When you send crypto, you don’t just want it to go through-you want to know it’s final. No reversals. No delays. No doubt. That’s what fast finality promises. But here’s the catch: the faster it happens, the more you might be giving up elsewhere. This isn’t just a technical detail. It’s the difference between a trade settling in seconds or hours, between a DeFi position surviving a market crash or getting liquidated too early, between feeling confident in your transaction or second-guessing it for hours.

What Fast Finality Really Means

Finality isn’t just confirmation. It’s irreversibility. In Bitcoin, a transaction isn’t final until it’s buried under six blocks-about an hour. That’s probabilistic finality. The more blocks on top, the harder it is to rewrite history. But it’s never guaranteed. Someone with enough mining power could still roll it back, at enormous cost. Fast finality flips that. It means your transaction is locked in within seconds-or even milliseconds. Systems like Algorand, Solana, and Ethereum after its Merge aim for this. They don’t wait for confirmations. They use consensus rules that let the network agree instantly: this is done. No waiting. No guessing. This matters because real-world applications demand it. On a decentralized exchange, if your buy order takes 30 seconds to finalize, the price could move 5% before you even know you’re in. In high-frequency trading, that’s a loss. In DeFi lending, it could mean your collateral gets liquidated before you can react.The Core Trade-off: Safety vs. Liveness

Every blockchain consensus system walks a tightrope between two principles: safety and liveness. - Safety means: no two conflicting transactions can be finalized. Ever. If a block is final, it’s unchangeable. - Liveness means: the network keeps processing transactions, even if some nodes fail or go offline. Fast finality often leans hard on safety. Algorand, for example, achieves what it calls “instant finality.” It uses random jury selection via Verifiable Random Functions (VRF) to pick validators for each block. Three voting rounds happen in sequence: propose, soft vote, certify. Only one proposal survives each round. No forks. No ambiguity. Once certified, it’s final-zero seconds. But here’s the cost: if the network splits due to a connectivity issue-say, a regional internet outage-Algorand stops. It won’t risk finalizing conflicting blocks. It waits until the network heals. That’s safety first. But if you’re trying to pay someone during a blackout, you’re stuck. Ethereum took a different path. After switching to proof-of-stake, it uses a system called Casper FFG. Finality happens in epochs-every 15 seconds, a set of validators vote on the last block. Once two-thirds agree, it’s final. It’s fast. But if the network gets partitioned, Ethereum keeps producing blocks. It prioritizes liveness. That means during a split, two chains might form. Eventually, one gets abandoned. But for a few minutes, you might not know which one is real. So: Algorand pauses to stay safe. Ethereum keeps going, even if it means temporary confusion.Decentralization: The Hidden Cost

Fast finality often requires tight coordination. The more validators you need to agree quickly, the harder it is to keep the network open to everyone. Algorand’s VRF system is elegant, but it only works if thousands of nodes are online and responsive. If only a few hundred participate, the randomness weakens. The system still works-but it becomes more centralized by default. The same goes for Solana’s proof-of-history and hot-stake validators. To hit 400ms finality, you need high-performance nodes, fast networks, and strict timing. That favors well-funded operators. It doesn’t favor your neighbor running a node on a Raspberry Pi. Bitcoin, by contrast, doesn’t care about speed. It lets anyone join. Finality takes time, but the barrier to entry is near-zero. That’s why it’s still the most decentralized network. Fast finality systems aren’t necessarily less decentralized by design. But in practice, the performance demands make it harder for small players to keep up. You trade openness for speed.

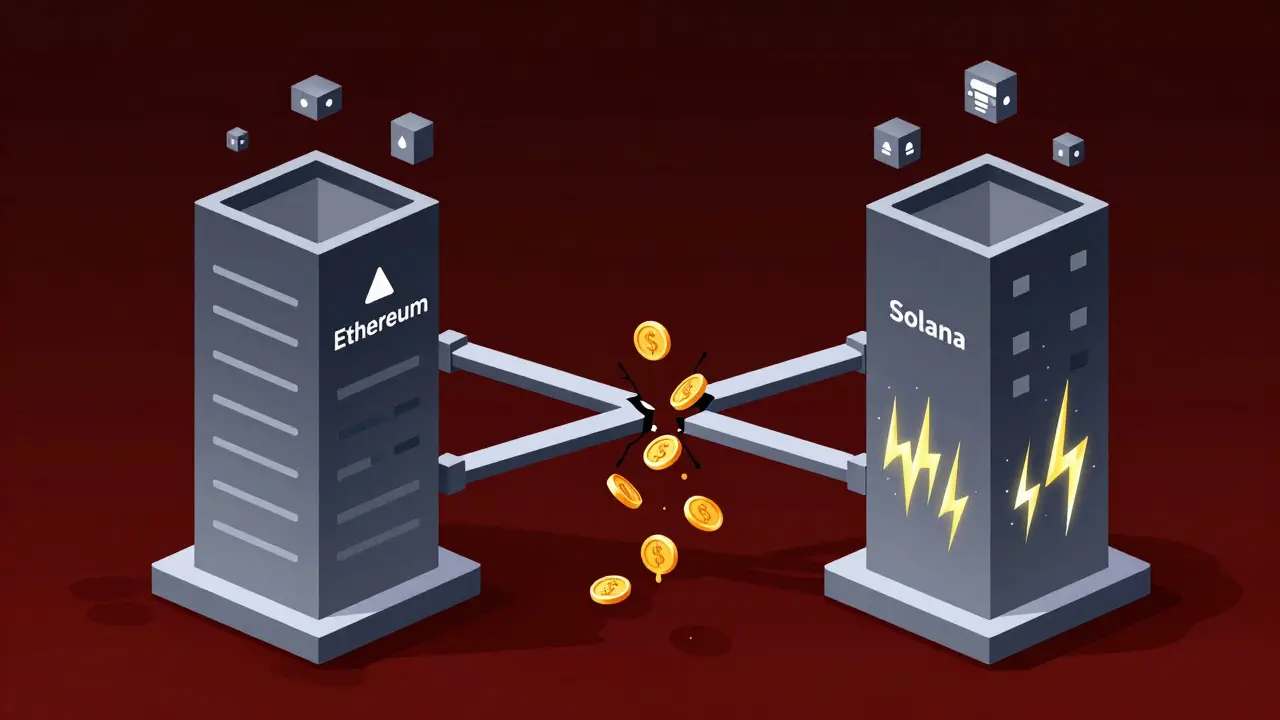

Cross-Chain Finality: The Nightmare Layer

Sending ETH from Ethereum to SOL on Solana? That’s not a simple transfer. It’s a bridge. And bridges are where fast finality breaks down. Each chain has its own rules. Ethereum finalizes in 15 seconds. Solana in under a second. But the bridge? It has to wait for both chains to confirm. It has to trust a set of validators on each side. It has to handle different time zones, different consensus clocks, different error conditions. A bridge might say: “We’ll wait for 10 Ethereum confirmations before releasing SOL.” That’s 2.5 minutes. Even if Solana is instant, you’re stuck waiting for Ethereum’s slower pace. Worse, if one chain reorgs-say, Ethereum rolls back a block-the bridge might have already sent the other side’s tokens. Now you’ve got a mismatch. Someone loses money. That’s happened. Multiple times. Fast finality on one chain doesn’t mean fast finality across chains. It means more complexity, more points of failure, and more risk.What’s Better: Economic Finality or Bitcoin-Style Finality?

Not all finality is built the same. Ethereum uses economic finality. It makes reversing a block so expensive that it’s not worth it. Validators put up 32 ETH as collateral. If they try to finalize conflicting blocks, they lose it all. That’s a financial deterrent. It’s fast and secure-because the cost of cheating is higher than the reward. Bitcoin uses proof-of-work finality. There’s no slashing. No collateral. Instead, security grows with each block. Reversing a transaction means redoing all the work on top of it. That takes massive computing power. It’s slow, but it’s been battle-tested for 15 years. Some new systems, like Bitcoin’s Proof-of-Proof (PoP), try to borrow Bitcoin’s security and attach it to faster chains. That’s promising. But it’s still experimental. No one’s proven it at scale yet. The trade-off here is simplicity vs. adaptability. Bitcoin’s model is slow but rock-solid. Ethereum’s is fast but relies on economic incentives that could change if ETH’s price crashes.

Real-World Impact: DeFi, Trading, and User Experience

If you’re trading on a DEX like Uniswap or a centralized exchange like Binance, finality affects your slippage, your fees, and your stress level. On a chain with fast finality-say, Arbitrum or Polygon-you can place a market order, get filled, and know you’re in before the price moves. Your liquidation risk drops. Your trades execute cleaner. You don’t need to overpay for gas to front-run yourself. On Bitcoin or Ethereum 1.0, you’d wait. You’d set wider slippage tolerance. You’d pay more. You’d get nervous. You’d check your wallet five times. That’s not just convenience. It’s financial safety. Fast finality reduces the window for MEV bots to exploit you. It makes automated strategies reliable. It lets DeFi protocols offer real-time lending and borrowing without massive over-collateralization. But if the network goes down because it prioritized safety over liveness? Then your entire strategy fails. You can’t trade. You can’t withdraw. You’re frozen.What Should You Care About?

You don’t need to understand VRFs or Casper FFG. But you do need to know this: - If you’re trading, staking, or using DeFi daily → choose a chain with fast, reliable finality (Ethereum L2s, Solana, Polygon). - If you’re holding long-term and want maximum security → Bitcoin’s slow but proven model still wins. - If you’re building a dApp → test how your smart contracts behave during network partitions. Does your app freeze? Or does it keep running with uncertain state? - If you’re using bridges → assume finality is slow. Wait longer than you think. Don’t trust single-chain confirmations. There’s no perfect system. Just trade-offs. The best choice depends on what you value more: speed, safety, or decentralization.What’s Next?

Researchers are working on hybrid models. Imagine a chain that uses fast finality under normal conditions but switches to Bitcoin-style proof-of-work if attacked. Or a system that lets users choose their own finality level-fast for small payments, slow for large ones. Single-slot finality for Ethereum is coming. That could cut finality to under a second. But will it hold up under attack? Only time will tell. For now, understand this: fast finality isn’t magic. It’s a design choice. And every choice has a cost.What does fast finality mean in blockchain?

Fast finality means a transaction becomes irreversible within seconds or milliseconds after being confirmed, instead of waiting for multiple blocks like in Bitcoin. It’s achieved through consensus protocols like BFT or DAGs that allow the network to agree instantly on the state of the ledger, enabling quicker settlements for trading, DeFi, and payments.

Why is fast finality important for DeFi?

In DeFi, delays in finality can cause liquidations, slippage, and failed trades. If your collateral isn’t confirmed quickly during a price drop, you might lose funds before you can react. Fast finality reduces these risks by ensuring transactions are locked in almost immediately, allowing automated strategies and real-time lending to function reliably.

Does fast finality make blockchains less secure?

Not necessarily-but it changes how security works. Fast finality systems often rely on economic penalties (like slashing staked ETH) or strict validator coordination to prevent double-spending. If the network is partitioned or attacked, some systems may halt (prioritizing safety), while others keep running with temporary uncertainty (prioritizing liveness). The trade-off is between immediate certainty and resilience under stress.

Is Algorand truly instant with finality?

Yes-Algorand claims and delivers 0-second finality. It uses a three-stage voting process with randomly selected juries based on stake, ensuring only one valid block is ever proposed. Because forks are mathematically impossible under normal conditions, once a block is certified, it’s final. However, if the network suffers a major split or attack, Algorand halts until quorum is restored, sacrificing availability for safety.

Can I trust cross-chain bridges with fast finality?

Not fully. Even if one chain has instant finality, bridges must wait for confirmation on both sides. If Ethereum finalizes in 15 seconds but the bridge waits for 10 confirmations, you’re waiting 2.5 minutes. Plus, bridges rely on external validators that can be hacked or misconfigured. Fast finality on one chain doesn’t make cross-chain transfers fast or safe-it often adds more complexity and risk.

Which blockchain has the best balance of speed and security?

For most users today, Ethereum’s Layer 2 networks (like Arbitrum or Optimism) offer the best balance. They inherit Ethereum’s security, use fast finality (under a minute), and have strong decentralization. Solana is faster but more centralized. Bitcoin is more secure but too slow for active trading. The ideal choice depends on your use case: trading? Use L2s. Holding? Use Bitcoin.

Author

Ronan Caverly

I'm a blockchain analyst and market strategist bridging crypto and equities. I research protocols, decode tokenomics, and track exchange flows to spot risk and opportunity. I invest privately and advise fintech teams on go-to-market and compliance-aware growth. I also publish weekly insights to help retail and funds navigate digital asset cycles.