BRY Token – What It Is and Why It Matters

When you hear BRY, a blockchain‑based cryptocurrency designed for fast payments and community rewards. Also known as Berry Coin, it aims to combine low fees with a deflationary model that encourages holding and spending. BRY token has been gaining traction on niche exchanges and in a handful of airdrop campaigns, so understanding its fundamentals can help you decide if it fits your portfolio.

Key Aspects of BRY

The first thing to nail down is the token’s Tokenomics, the economic blueprint that sets supply caps, distribution schedules, and fee structures. BRY uses a 4% transaction tax: 2% is burned, shrinking supply over time, while the other 2% goes to a community pool that funds development and promotional events. This dual‑tax approach means every trade shrinks the circulating amount and adds value to the ecosystem, a relationship that directly influences price dynamics. Because the supply is elastic, investors often watch the burn rate as a health indicator.

Where you can actually buy or sell BRY matters just as much as the tokenomics. The Crypto Exchange, online platforms that list digital assets and facilitate trading landscape for BRY is still emerging. Today, BRY appears on a few decentralized exchanges (DEXs) on the Binance Smart Chain and a couple of niche centralized platforms that focus on low‑volume altcoins. Each listing expands the token’s liquidity, which in turn improves price discovery and reduces slippage. If a major exchange adds BRY, you’ll likely see a spike in trading volume—a clear example of how exchange placement enables broader adoption.

Regulatory compliance is another piece of the puzzle that can’t be ignored. The Regulatory Compliance, the set of laws, licenses, and reporting requirements that crypto projects must follow environment varies by jurisdiction, and BRY’s team has been proactive in engaging with legal advisors to meet U.S. Money Services Business (MSB) standards and EU MiCA guidelines. Compliance work reduces the risk of exchange delistings and protects investors from sudden legal shutdowns. When a token meets regulatory benchmarks, it often opens doors to institutional interest—a factor that can dramatically shift market perception.

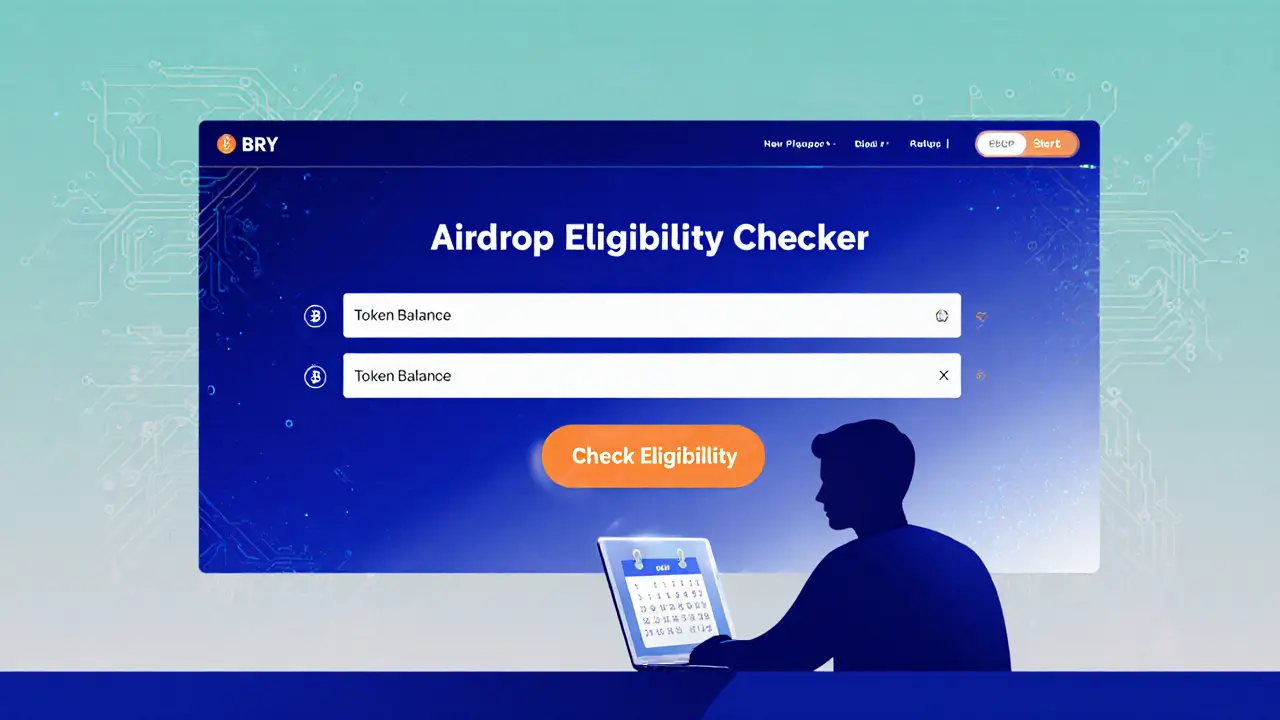

Airdrops have played a big role in BRY’s community growth. The project runs periodic reward campaigns that distribute extra BRY to active wallets, staking participants, and early adopters. These airdrops serve two purposes: they boost short‑term transaction volume and they lock up more tokens in user hands, reinforcing the deflationary loop. If you’re hunting for a low‑cost entry point, keeping an eye on upcoming airdrop announcements can be a smart move.

From a market‑analysis perspective, BRY’s price has shown classic altcoin behavior: sharp rallies on news, followed by corrective phases. The token’s volatility is driven by three main forces—tokenomics (burn rate), exchange listings (liquidity), and regulatory milestones (legitimacy). Watching these signals helps you time entry and exit points more effectively. For example, a new DEX listing combined with a scheduled burn event often creates a short‑term price spike, while a regulatory clearance can sustain a longer bullish trend.

Putting it all together, BRY offers a blend of deflationary tokenomics, growing exchange presence, and a clear compliance roadmap. The community’s focus on airdrops and rewards adds an extra layer of participation, making the token attractive for both traders and long‑term holders. Below you’ll find a curated set of articles that dive deeper into each of these angles—licensing guides, exchange reviews, tokenomics breakdowns, and airdrop details—so you can get the full picture before making a decision.

Berry Data (BRY) Airdrop Details: What We Know and How to Stay Ready

Jun 9, 2025, Posted by Ronan Caverly

No official Berry Data airdrop has been announced yet. Learn what Berry Data (BRY) is, price forecasts, how typical airdrops work, and how to stay ready for any future giveaway.

MORESEARCH HERE

Categories

TAGS

- decentralized exchange

- crypto exchange

- crypto exchange review

- crypto coin

- crypto airdrop

- cryptocurrency

- CoinMarketCap airdrop

- cryptocurrency trading

- smart contracts

- tokenomics

- DeFi

- cryptocurrency exchange safety

- crypto airdrop 2025

- cryptocurrency airdrop

- cryptocurrency exchange

- MiCA

- crypto airdrop guide

- blockchain token distribution

- crypto token

- Portugal crypto tax