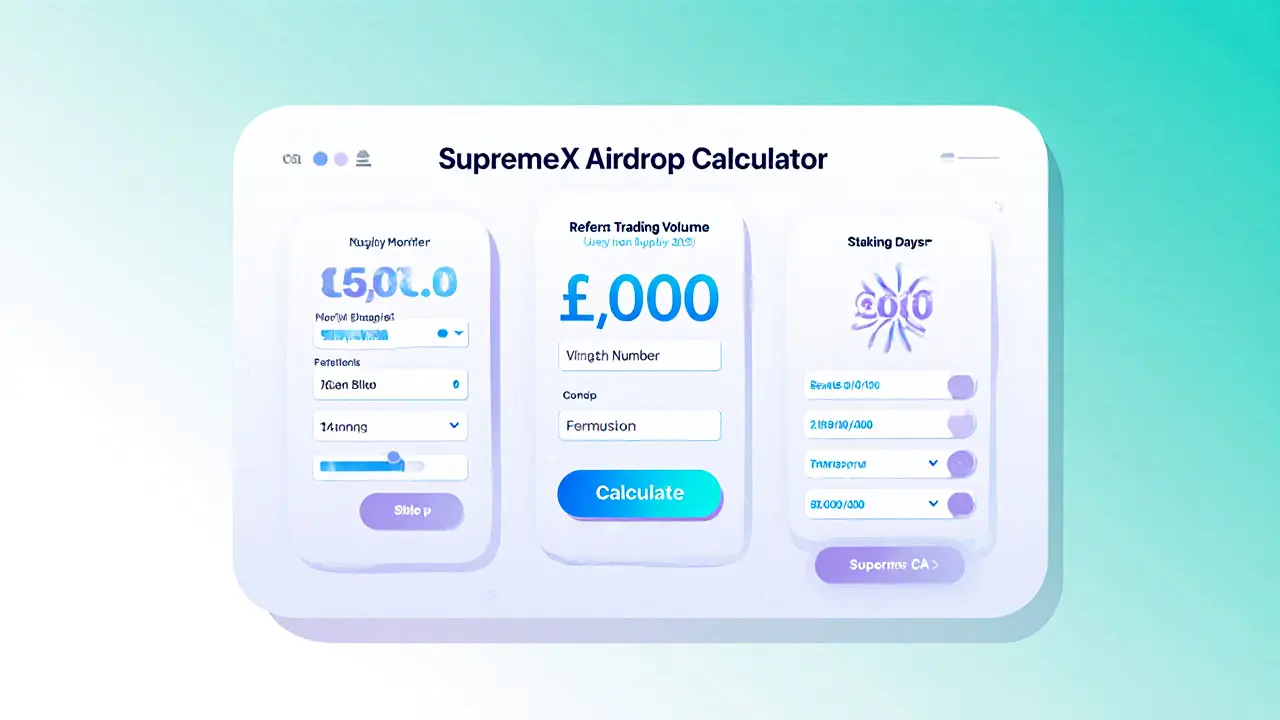

SupremeX (SXC) Airdrop Calculator

Airdrop Eligibility Checker

Enter your trading details below to estimate potential SXC rewards from the Bitget airdrop.

Your Estimated Rewards

Total SXC Tokens: 0

Trading Bonus: 0 SXC

Referral Bonus: 0 SXC

Staking Bonus: 0 SXC

Note: These estimates are based on current campaign parameters and may vary.

If you’ve been hunting for a low‑entry DeFi token with a chance to earn it for free, the SupremeX airdrop is worth a close look. Below you’ll find everything you need to know - from what SupremeX actually does, to the exact steps for grabbing airdropped SXC on Bitget, and the risks you should weigh before diving in.

What is SupremeX (SXC)?

SupremeX is a decentralized finance (DeFi) protocol that offers crypto‑asset lending with near‑instant settlement and tiny fees. Its native token, SXC, powers the platform’s governance and rewards borrowers who use the service. In practice, users deposit mainstream tokens (USDC, ETH, etc.) as collateral, receive a loan in another crypto, and earn SXC as a rebate for participating in the lending flow.

Tokenomics and Market Snapshot (Oct2025)

- Current price: $0.005877USD per SXC

- 24‑hour volume: $0.367USD (very low liquidity)

- Rank: #6429 on CoinMarketCap

- Fully diluted valuation (FDV): $5.71million

- Holders: 670 unique addresses

The oddly reported “0” total and circulating supply on tracking sites suggests the token is still in a distribution phase - most of the supply is likely locked in smart contracts or earmarked for future airdrops and liquidity incentives.

How the Airdrop Fits Into the Ecosystem

SupremeX’s roadmap includes rewarding early users and growing its community through periodic airdrops. The most concrete opportunity today comes via the Bitget exchange, which runs promotional challenges that hand out free SXC to participants.

Bitget’s Role in Distributing SXC

Bitget is a global crypto exchange that frequently partners with new projects for marketing campaigns. For SupremeX, Bitget runs two types of programs:

- Task‑based challenges - complete a set of actions (e.g., trade volume, referral sign‑ups) and receive a fixed SXC allocation.

- Random airdrops - eligible users receive a surprise SXC drop tied to their Bitget account balance.

Both methods convert any earned reward into SXC automatically, so there’s no extra token swap needed.

Eligibility Criteria - Who Can Grab the Airdrop?

- Must have a verified Bitget account (KYC completed).

- Need to hold at least 0.01BTC or 0.5ETH in the exchange wallet at the snapshot time.

- Participate in at least one of the listed challenges within the campaign window (usually 7‑10days).

- Maintain a minimum trading volume of $100 during the period to qualify for higher tiers.

There’s no minimum SXC balance required, which makes it truly a “free” entry point for newcomers.

Step‑by‑Step: Claiming SXC on Bitget

- Log into your Bitget account and navigate to the “Airdrop Center”.

- Locate the “SupremeX (SXC) Airdrop” banner and click “Join Campaign”.

- Complete the listed tasks - for example, place a $200 trade of any pair, invite a friend, or stake USDT for 48hours.

- After task verification, the platform will credit your wallet with a SXC amount (typically 50‑200SXC, depending on tier).

- Check the “Balance” tab - the SXC will appear under “Earned Tokens”. You can leave it on Bitget for governance voting or transfer it to an external wallet that supports ERC‑20 tokens.

All actions are recorded on‑chain, so you can verify the distribution via the SupremeX contract address (viewable on Etherscan).

Risks and Pitfalls to Watch

Free tokens are tempting, but they come with caveats:

- Liquidity risk - With a 24‑hour volume under $1USD, selling SXC could move the price dramatically.

- Regulatory exposure - Some jurisdictions treat airdropped tokens as taxable income, so check local rules.

- Lock‑up periods - Certain Bitget campaigns impose a 7‑day hold before you can withdraw the SXC.

- Smart‑contract bugs - As a newer protocol, SupremeX’s code has seen fewer audits than established rivals.

Consider these factors before allocating any capital beyond the free airdrop.

SupremeX vs. Established DeFi Lenders

| Feature | SupremeX | Aave | Compound | MakerDAO |

|---|---|---|---|---|

| Primary token | SXC (governance) | AAVE | COMP | MKR |

| Collateral types | Broad, includes mainstream tokens | ERC‑20, stablecoins, ETH | ERC‑20, stablecoins | ETH, BAT, USDC, others |

| Average loan fee | ~0.1% (very low) | ~0.2‑0.3% | ~0.2% | ~0.25% |

| Liquidity depth | Low - $0.3USD daily volume | High - billions daily | High - billions daily | High - billions daily |

| Governance participation | Yes - SXC holders vote on parameters | Yes - AAVE token holders | Yes - COMP token holders | Yes - MKR token holders |

SupremeX’s biggest advantage is its ultra‑low fee structure, but the trade‑off is minimal market depth and a nascent community.

Getting Started Beyond the Airdrop

- Secure an ERC‑20 compatible wallet (MetaMask, Trust Wallet).

- Transfer any received SXC from Bitget to your personal address.

- Visit the SupremeX lending portal (link available on the project’s official Discord).

- Connect your wallet, choose a collateral token, and specify the loan amount.

- Confirm the transaction - the loan is executed instantly, and a small SXC reward is credited to your wallet.

- Participate in governance polls via the “Governance” tab on the platform to influence future upgrades.

Even if you only keep the airdropped tokens, you can still vote on proposals. That’s an easy way to stay involved without risking capital.

Frequently Asked Questions

How many SXC tokens can I earn from the Bitget airdrop?

The amount varies by campaign tier. Basic participants usually receive 50‑100SXC, while high‑volume traders can earn up to 200SXC per round.

Is the SXC token tradable on other exchanges?

As of October2025, SXC is listed on Bitget and a few smaller DEXs. Liquidity is thin, so price slippage can be high.

Do I need to hold SXC to use the SupremeX lending service?

No. Borrowers can use the platform without holding SXC, but they earn SXC as a rebate when they take a loan. Holding SXC only adds voting power.

What are the tax implications of receiving an airdrop?

In many jurisdictions, airdropped tokens are considered ordinary income at market value on the receipt date. Check local tax guidance.

Can I stake SXC for additional rewards?

The current protocol does not offer a native staking pool, but upcoming roadmap items hint at liquidity‑mining incentives. Keep an eye on official announcements.

Final Thoughts

The SupremeX airdrop is a low‑cost entry point into a DeFi lending platform that promises fast, cheap loans. The real hook is the governance token - holding SXC gives you a voice in how the protocol evolves. However, the market is tiny, liquidity is scarce, and the token is still in an early distribution phase. If you’re comfortable with those constraints, grabbing the Bitget airdrop, moving the tokens to your own wallet, and testing a small loan can be a worthwhile experiment. For risk‑averse investors, waiting for better liquidity or a larger ecosystem rollout might make more sense.

Author

Ronan Caverly

I'm a blockchain analyst and market strategist bridging crypto and equities. I research protocols, decode tokenomics, and track exchange flows to spot risk and opportunity. I invest privately and advise fintech teams on go-to-market and compliance-aware growth. I also publish weekly insights to help retail and funds navigate digital asset cycles.