In Nepal, owning or using cryptocurrency isn’t just risky-it’s a crime. As of 2025, the government still treats Bitcoin, Ethereum, and all other digital currencies as illegal. If you’re caught trading, mining, or even holding crypto, the authorities can seize your assets. This isn’t a warning. It’s enforcement. And it’s happening right now.

Why Nepal Banned Crypto Completely

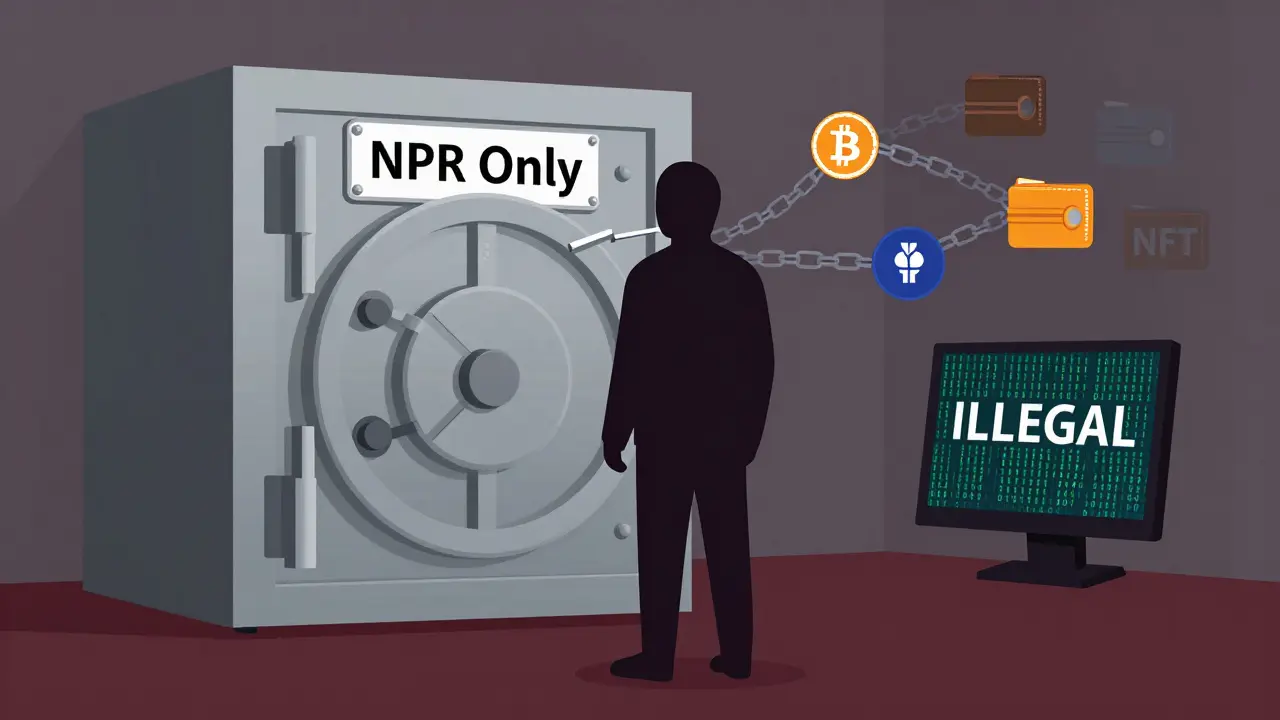

Nepal doesn’t just discourage cryptocurrency-it outlaws it. The Nepal Rastra Bank (NRB), the country’s central bank, has made it clear: digital currencies have no legal status. They’re not money. They’re not assets. They’re not protected. And using them breaks the law. The government’s reasoning is straightforward. Cryptocurrencies operate outside the banking system. No central authority tracks them. No regulator controls them. That means no one can stop money laundering, tax evasion, or fraud. The Nepalese Rupee (NPR) is the only legal tender, and the state won’t let digital coins threaten its control over the economy. In 2021, the Nepal Telecommunication Authority blocked over 200 crypto exchange and mining websites. Since then, no new platforms have been allowed to operate. Even peer-to-peer trading apps are monitored. If you’re using one, you’re breaking the law.What the Law Says: Muluki Criminal Code Act 2017

The legal backbone of Nepal’s crypto ban is Section 262(A) of the Muluki Criminal Code Act 2017. It defines cryptocurrency as any digital token, code, or information created through cryptography that holds value or can be used commercially. That covers everything-Bitcoin, Dogecoin, NFTs, stablecoins, even decentralized finance (DeFi) tokens. Under this law, any activity involving crypto-buying, selling, mining, storing, transferring-is a criminal offense. It’s not a civil fine. It’s a criminal charge. And criminal charges mean more than just penalties. They mean asset forfeiture.How Asset Forfeiture Works in Crypto Cases

Nepal doesn’t have a separate law for seizing crypto assets. Instead, it uses its existing anti-money laundering (AML) and financial crime laws. If you’re investigated for crypto-related activity, authorities can freeze your bank accounts, seize cash, lock your devices, and take any digital wallets linked to your identity. In practice, this means:- If police find a crypto wallet on your phone or laptop during a raid, they can confiscate the device.

- If you transferred crypto to a local exchange account, that account can be frozen.

- If you used cash to buy crypto, the cash can be seized as proceeds of illegal activity.

- If you mined crypto using electricity, your power usage can be investigated as part of the case.

Real Consequences: Fines, Jail, and Lost Assets

The penalties aren’t theoretical. In 2023, a man in Kathmandu was arrested after police found $12,000 worth of Bitcoin on his phone. He was charged under the AML law. His phone, laptop, and bank account were seized. He paid a fine of 500,000 NPR (about $3,700) and received a six-month suspended sentence. Another case involved a group of students who mined Ethereum using university power. Authorities traced the energy usage, identified the miners, and shut down their operation. All mining rigs were confiscated. The students faced criminal charges and were barred from using university internet for a year. These aren’t isolated incidents. They’re examples of how the system works. The government doesn’t need to prove you made money from crypto. Just possessing it or using it is enough to trigger enforcement.What Happens to Seized Crypto?

No one knows for sure. Nepal doesn’t have a legal mechanism to hold or sell seized cryptocurrency. Banks can’t touch it. Exchanges are banned. So what do they do? Based on how other countries handle similar cases, here’s what likely happens:- Seized crypto is stored on secure offline wallets managed by law enforcement.

- It’s never sold or converted to NPR-doing so would imply it has value, which contradicts the ban.

- After legal proceedings, the crypto is likely destroyed or held indefinitely.

How This Compares to Other Countries

Nepal is one of only 12% of emerging markets that still ban crypto outright. Most countries-India, Brazil, South Africa, even Indonesia-have moved toward regulation. They tax it. They license exchanges. They track users. Nepal hasn’t. It’s chosen total prohibition. That’s unusual. And it’s becoming more isolated. The NRB hasn’t signaled any shift in policy. No consultations. No pilot programs. Just silence. This makes Nepal an outlier. While other nations try to control crypto, Nepal tries to erase it.

What Should You Do If You’re in Nepal?

If you’re living in Nepal and you own crypto, your options are limited:- Don’t trade. Don’t mine. Don’t hold. Even storing it on a hardware wallet is risky if authorities find it.

- Don’t use local banks to convert crypto to NPR. That’s a red flag.

- Don’t talk about it online. Social media posts have led to investigations.

- If you already own crypto, consider transferring it out before it’s too late. But be careful-cross-border transfers can be monitored.

What About Blockchain? Is That Illegal Too?

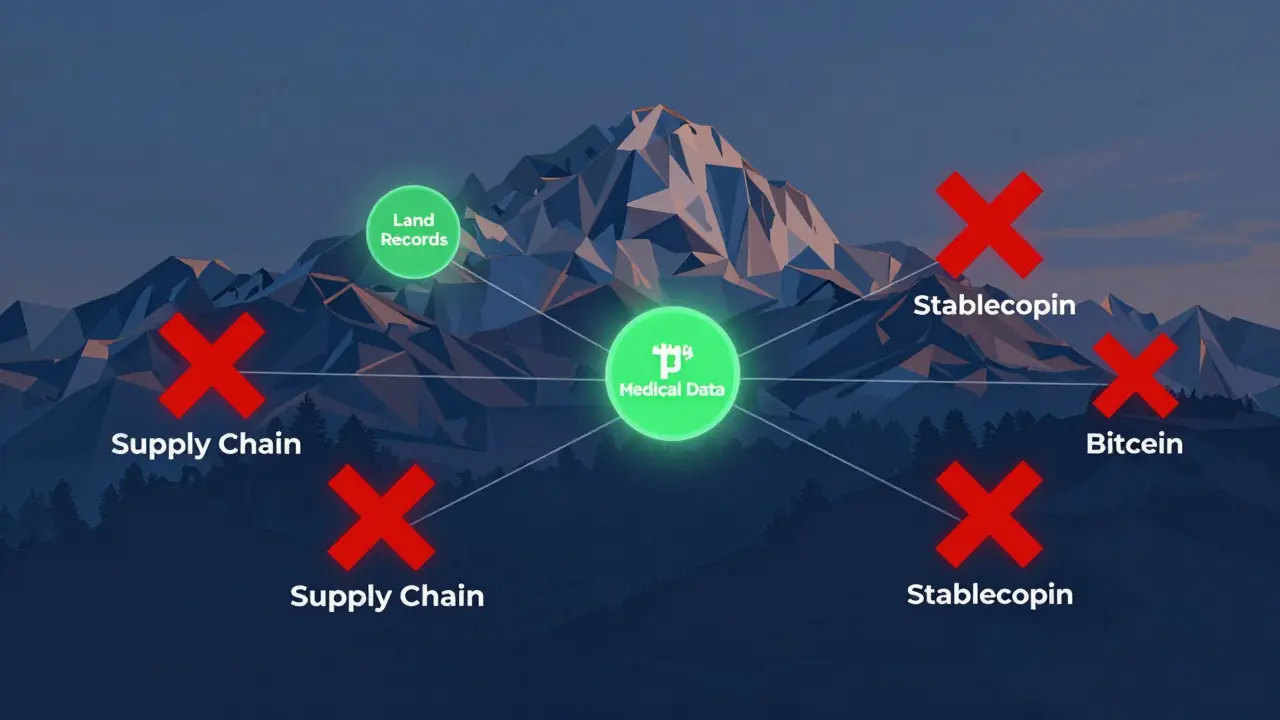

This is a common confusion. Nepal’s ban targets cryptocurrency-not blockchain technology. The law doesn’t ban distributed ledgers, smart contracts, or decentralized systems. It bans assets that use cryptography to store value. That means businesses can still use blockchain for supply chain tracking, land records, or medical data-if they avoid any token or coin. Some NGOs and government agencies are quietly testing these applications. But if you add a token, even for internal use, you cross the line.Is There Any Hope for Change?

Not anytime soon. The NRB has repeatedly stated that crypto poses a threat to financial stability. The government has no interest in regulating it. It wants to eliminate it. There are no pending bills. No public consultations. No committee reviews. The stance has been consistent since 2021-and there’s no sign it’s changing in 2025. If you’re thinking about moving to Nepal to run a crypto business, don’t. If you’re thinking about investing in crypto here, don’t. The risk isn’t just financial. It’s legal. And the consequences are severe.Is it legal to hold Bitcoin in Nepal?

No. Holding Bitcoin or any other cryptocurrency is illegal in Nepal under Section 262(A) of the Muluki Criminal Code Act 2017. Even storing crypto on a wallet or phone can lead to asset seizure and criminal charges.

Can the government seize my bank account if I traded crypto?

Yes. Nepalese authorities can freeze any bank account linked to crypto transactions under anti-money laundering laws. If they trace funds to a crypto purchase or sale, that account becomes part of the investigation and can be seized.

What happens to crypto that gets seized by police?

Seized cryptocurrency is stored in secure offline wallets by law enforcement. It is not sold or converted into Nepalese Rupees because that would contradict the government’s position that crypto has no legal value. Most seized crypto is either destroyed or held indefinitely after legal proceedings.

Can I use blockchain technology legally in Nepal?

Yes, but only if you don’t use tokens or coins. Blockchain for supply chain tracking, land registries, or medical records is allowed. However, if your system involves any digital asset with monetary value-even internally-it falls under the crypto ban and becomes illegal.

Are there any known cases of people going to jail for crypto in Nepal?

While most cases end in fines and asset seizures, criminal charges with potential jail time are common. In 2023, several individuals received suspended sentences after being convicted under AML laws for crypto trading. Actual prison time is rare, but always possible if the case involves large sums or repeated offenses.

Author

Ronan Caverly

I'm a blockchain analyst and market strategist bridging crypto and equities. I research protocols, decode tokenomics, and track exchange flows to spot risk and opportunity. I invest privately and advise fintech teams on go-to-market and compliance-aware growth. I also publish weekly insights to help retail and funds navigate digital asset cycles.