By 2025, if you're building anything that needs blockchain - whether it’s digital assets, supply chain tracking, or secure payment rails - you don’t need to run your own nodes, manage consensus protocols, or hire a team of cryptographers. That’s the whole point of Blockchain as a Service (BaaS). It’s not just a buzzword anymore. It’s the backbone of enterprise Web3 projects. Companies are choosing BaaS because it cuts development time from months to weeks and removes the operational nightmare of maintaining decentralized infrastructure.

What Blockchain as a Service Actually Means

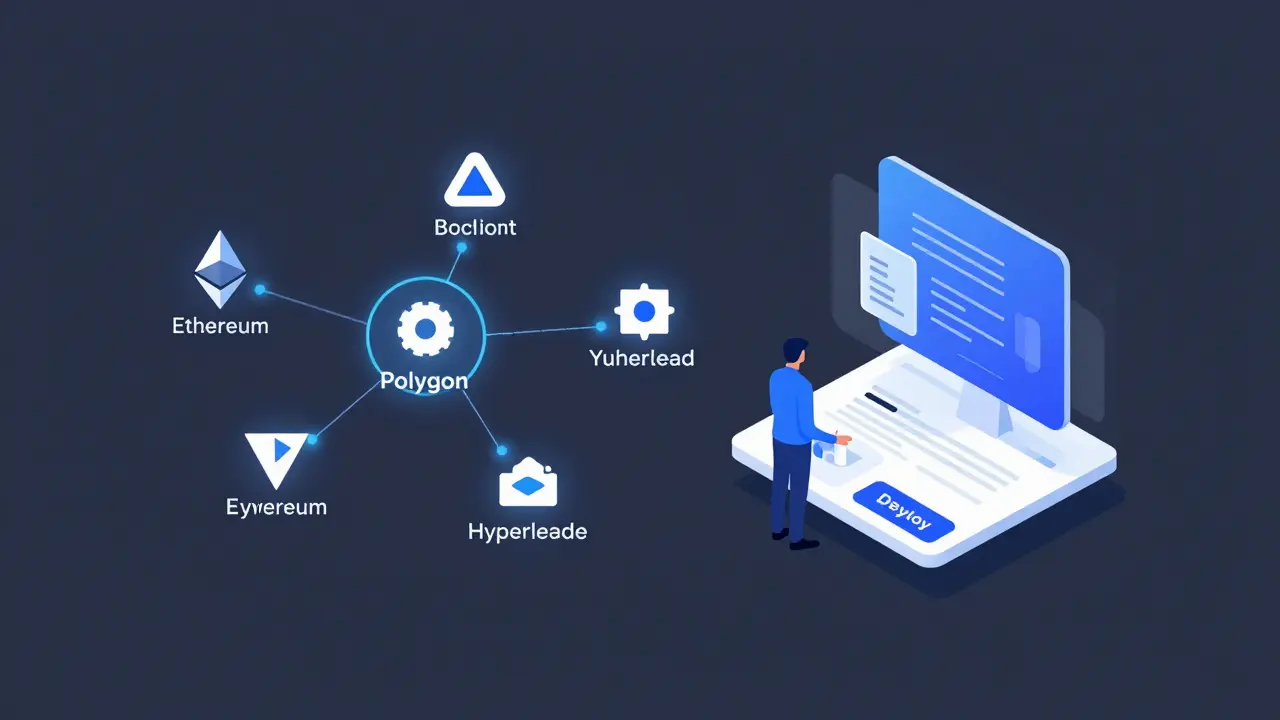

Blockchain as a Service is exactly what it sounds like: you rent blockchain infrastructure from a cloud provider. Instead of setting up Ethereum nodes, configuring Hyperledger Fabric, or dealing with consensus mechanisms, you get an API, a dashboard, and maybe some pre-built smart contract templates. You focus on your business logic. They handle the blockchain plumbing. This isn’t for hobbyists. It’s for businesses that need reliability, compliance, and scalability. Think banks issuing tokenized bonds, manufacturers tracking drug shipments across borders, or logistics firms verifying shipment authenticity with immutable records. These aren’t experiments. They’re live systems handling real money and legal obligations. In 2025, the BaaS market isn’t dominated by giants like AWS or Azure - though they’re in the game. It’s led by specialists who understand blockchain’s quirks: the gas fees, the fork risks, the need for private vs. public chains, and how to integrate with existing ERP and accounting systems.Rapid Innovation: Fastest Deployment, Lowest Barrier

If speed is your priority, Rapid Innovation is the name to know. They’ve built their reputation on one promise: deploy a working blockchain solution in 90 days or it’s free. That’s not marketing fluff - it’s backed by a team that’s shipped over 400 blockchain projects since 2021. They support Ethereum, Polygon, and private Hyperledger Fabric networks. Their pricing is hourly, which means you pay only for what you use. No monthly retainers. No lock-in contracts. A startup testing a tokenized loyalty program can spin up a testnet in under an hour and shut it down when done - without signing a 12-month agreement. What sets them apart is their AI-assisted smart contract auditor. It scans code for vulnerabilities before deployment, flagging issues like reentrancy attacks or overflow bugs. For companies that don’t have in-house blockchain devs, this is a game-changer.Kaleido: The Enterprise Multi-Chain Platform

Kaleido doesn’t just offer one blockchain. It offers a choice - and the tools to manage them all from a single dashboard. Need to run a private Ethereum network for internal audits and a public Polygon chain for customer-facing NFTs? Kaleido handles both, with unified identity management and cross-chain data sync. It’s the go-to for Fortune 500 companies. Why? Because it integrates with SAP, Oracle, and Microsoft Dynamics out of the box. You don’t have to rebuild your backend. Kaleido plugs into your existing systems. It also offers built-in compliance tools: KYC/AML workflows, audit trails, and regulatory reporting templates for GDPR, MiCA, and other frameworks. Their customer base includes major pharmaceutical firms tracking drug provenance and global retailers verifying ethical sourcing. One client reduced supply chain fraud by 73% in six months after deploying Kaleido’s blockchain ledger for vendor documentation.BlockApps: Ethereum for the Corporate World

If your company is all-in on Ethereum, BlockApps is your best bet. They don’t just host Ethereum nodes - they’ve built a full enterprise toolkit around it. Their AppChain platform lets you create custom, permissioned Ethereum networks with your own rules: who can transact, what data is visible, how fast blocks confirm. They offer a visual smart contract builder. No Solidity coding required. Drag and drop functions to create loan agreements, escrow contracts, or asset transfer rules. Then deploy with one click. It’s designed for legal and finance teams who understand business logic but not code. BlockApps also has a built-in tokenization engine. Want to issue a digital share certificate? Or a loyalty token redeemable in-store? Their platform generates compliant ERC-20 or ERC-1400 tokens with embedded restrictions - like transfer limits or investor accreditation checks. Major banks in the U.S. and EU use BlockApps to tokenize bonds and trade them on private markets. One client reduced settlement times from 3 days to 3 minutes.

Blockstream: Bitcoin Infrastructure for Institutions

Bitcoin isn’t just for speculation anymore. In 2025, institutions use it for treasury reserves, cross-border payments, and as a hedge against currency devaluation. Blockstream makes that possible. They don’t offer smart contracts. They offer reliability. Their Liquid Network lets companies settle Bitcoin transactions in under two minutes with privacy and lower fees. Their satellite API lets nodes sync even in areas with poor internet - critical for global supply chains or remote mining operations. Blockstream’s BaaS is used by payment processors, crypto exchanges, and even central banks testing digital currency models. One European bank uses their infrastructure to settle €200M in daily Bitcoin trades without exposing their internal systems to public blockchain traffic.Cryptowerk: Trust Through Immutable Logs

Not every blockchain project needs tokens or smart contracts. Sometimes, you just need proof that a document, image, or log file hasn’t been altered. Cryptowerk specializes in that. They anchor data to public blockchains - Bitcoin, Ethereum, or Filecoin - creating a tamper-proof timestamp. Think audit logs for financial transactions, medical records, or manufacturing quality checks. Their platform integrates with existing file systems. You upload a PDF? They hash it, anchor the hash to a blockchain, and give you a verifiable certificate. No one can alter the file without breaking the chain. Regulators love this. It’s used by insurance firms, law firms, and government agencies for compliance. One U.S. state agency reduced document fraud claims by 91% after switching to Cryptowerk for storing signed contracts.tZERO: Blockchain for Capital Markets

If you’re dealing with stocks, bonds, or private equity, tZERO is the only BaaS provider built for securities regulation. They’re not just a blockchain platform - they’re a licensed alternative trading system (ATS) in the U.S. Their platform allows companies to issue tokenized securities that comply with SEC rules. Investors must pass KYC. Transfers are restricted by accreditation status. Dividends are auto-distributed. All trades are recorded on-chain with audit trails. They’ve partnered with major broker-dealers and custodians. A mid-sized private equity firm used tZERO to raise $45M from accredited investors in 14 days - a process that normally takes 6-9 months.

Why Not Use AWS or Azure?

AWS and Microsoft Azure do offer blockchain services. But they’re generic. You get a VM with Ethereum installed. You still have to configure the network, manage consensus, patch vulnerabilities, and handle scaling. BaaS providers like Kaleido or BlockApps handle all that. They offer SLAs, dedicated support teams, compliance certifications, and pre-built templates. For enterprise users, that’s worth the premium.Choosing the Right BaaS Provider

Here’s what to ask before you sign up:- Which blockchains do they support? (Ethereum, Bitcoin, Hyperledger, etc.)

- Can you deploy a private chain? Or is it public-only?

- Do they offer smart contract auditing or visual builders?

- Is there compliance support for your region? (GDPR, MiCA, SEC, etc.)

- What’s the pricing model? Hourly? Monthly? Usage-based?

- Do they integrate with your existing tools? (ERP, CRM, accounting software)

- What’s their uptime guarantee? And what happens if the chain forks?

What’s Next for BaaS in 2026?

The next wave of BaaS will focus on interoperability. Right now, most platforms are siloed. You can’t easily move data from a Kaleido Ethereum chain to a Blockstream Bitcoin network. But new protocols like Polkadot and Cosmos are changing that. Expect BaaS providers to start offering cross-chain bridges as standard features. Also, AI will play a bigger role - not just in auditing smart contracts, but in predicting gas costs, auto-scaling nodes, and even generating contract code from natural language prompts. The goal isn’t to replace developers. It’s to remove the friction so businesses can focus on what matters: building products that solve real problems.What’s the difference between Backend as a Service and Blockchain as a Service?

Backend as a Service (BaaS) handles server-side functions like user authentication, databases, and APIs for apps - think Firebase or Supabase. Blockchain as a Service provides infrastructure to build and run blockchain networks - like Ethereum nodes, smart contract deployment, and consensus management. They solve different problems: one for app development, the other for decentralized systems.

Can I use BaaS for cryptocurrency mining?

No. Blockchain as a Service lets you build and interact with blockchain networks, but it doesn’t provide mining hardware or computational power for proof-of-work. Mining requires physical hardware and high energy use. BaaS platforms like Blockstream or Rapid Innovation focus on application layer services - not consensus participation.

Are BaaS platforms secure?

Yes - if you choose a reputable provider. Leading BaaS platforms like Kaleido and BlockApps are audited, comply with ISO 27001, and offer private networks with role-based access. But security also depends on how you use it. Poorly written smart contracts or leaked API keys can still lead to breaches. BaaS reduces infrastructure risk, but not human error.

Do I need to know how to code to use BaaS?

Not always. Platforms like BlockApps and Cryptowerk offer visual builders and drag-and-drop interfaces for creating smart contracts or anchoring documents. But for full customization - like building complex DeFi logic - you’ll still need developers familiar with Solidity or Rust. BaaS lowers the barrier, but doesn’t eliminate the need for technical skills entirely.

How much does Blockchain as a Service cost?

Prices vary widely. Rapid Innovation charges hourly - as low as $0.10 per hour for testnets. Enterprise platforms like Kaleido or tZERO start at $5,000-$15,000 per month, depending on usage and features. Some offer pay-as-you-go models based on API calls or storage. Always check for hidden fees: transaction costs, node upgrades, or compliance add-ons.

Author

Ronan Caverly

I'm a blockchain analyst and market strategist bridging crypto and equities. I research protocols, decode tokenomics, and track exchange flows to spot risk and opportunity. I invest privately and advise fintech teams on go-to-market and compliance-aware growth. I also publish weekly insights to help retail and funds navigate digital asset cycles.