Crypto Tax Compliance Checklist

Compliance Check Results

Key Takeaways

- From 2025 the IRS requires every crypto transaction to be logged, no matter how small.

- Form 1099-DA will arrive in early 2026 for all 2025 sales.

- Cost basis must be calculated wallet‑by‑wallet, not across all holdings.

- Mining, staking, airdrops and DeFi actions each need separate income documentation.

- Specialized tax software can cut tracking time, but manual checks are still required for self‑custody wallets.

When it comes to crypto tax record keeping, the rules have gotten a lot tighter over the past few years. The IRS now treats every digital‑asset movement as a taxable event, which means even a $10 trade must be reported. Missing a single entry can trigger penalties, and the agency’s new Form 1099‑DA and mandatory wallet‑by‑wallet accounting make the paperwork more detailed than ever before.

Below is a step‑by‑step playbook that walks you through what to record, how to store the data, and which tools make the process painless. By the end of this guide you’ll know exactly what the IRS expects and how to keep your crypto finances audit‑ready.

What the IRS Changed in 2025

The tax landscape shifted dramatically on January1,2025. Two key updates now drive every record‑keeping strategy:

- Form 1099‑DA - Exchanges, payment processors and hosted wallets must issue this form to report digital‑asset proceeds. The form lists gross proceeds, transaction dates, fair‑market values at the time of sale, and broker identification. First copies will land in taxpayers’ mailboxes in early 2026 for the 2025 tax year.

- Mandatory wallet‑by‑wallet accounting - Until 2024 you could lump all holdings together to calculate cost basis. Starting in 2025 each wallet (including hardware, software and exchange wallets) must be tracked separately. This affects both the basis you report and the holding period that determines short‑term versus long‑term capital gains.

The IRS also ramped up its partnership with blockchain‑analysis firms, meaning the agency can now trace transactions far beyond the data supplied on 1099‑DA. Accurate, wallet‑specific records are therefore your best defense against an audit.

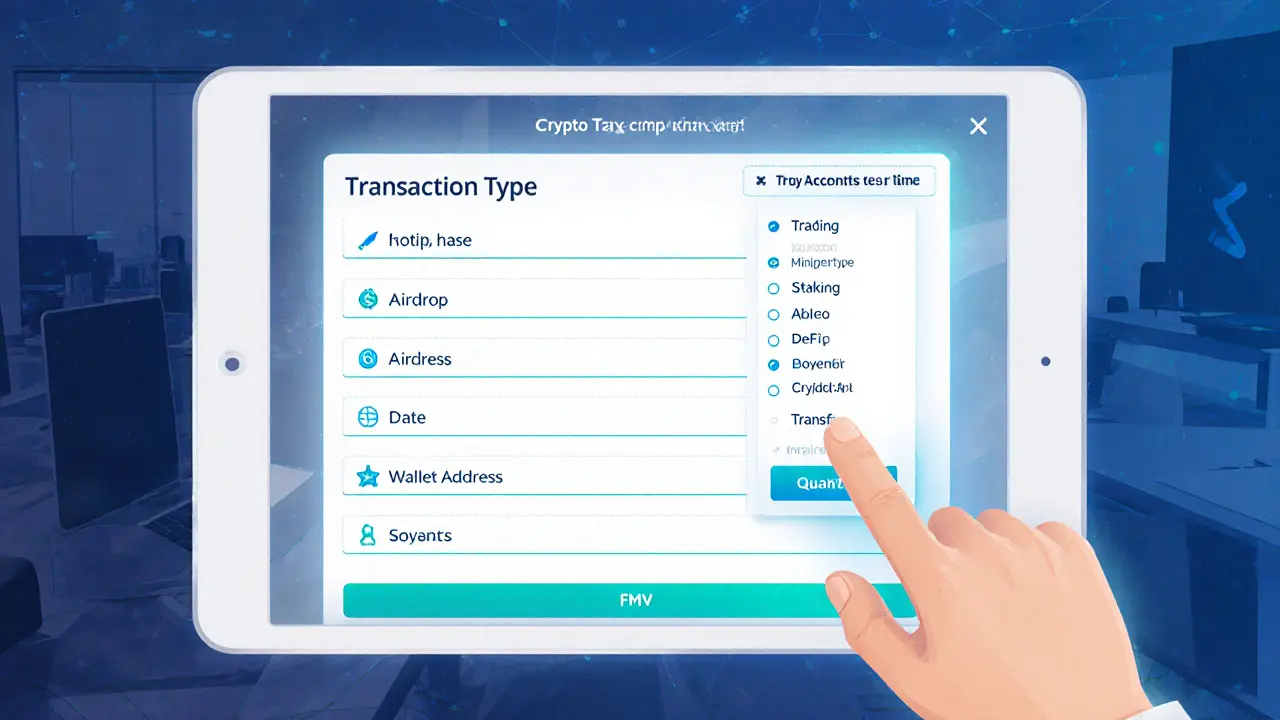

Every Crypto Activity You Must Document

Not all crypto actions are created equal. Here’s a quick cheat‑sheet of the most common categories and the exact data points the IRS expects.

| Activity | What to Record | IRS Form(s) |

|---|---|---|

| Trading / Selling / Exchanging | Date, wallet address, crypto pair, quantity, fair‑market value (USD) at execution, fees, cost basis, holding period | Form 8949, Schedule D |

| Mining (self‑employed) | Date coins received, quantity, FMV at receipt, equipment/electricity costs, wallet address | Schedule C, Schedule SE |

| Staking Rewards | Date of reward, token amount, FMV at receipt, subsequent disposition details | Schedule 1 (ordinary income) + Form 8949 for later sales |

| Airdrops | Date of distribution, token amount, FMV, wallet address | Schedule 1 |

| DeFi (LP, Yield Farming, AMM) | Deposit date, pool name, token amounts in/out, FMV at each event, transaction hash, wallet address | Schedule C (if business), Form 8949 for disposals |

| Self‑Transfers (personal wallets) | Transfer date, sending & receiving wallet IDs, amount, purpose (e.g., cold‑storage) | None required for tax, but needed to preserve cost basis |

Even activities that feel “free”-like airdrops-create ordinary income the moment you receive them. Skipping any line item can lead to a mis‑calculated basis and trigger an audit flag.

Building a Compliant Record‑Keeping System

The easiest way to stay on top of the IRS requirements is to set up a system before you make your next trade. Below are three scalable approaches.

1. Manual Spreadsheet

For hobbyists who trade on one or two exchanges, a well‑structured Google Sheet can do the job. Include columns for:

- Date (UTC)

- Transaction Type (Buy, Sell, Transfer, Reward)

- Wallet / Exchange (name + address)

- Asset Symbol

- Quantity

- USD Value at Transaction (use CoinMarketCap or Crypto tax software API)

- Fees

- Cost Basis (for disposals)

- Notes (e.g., “Moved to cold storage”)

Take a screenshot of each confirmation email or blockchain explorer transaction and attach it to the row using the comment feature. This creates an audit trail that the IRS can’t easily dispute.

2. Dedicated Crypto Tax Software

Platforms like Koinly, CoinTracker and ZenLedger automate the heavy lifting. Here’s how they fit into the compliance workflow:

- Connect exchange APIs or import CSV statements.

- Software parses each transaction, tags it by type, and calculates wallet‑specific cost basis.

- It generates ready‑to‑file forms: Form 8949, Schedule D, and even Schedule C where applicable.

- Export a full audit‑ready PDF that includes transaction hashes and screenshots.

Most tools still struggle with DeFi smart‑contract interactions, so you’ll need to manually upload those events.

3. Hybrid Model (Spreadsheet + Software)

If you operate across multiple chains and a mix of centralized and decentralized platforms, combine both methods. Use software for high‑volume exchange trades, and a spreadsheet for occasional DeFi moves, staking rewards, and self‑transfers. Sync the two by exporting the software’s CSV and appending it to your master sheet weekly.

Tool Comparison: Manual vs Software vs Hybrid

| Criteria | Manual Spreadsheet | Crypto Tax Software | Hybrid |

|---|---|---|---|

| Initial Setup Time | Low (just create columns) | Medium (account creation + API linking) | High (set up both) |

| Ongoing Maintenance | High (data entry each trade) | Low (auto‑import) | Medium (manual for DeFi) |

| Accuracy for Cost Basis | Prone to human error | Algorithmic, supports wallet‑by‑wallet | Best of both |

| Audit‑Ready Documentation | Requires manual screenshots | Generated PDF with all hashes | Combined |

| Cost (Annual) | Free (Google Sheets) | $100‑$300 depending on plan | +$100 for software + time cost |

Common Pitfalls and How to Avoid Them

Even seasoned traders slip up. Here are the most frequent errors and quick fixes.

- Ignoring self‑transfers. Moving coins between your own wallets doesn’t create a taxable event, but it does reset the cost‑basis tracker if you forget to log the move. Always note the sending and receiving wallet IDs.

- Relying solely on exchange statements. Many exchanges still omit DeFi yields, staking rewards, or small airdrops. Cross‑check your wallet activity on a blockchain explorer.

- Using a single cost‑basis pool. The 2025 rule forces wallet‑by‑wallet accounting. Separate sheets per wallet or use software that supports the feature.

- Missing the FMV timestamp. The IRS wants the market price at the exact second of receipt. Pull the price from a reputable spot‑price source (CoinGecko, CoinMarketCap) and record the UTC timestamp.

- Delaying record entry. Waiting weeks to log trades leads to memory gaps. Set a daily reminder to export new CSVs or capture screenshots.

Next Steps: Making Your Record‑Keeping Routine Bullet‑Proof

1. Pick a primary tool. If you trade under $10,000 a year, a spreadsheet may suffice. Above that, invest in a reputable crypto tax platform.

2. Create a wallet inventory. List every address you control, label it (e.g., “Hardware - Ledger Nano X”), and assign a dedicated sheet or software tag.

3. Automate imports. Connect API keys for every exchange you use. For DeFi, schedule a weekly download of your wallet’s CSV from a block explorer.

4. Backup everything. Store encrypted copies of CSVs, PDFs, and screenshots in both cloud and an external hard drive. The IRS recommends three years of retention, but keep records for at least seven years if you’ve used crypto for business.

5. Run a pre‑filing audit. Before you send your 2025 return, run a reconciliation between your master sheet and the Form 1099‑DA you receive. Resolve any mismatches early to avoid penalties.

By treating crypto tax compliance as an ongoing process rather than a once‑a‑year chore, you’ll save time, reduce stress, and stay safely on the IRS’s good side.

Frequently Asked Questions

Do I need to report crypto trades under $100?

Yes. The IRS treats every crypto transaction as a taxable event, regardless of amount. Small trades still affect your cost basis and holding period, so they must be recorded.

How does Form 1099‑DA differ from the old 1099‑K?

Form 1099‑DA is specific to digital‑asset proceeds. It lists each sale, the fair‑market value at execution, and the broker’s identification. Unlike the 1099‑K, which covers generic payment‑card transactions, 1099‑DA focuses solely on crypto and appears earlier-starting with the 2025 tax year.

Can I use a single spreadsheet for all my wallets?

No. The wallet‑by‑wallet rule requires separate cost‑basis tracking per address. You can keep one master file, but each wallet should have its own tab or tag.

What records should I keep for staking rewards?

Record the reward date, token amount, USD fair‑market value at receipt, and the wallet that received it. When you later sell or swap the staked token, treat that as a separate capital‑gain event.

How long must I retain crypto tax records?

The IRS advises keeping documentation for at least three years after filing, but if you have complex DeFi activity or business income, seven years is a safer window.

Author

Ronan Caverly

I'm a blockchain analyst and market strategist bridging crypto and equities. I research protocols, decode tokenomics, and track exchange flows to spot risk and opportunity. I invest privately and advise fintech teams on go-to-market and compliance-aware growth. I also publish weekly insights to help retail and funds navigate digital asset cycles.