional period.

- Implement Travel Rule data collection for all transfers above NAD20,000.

- Maintain detailed transaction logs; NAMFISA can request them at any time.

- Stay alert for public statements from the Bank of Namibia about license extensions or policy shifts.

Frequently Asked Questions

Is Bitcoin legal to own in Namibia?

You can own Bitcoin in a personal wallet, but the Bank of Namibia does not recognize it as legal tender. Using a Namibian bank to buy, sell, or transfer Bitcoin may lead to account restrictions.

Can a foreign crypto exchange operate in Namibia?

No. The Virtual Assets Act explicitly bans non‑resident exchanges from offering services to Namibian residents. Only locally licensed VASPs may operate.

What is the Travel Rule and how does it affect me?

The Travel Rule requires VASPs to collect and share sender‑and‑receiver information for transactions over NAD20,000. If you send or receive amounts above that threshold, the service you use must report your full name, ID number, and account details to NAMFISA.

How long does a provisional license last?

The standard period is six months, but extensions can be granted on a case‑by‑case basis. The provisional holder cannot serve Namibian customers until a full licence is issued.

What should I do if my bank account gets restricted because of crypto activity?

Contact the bank’s compliance department for clarification, and be prepared to prove that any crypto transactions were personal and not part of a business. You may need to switch to an international bank that does not fall under BON’s jurisdiction.

Author

Ronan Caverly

I'm a blockchain analyst and market strategist bridging crypto and equities. I research protocols, decode tokenomics, and track exchange flows to spot risk and opportunity. I invest privately and advise fintech teams on go-to-market and compliance-aware growth. I also publish weekly insights to help retail and funds navigate digital asset cycles.