When you hear about Russia and cryptocurrency, you might think of wild underground trading or a total ban. But the truth is more complicated. In 2025, Russia doesn’t ban crypto - it just controls it tightly. The real story isn’t about whether Russians can buy Bitcoin. It’s about Russian ruble crypto trading restrictions - and how the government is using crypto to dodge sanctions while keeping the ruble king at home.

Domestic Crypto Payments Are Still Illegal

You can’t use Bitcoin to pay for groceries in Moscow. You can’t use Ethereum to buy a train ticket in St. Petersburg. That’s still illegal. Since January 2021, Russian law has banned any use of cryptocurrencies as payment within the country. Only the Russian ruble - and its official digital version, the digital ruble - are recognized as legal tender inside Russia. This isn’t just a rule. It’s a policy choice. The Central Bank of Russia (CBR) sees crypto as a threat to monetary control. If people start paying for coffee with Bitcoin, the ruble loses its grip. And the CBR won’t allow that. Even as crypto prices soared in 2024 and 2025, the bank held firm: no domestic payments. No crypto wallets as bank accounts. No crypto debit cards. Nothing. But here’s the twist: Russians still own billions in crypto. Estimates put private holdings at over $25 billion. Where’s it all stored? Mostly on foreign exchanges - Binance, Bybit, Kraken. People buy it overseas, send it to personal wallets, and hold it. There’s no legal domestic exchange. No official app. No Russian Coinbase. It’s all done in the shadows.The ELR: Russia’s Secret Crypto Backdoor

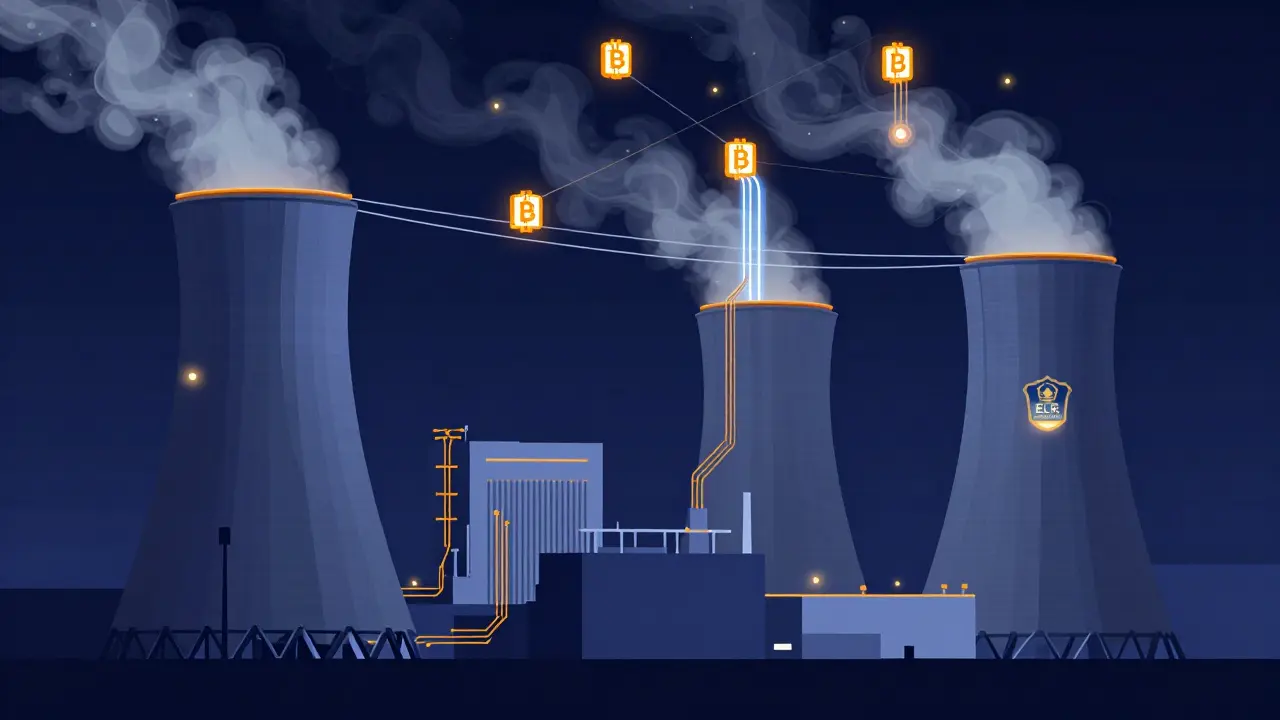

In summer 2024, Russia introduced something called the Experimental Legal Regime (ELR). It’s a three-year trial, running until 2027, and it’s the only legal way Russians can use crypto - but only for international trade. Under the ELR, Russian exporters and importers can settle cross-border deals in Bitcoin, Ethereum, or other approved digital assets. It’s not a loophole. It’s a weapon. After Western sanctions froze Russian banks out of SWIFT and cut off access to dollar reserves, Moscow needed a new way to trade oil, gas, and metals with China, India, Turkey, and others. Crypto became the workaround. By March 2025, crypto-facilitated international trade hit 1 trillion rubles ($11 billion). That’s not small change. That’s a major shift in how Russia does business. Companies like Rosneft and Gazprom aren’t just using crypto - they’re building systems around it. They’re working with foreign partners who accept Bitcoin as payment. They’re converting crypto into local currencies abroad, then sending the cash back to Russia through third-party channels. The ELR doesn’t let just anyone use crypto. Only qualified businesses that pass strict vetting. They need to register with the government, prove their export/import status, and follow detailed reporting rules. And they can’t use Russian banks to process the crypto. Everything goes through foreign gateways.Who Can Trade Crypto Inside Russia? Only the Rich

If you’re not an exporter, you still can’t trade crypto freely - unless you’re rich. In May 2025, the Central Bank opened the door to crypto derivatives for high-net-worth individuals. The bar? You need either:- Assets worth more than 100 million rubles (about $1.1 million), or

- An annual income over 50 million rubles (about $550,000)

What About Mining? Yes, But Only If It’s Official

Russia has cheap electricity - especially in Siberia and the Far East. That makes it perfect for crypto mining. But until recently, mining was a gray area. Now, it’s being pulled into the system. In October 2025, Deputy Finance Minister Ivan Chebeskov confirmed that Russia is building its own crypto mining infrastructure. The goal? To bring mining under state oversight. Companies that want to mine Bitcoin or Ethereum must now register, report energy usage, and pay taxes. The government isn’t banning mining - it’s taking a cut. President Putin has even encouraged regions with idle power plants to get into mining. Why? Because it’s a way to monetize wasted energy and generate foreign currency. A mining rig running on Siberian hydro power can turn excess electricity into Bitcoin - which then flows out of Russia as hard currency.Compliance Is a Minefield

Even if you’re playing by the rules, compliance is brutal. The Central Bank demands:- Full KYC for every investor and business using the ELR

- Anti-Money Laundering (AML) checks on all crypto transactions

- Reporting of any crypto transaction over 600,000 rubles ($6,600) to tax authorities

- No direct investment in crypto by banks or financial institutions

- Strict separation between domestic ruble systems and crypto flows

Author

Ronan Caverly

I'm a blockchain analyst and market strategist bridging crypto and equities. I research protocols, decode tokenomics, and track exchange flows to spot risk and opportunity. I invest privately and advise fintech teams on go-to-market and compliance-aware growth. I also publish weekly insights to help retail and funds navigate digital asset cycles.