When you trade crypto with leverage, you’re borrowing money to amplify your position. That sounds powerful - until the market moves against you. At some point, your exchange will automatically close your trade. That’s called liquidation. And the price at which it happens? That’s your liquidation price.

Knowing this number isn’t just helpful - it’s survival. Too many traders lose everything because they didn’t understand when their position would get wiped out. It’s not about guessing. It’s about math. And once you know how to calculate it, you stop playing Russian roulette with your capital.

What Exactly Is a Liquidation Price?

The liquidation price is the exact market price where your margin balance drops below the minimum required to keep your leveraged position open. At that point, the exchange steps in and closes your trade - no warning, no second chance. This isn’t a penalty. It’s a safety net. Without it, you could end up owing more than you deposited.

Most exchanges don’t use the last traded price to calculate this. They use the mark price. Why? Because the last price can be manipulated by a single large trade. The mark price is an average based on multiple sources, making it harder to game. For example, Binance, Bybit, and Crypto.com all rely on mark price to avoid false liquidations triggered by flash crashes or spoofing.

Think of it like this: Your liquidation price is the red line on your trading chart. Cross it, and your position dies. You don’t get to argue. You don’t get to wait. The system acts instantly.

How to Calculate Liquidation Price (Long Position)

If you’re long (betting the price will go up), here’s the formula:

Liquidation Price = Entry Price × (1 - Initial Margin Rate + Maintenance Margin Rate)

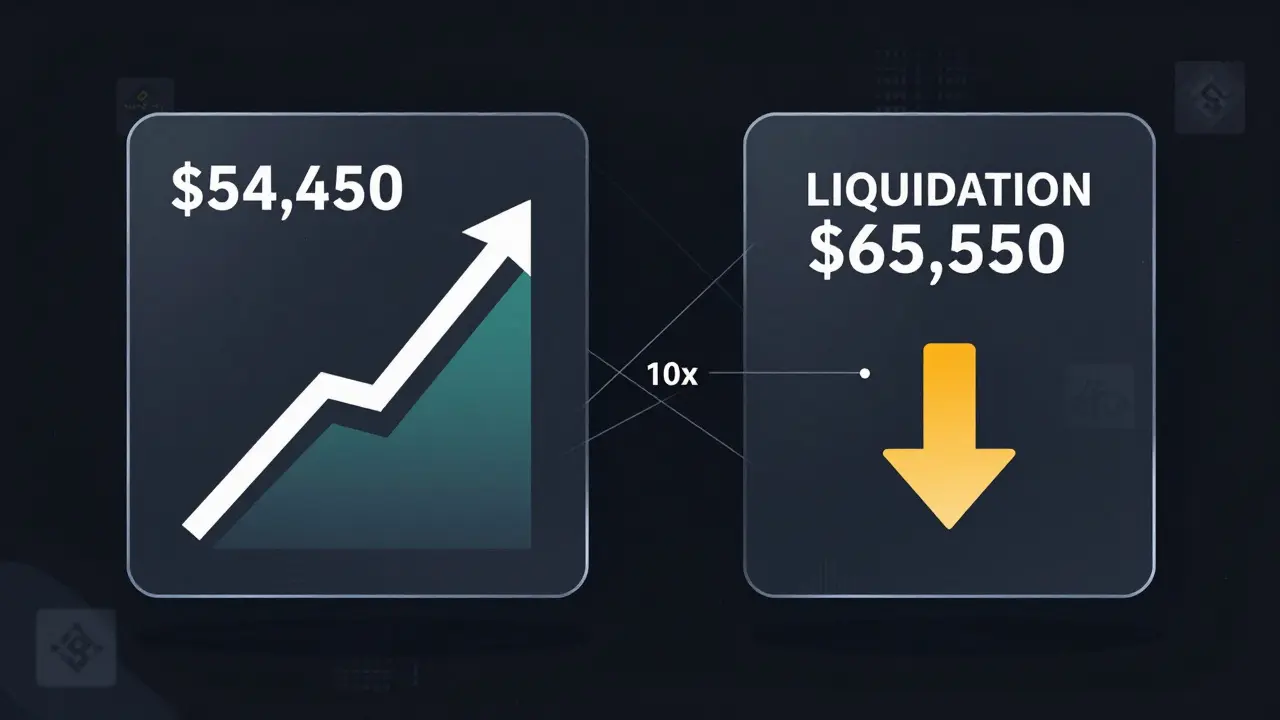

Let’s say you buy 1 BTC at $60,000 with 10x leverage. Your initial margin rate is 10% (because 1/10 = 10%). Most exchanges set maintenance margin around 0.5% to 1%. Let’s use 0.75%.

Plug it in:

60,000 × (1 - 0.10 + 0.0075) = 60,000 × 0.9075 = $54,450

So if Bitcoin drops to $54,450, your position gets liquidated. Not $50,000. Not $45,000. $54,450. That’s the line.

Notice something? The lower your leverage, the farther away your liquidation price is from your entry. With 5x leverage (20% initial margin), your liquidation price would be $60,000 × (1 - 0.20 + 0.0075) = $48,450. That’s a bigger buffer. Less risk.

How to Calculate Liquidation Price (Short Position)

If you’re short (betting the price will fall), the formula flips:

Liquidation Price = Entry Price × (1 + Initial Margin Rate - Maintenance Margin Rate)

Same example: You short 1 BTC at $60,000 with 10x leverage. Initial margin = 10%. Maintenance margin = 0.75%.

60,000 × (1 + 0.10 - 0.0075) = 60,000 × 1.0925 = $65,550

So if Bitcoin rises to $65,550, you get liquidated. That’s the danger of shorts. The upside is unlimited. So is your risk.

Many traders forget this. They think “I’m short, so I’m safe if the price drops.” But if the market surges - even briefly - you can get wiped out fast. That’s why short positions need tighter risk controls.

Isolated Margin vs. Cross Margin: Big Difference

Not all margin types are created equal. This changes how liquidation works - and how much you can lose.

- Isolated Margin: Each trade has its own separate margin. If one position gets liquidated, your other trades are untouched. Your risk is locked to that single trade. Great for beginners or traders who want to isolate risk.

- Cross Margin: Your entire account balance acts as collateral for all positions. If one trade starts losing, the system can pull funds from your other positions to keep it alive. Sounds safer? Not always. During a crash, cross-margin can trigger cascading liquidations. One bad trade can drag down your whole account.

During the March 2020 crash and the 2022 market collapse, traders using cross-margin saw entire portfolios wiped out in minutes. Isolated margin saved many others. If you’re not experienced, stick with isolated. You control the risk. You know exactly where your line is.

Liquidation Price vs. Bankruptcy Price: Don’t Confuse Them

Many traders think liquidation and bankruptcy are the same. They’re not.

Liquidation price is when the exchange closes your position because your margin fell below the maintenance level.

Bankruptcy price is when your losses equal your entire initial margin. Your account balance hits zero. You’ve lost everything you put in.

There’s a gap between these two. That’s where the exchange’s Insurance Fund steps in. If your position is liquidated at a price above the bankruptcy price, the leftover funds go into the fund. If it drops below - meaning you lost more than your margin - the fund covers the deficit so you don’t owe the exchange money.

But here’s the catch: The Insurance Fund isn’t infinite. During extreme volatility, like the May 2021 crash, the fund was nearly drained. Exchanges had to use auto-deleveraging (ADL) to close positions of profitable traders to cover losses. That’s how bad it got.

Why Liquidation Prices Often Don’t Match Reality

Here’s the ugly truth: The liquidation price you see on your screen is a theoretical estimate. It’s not guaranteed.

During high volatility - think Bitcoin dropping 10% in 30 minutes - prices can gap. Your liquidation price might be $54,000, but the market crashes to $52,000 in one second. Your position gets liquidated at $52,000, not $54,000. That’s slippage. That’s market chaos.

Traders on Reddit and TradingView report liquidations happening 2-5% away from the displayed price. One user lost $12,000 because his liquidation was shown at $26,500 - but he got closed out at $26,850. He didn’t have time to react.

Exchanges like PrimeXBT now offer liquidation simulators that factor in real-time order book depth. These tools are more accurate. But they’re not perfect. No system can predict a flash crash.

How to Avoid Getting Liquidated

You can’t control the market. But you can control your risk.

- Use lower leverage. 5x or 10x is enough. 50x? That’s gambling. The 2024 CoinGecko report showed average liquidation sizes jumped from $1,850 in 2022 to $3,420 in 2024. Higher leverage = bigger losses.

- Keep a buffer. Don’t let your current price get within 10% of your liquidation price. Professionals aim for 20-30%. During the July 2024 Bitcoin crash, traders with 25%+ buffers avoided liquidation entirely. Those with 10%? Wiped out.

- Use stop-losses. Set a manual stop-loss 5-10% away from your liquidation price. It’s your second line of defense.

- Never risk more than 5% of your total capital on one trade. That’s the CFA Institute’s rule. If you have $10,000, don’t put $500 on a single leveraged position. That’s how you survive multiple bad trades.

- Monitor funding rates. On perpetual futures, funding payments can eat into your margin over time. A positive funding rate (longs pay shorts) can slowly drain your balance - even if the price doesn’t move.

And remember: Your exchange won’t warn you. They won’t call you. They won’t email you. The moment your margin drops below maintenance, your position is gone.

What’s Changing in 2026?

AI-powered liquidation systems are starting to roll out. By 2026, exchanges like Binance and Bybit plan to use machine learning to predict volatility spikes and adjust liquidation thresholds dynamically. Early tests show a 40-60% drop in false liquidations.

But the core math won’t change. The formulas from BitMEX in 2014 still work today. What’s changing is how accurately exchanges estimate risk. The goal isn’t to eliminate liquidation - it’s to make it fairer.

Regulators are also stepping in. In the U.S., the CFTC now requires exchanges to clearly disclose how liquidation prices are calculated. No more hidden formulas. No more vague terms.

But here’s the bottom line: No algorithm, no regulation, no AI will protect you if you don’t understand your own risk. You’re the only one who can set your limits. You’re the only one who can walk away before it’s too late.

Final Thought: Liquidation Is a Feature, Not a Bug

Liquidation isn’t there to punish you. It’s there to stop you from losing more than you can afford. The problem isn’t the system. The problem is thinking you can outsmart it.

Trade with respect. Trade with discipline. Know your numbers. And never, ever ignore your liquidation price.

How is liquidation price different from stop-loss?

Liquidation price is set by the exchange and triggers automatically when your margin falls below the maintenance level. It’s forced and non-negotiable. A stop-loss is a manual order you place to close your position at a specific price. You control it. It’s a tool to avoid liquidation - not a replacement for it.

Can I get liquidated if the price doesn’t reach my liquidation price?

Yes. During extreme volatility, prices can gap past your liquidation level in milliseconds. Even if the displayed price hasn’t hit your limit, your position can still be closed due to slippage. This is called early liquidation. It’s common during flash crashes and low-liquidity events.

Does leverage affect liquidation price?

Absolutely. Higher leverage means lower initial margin, which brings your liquidation price closer to your entry price. For example, with 20x leverage, your liquidation price might be just 5% away from your entry. With 5x leverage, it’s 20% away. Lower leverage = more breathing room.

Why do exchanges use mark price instead of last price?

Last price can be manipulated by a single large trade or spoofing. Mark price is calculated using a weighted average from multiple exchanges and timeframes. This makes it harder to trigger false liquidations. Exchanges like Binance and Bybit use mark price specifically to protect traders from market manipulation.

Is it possible to recover after liquidation?

No. Once your position is liquidated, it’s permanently closed. You lose the entire margin allocated to that trade. You can deposit more funds and open a new position, but the old one is gone. That’s why risk management before entry is critical - not after.

Author

Ronan Caverly

I'm a blockchain analyst and market strategist bridging crypto and equities. I research protocols, decode tokenomics, and track exchange flows to spot risk and opportunity. I invest privately and advise fintech teams on go-to-market and compliance-aware growth. I also publish weekly insights to help retail and funds navigate digital asset cycles.