China Crypto Mining Ban Timeline & Impact Simulator

Current Status

As of October 2025, all forms of cryptocurrency activities in China are criminalized.

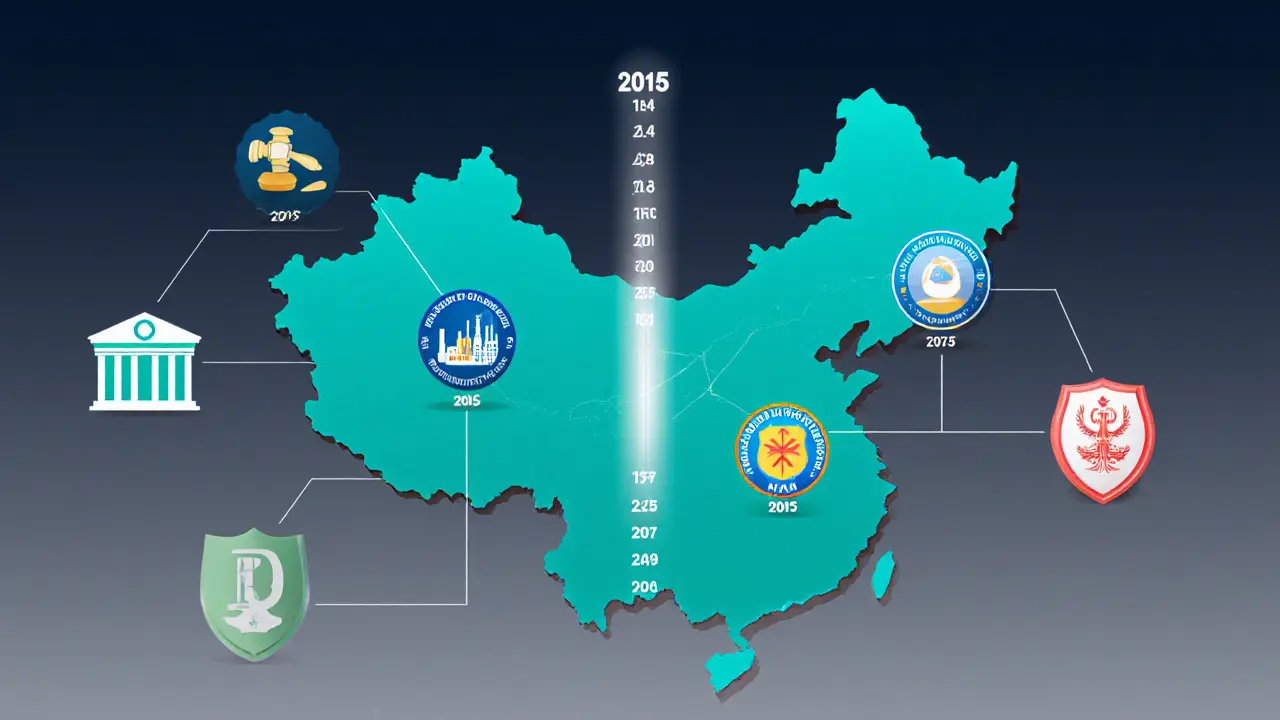

Key Enforcement Agencies

- People's Bank of China

- State Administration of Foreign Exchange

- Cyberspace Administration

- Ministry of Industry and Information Technology

| Year | Regulatory Action | Lead Agency |

|---|---|---|

| 2013 | Banned banks from processing Bitcoin transactions | People's Bank of China |

| 2017 | Prohibited Initial Coin Offerings and shut down domestic exchanges | China Securities Regulatory Commission |

| 2019 | Crackdown on large mining farms; forced relocations abroad | Ministry of Industry and Information Technology |

| 2021 | Nationwide ban on cryptocurrency mining | People's Bank of China |

| 2022 | Court rulings denied civil claims related to crypto losses | Supreme People's Court |

| 2023 | Allowed blockchain platforms only under central oversight | Cyberspace Administration |

| 2024 | Systematic arrests and asset seizures of illegal miners | State Administration of Foreign Exchange & Ministry of Industry |

| 2025 | Comprehensive criminal ban on mining, trading, and ownership | People's Bank of China (lead) |

Reasons Behind the Ban

- Energy Consumption: Mining consumes enormous amounts of electricity, conflicting with carbon-neutral goals.

- Financial Control: Decentralized currencies challenge monetary policy and central bank authority.

- Illicit Activity: Risk of money laundering and illegal capital flows.

- Digital Yuan Promotion: Supporting state-backed e-CNY requires a controlled digital landscape.

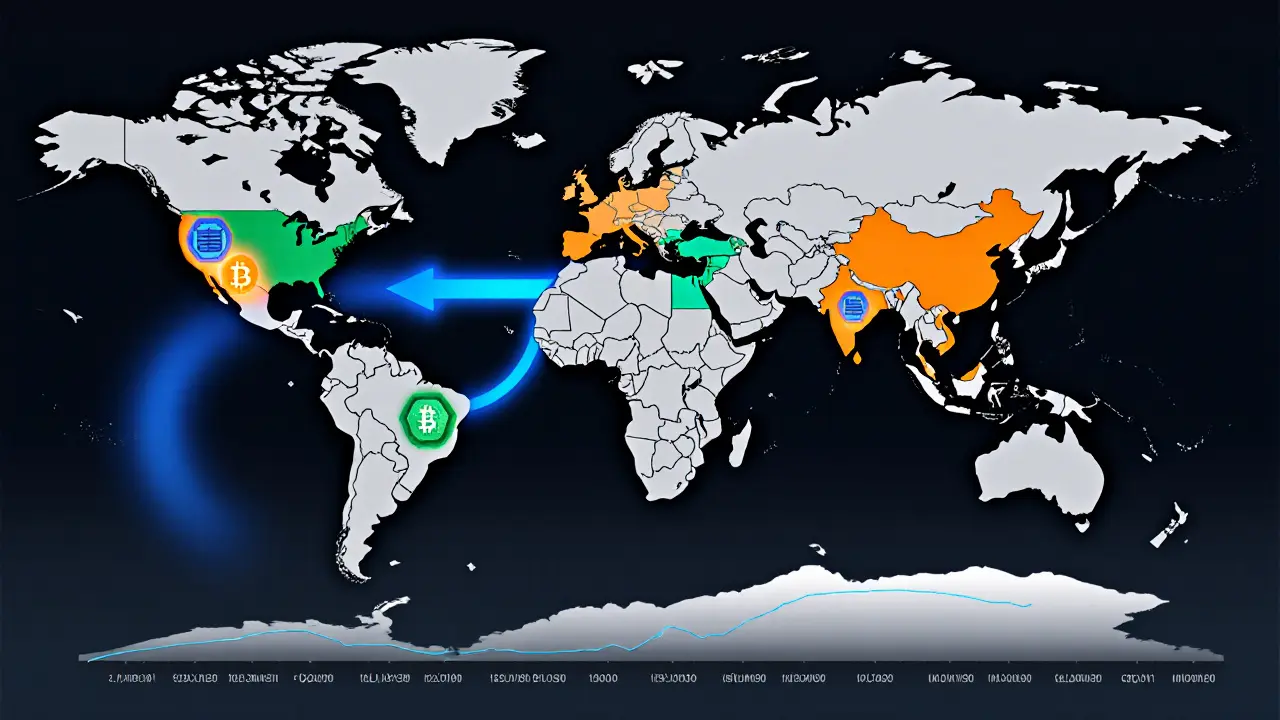

Global Hashpower Shift

After China’s 2025 ban, global hashpower redistributed dramatically:

- United States: ~18%

- Canada: ~12%

- Kazakhstan: Short-term surge

- Norway & Iceland: Renewable energy-driven growth

Market Impact: On May 31, 2025, Bitcoin dropped from $111,000 to $104,500, with a $750M market cap loss in 24 hours.

Underground Mining Risks

Despite the ban, some underground operations persist:

- Power usage analytics detect unusual consumption patterns.

- Financial investigations trace payouts to flagged bank accounts.

- AI-driven network monitoring detects mining protocols in traffic.

Operational costs now outweigh potential profits.

When we talk about cryptocurrency mining in China is the practice of using computer hardware to validate blockchain transactions and earn digital coins, an activity that the Chinese government has progressively outlawed since 2013, the story reads like a legal roller‑coaster. By May312025 China declared a “comprehensive ban on all cryptocurrency activities,” turning what was once the world’s biggest mining hub into a criminal offense. This article unpacks the current legal status, the agencies behind enforcement, the reasons driving the crackdown, and what the ban means for the global mining ecosystem.

Key Takeaways

- As of October2025, any form of crypto mining, trading, or ownership in China is a criminal offense.

- The ban is enforced by multiple agencies, notably the People's Bank of China, the State Administration of Foreign Exchange, and the Cyberspace Administration.

- Energy consumption, financial risk, illegal capital flows, and promotion of the digital yuan drive the policy.

- China’s crackdown forced a massive shift of hash power to the United States, Canada, Kazakhstan, and other crypto‑friendly regions.

- Underground mining persists but faces escalating detection methods and severe penalties.

Regulatory Timeline: From Caution to Criminalization

| Year | Regulatory Action | Lead Agency |

|---|---|---|

| 2013 | Banned banks from processing Bitcoin transactions | People's Bank of China |

| 2017 | Prohibited Initial Coin Offerings and shut down domestic exchanges | China Securities Regulatory Commission |

| 2019 | Crackdown on large mining farms; forced relocations abroad | Ministry of Industry and Information Technology |

| 2021 | Nationwide ban on cryptocurrency mining | People's Bank of China |

| 2022 | Court rulings denied civil claims related to crypto losses | Supreme People's Court |

| 2023 | Allowed blockchain platforms only under central oversight | Cyberspace Administration |

| 2024 | Systematic arrests and asset seizures of illegal miners | State Administration of Foreign Exchange & Ministry of Industry |

| 2025 | Comprehensive criminal ban on mining, trading, and ownership | People's Bank of China (lead) |

Why China Said ‘No’ - The Four Pillars of the Ban

The crackdown rests on four articulated concerns:

- Energy consumption: Bitcoin mining alone can chew through tens of terawatt‑hours a year, clashing with China’s carbon‑neutral targets.

- Financial control: Decentralized tokens bypass the People’s Bank of China’s monetary policy, creating systemic risk.

- Illicit activity: Cryptocurrencies are linked to money laundering, capital flight, and other illegal capital flows.

- Digital yuan promotion: The state‑backed digital yuan (e‑CNY) needs a clean policy environment without competing decentralized assets.

Enforcement Mechanics - How the Ban Is Policed

Multiple bodies work in tandem:

- People's Bank of China monitors banking channels, ensuring no crypto‑related payments slip through.

- The State Administration of Foreign Exchange tracks cross‑border fund movements that could finance mining.

- The Cyberspace Administration scans internet traffic for mining software signatures.

- The Ministry of Industry audits electricity grids, flagging abnormal power spikes that suggest hidden mining rigs.

When an anomaly is spotted, a coordinated raid can result in equipment seizure, fines, and criminal charges that carry up to several years in prison.

Underground Mining - Still Alive, But Risky

Despite the ban, small‑scale, covert operations linger in remote provinces. They often hide rigs in industrial warehouses, agricultural facilities, or even residential basements, using recycled hardware to stay under the radar. However, these setups face three escalating threats:

- Power‑usage analytics can pinpoint abnormal consumption patterns within minutes.

- Financial investigators trace cryptocurrency payouts back to bank accounts flagged for “high‑risk” activity.

- The government has begun deploying AI‑driven network monitoring to detect mining protocols embedded in normal traffic.

For operators, the cost‑benefit equation is rapidly tipping toward closure.

Global Ripple Effect - Where Did the Hashpower Go?

Before the 2021 ban, China contributed roughly 65% of the world’s Bitcoin hashrate, thanks to cheap coal‑derived electricity and proximity to hardware manufacturers. After the 2025 ban, the following trends emerged:

- United States: Hashrate share rose to ~18%, driven by Texas and Wyoming’s favorable policies.

- Canada: Benefited from abundant hydro power, now holding ~12% of global hashrate.

- Kazakhstan: Experienced a short‑term surge but faces its own power‑supply instability.

- Norway & Iceland: Grew modestly thanks to renewable energy incentives.

Market reaction was immediate. On the day of the May312025 announcement, Bitcoin slipped from $111,000 to $104,500, and the total crypto market cap lost over 10% in 24hours, wiping out roughly $750million in long positions.

Future Outlook - No Sign of Relaxation

Analysts agree that China’s stance will stay firm. The government continues to pour resources into the digital yuan, and the legal text of the 2025 ban categorizes violations as “criminal offenses,” implying heavier penalties and more sophisticated detection tools. For the global mining community, the lesson is clear: regulatory risk can reshape the entire ecosystem overnight, making diversified jurisdiction strategies a must‑have.

Frequently Asked Questions

Is cryptocurrency mining legal anywhere in China now?

No. As of October2025, mining, trading, and even private ownership of digital assets are classified as criminal offenses throughout the entire country.

What agencies enforce the crypto mining ban?

The lead agency is the People's Bank of China, working with the State Administration of Foreign Exchange, the Cyberspace Administration, and the Ministry of Industry.

Why did China focus on energy consumption in its rationale?

Bitcoin mining can consume as much electricity as a small country. This clashes with China's pledge to hit carbon neutrality by 2060, so cutting energy‑hungry mining aligns with environmental policy.

Can I still buy Bitcoin on a Chinese exchange?

No. All domestic exchanges were shut down in 2017, and the 2025 ban bars any crypto‑related financial service, including exchange operations.

What happens to miners caught operating illegally?

Authorities typically seize equipment, freeze any related bank accounts, and prosecute individuals. Penalties range from hefty fines to several years of imprisonment.

Author

Ronan Caverly

I'm a blockchain analyst and market strategist bridging crypto and equities. I research protocols, decode tokenomics, and track exchange flows to spot risk and opportunity. I invest privately and advise fintech teams on go-to-market and compliance-aware growth. I also publish weekly insights to help retail and funds navigate digital asset cycles.