South Korea Crypto Tax Calculator

Capital Gains Tax Calculator

Calculate tax on crypto profits exceeding 50 million KRW (2027 deadline)

Income Tax Calculator

Calculate tax on crypto as income (staking, mining, payments)

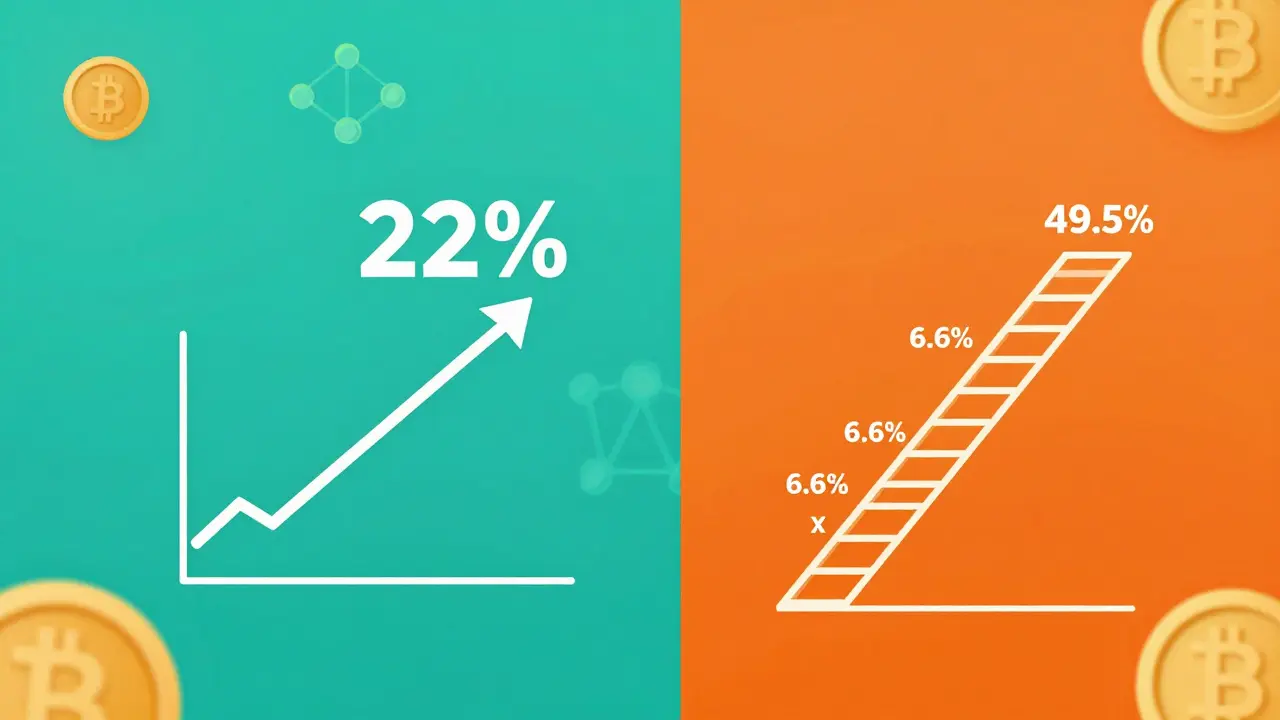

Important Note: Under South Korea's new rules, crypto earned through staking, mining, or payments is taxed as income at progressive rates (up to 49.5%), while capital gains are taxed at 22% only if exceeding 50 million KRW annually.

By January 2027, if you make more than 50 million Korean Won ($35,900 USD) in crypto profits in South Korea, you’ll pay 20% in capital gains tax - plus 2% local tax, bringing the total to 22%. But if you earn crypto as income - from staking, mining, or getting paid in crypto - your tax rate could climb as high as 49.5%. That’s where the 5-45% range people talk about actually comes from.

It’s Not One Tax Rate - It’s Two Different Systems

People hear "5-45% crypto tax in South Korea" and assume it’s one flat rate. It’s not. There are two completely separate tax rules, and which one applies depends entirely on how you got your crypto.If you bought Bitcoin at $30,000 and sold it at $50,000, that’s a capital gain. You only pay tax if your total annual gains from all crypto trades hit 50 million KRW. Below that? Zero tax. Above it? 20% federal tax on the profit, plus 2% local tax. That’s it. No matter how long you held it. No discounts for holding a year like in Germany. Just pure profit, taxed once you cross the threshold.

But if you earned crypto as income - say, you staked Ethereum and got 0.5 ETH as rewards, or you mined Bitcoin, or a company paid you in USDT - that’s treated as "other income." And that’s taxed at your personal income tax rate. That’s where the 49.5% comes in. If you’re a high earner making over 120 million KRW a year from your job and crypto, the top marginal rate applies. That’s not a crypto-specific rate - it’s just the highest income tax bracket in South Korea, and crypto earnings get lumped in with your salary.

Why the 50 Million KRW Threshold Matters

The 50 million KRW exemption isn’t just a number - it’s a lifeline for everyday investors. Most South Koreans who buy a little Bitcoin or Ethereum on Bithumb or Upbit will never hit that mark. Even if you trade weekly, unless you’re moving hundreds of thousands of dollars, you’re probably safe.For example: If you bought $10,000 worth of Solana and sold it for $18,000, your profit is $8,000. You’d need to make over $4.5 million in total crypto profits in a year to hit the 50 million KRW threshold. That’s not the average person. That’s a serious trader or institutional player.

This design was intentional. The government wanted to target people who treat crypto like a business, not those who bought a few coins as a side investment. The delay to 2027 was pushed through because even the ruling party admitted the system was too complex for small investors to handle without proper tools and guidance.

Income Tax Rates: Where the Real Bite Comes From

The 22% capital gains rate might sound steep, but compared to the income tax side, it’s gentle. If you’re earning crypto from DeFi yields, airdrops, or freelance payments in crypto, you’re not getting a flat 20%. You’re getting slapped with your personal income tax rate.Here’s how it breaks down for 2025:

- Under 12 million KRW/year: 6.6%

- 12-46 million KRW: 15%

- 46-88 million KRW: 24%

- 88-150 million KRW: 35%

- 150-300 million KRW: 38%

- 300-500 million KRW: 40%

- Over 500 million KRW: 45% + 4.5% local tax = 49.5%

So if you’re running a crypto staking operation and pulling in 100 million KRW a year in rewards, you’re paying 38% on that income - not 22%. That’s the real reason some people say crypto taxes in Korea can hit 45%.

What Counts as a Taxable Event?

Not every crypto action triggers tax. But many do - and the rules are strict.Here’s what’s taxable:

- Selling crypto for fiat (KRW, USD, etc.)

- Trading one crypto for another (BTC → ETH = taxable event)

- Receiving crypto as payment for goods or services

- Earning staking rewards, mining rewards, or airdrops

- Receiving crypto from a foreign company (even if you didn’t sell it)

Here’s what’s NOT taxable:

- Buying crypto with KRW

- Transferring crypto between your own wallets

- Gifting crypto to family (unless it’s part of a business arrangement)

- Donating crypto to registered charities

That last one - crypto-to-crypto trades - trips up a lot of people. If you swap 0.5 BTC for 15 ETH, the IRS treats it as two separate events: sell BTC, buy ETH. South Korea does the same. You must calculate the KRW value of your BTC at the time of the swap, then the KRW value of the ETH you received. The difference? That’s your taxable gain. Even if you didn’t touch fiat, you still owe tax.

Tracking Is Hard - And You Need Records

The National Tax Service doesn’t care if you used 12 different exchanges, DeFi protocols, or wallets. You have to track every transaction: date, time, amount, value in KRW, and what you did with it.That means:

- Exporting transaction history from Binance, Upbit, Coinbase, etc.

- Recording the KRW price of each coin at the exact moment of trade (using a reliable source like CoinGecko or Naver Finance)

- Keeping screenshots of airdrops, staking payouts, and wallet receipts

- Documenting the purpose of each transfer (e.g., "paid for freelance work")

Tax professionals say active traders need 10 to 20 hours just to set up their records for 2026. Then another 2-4 hours per month to keep it updated. If you’re doing DeFi yield farming or NFT flipping, it’s worse. You need to track gas fees, slippage, and multiple smart contract interactions.

There’s no official government tool. No automated reporting like with banks. You’re on your own. That’s why crypto tax software like Koinly and CoinTracker are gaining traction in Korea - even though they’re not Korean-language native.

What About Foreigners and Companies?

If you’re not a South Korean resident, the rules change. If you sell crypto from a Korean exchange, you’ll pay 11% withholding tax on the total sale amount - not the profit. If you’re a foreign company selling crypto in Korea, you pay 22% on net gains. That’s simpler, but it’s still a tax.And if you’re a Korean resident who gets crypto from a foreign corporation - say, a US-based crypto startup pays you in USDC - you must report that as income, even if you never cashed out. The National Tax Service made this clear in July 2025. They’re cracking down on offshore crypto payments.

Why the Delay to 2027?

The original plan was 2022. Then 2025. Then December 2024, the government pushed it to January 2027. Why? Because the crypto community pushed back hard.Industry groups warned that forcing small investors to track thousands of micro-transactions would drive them to offshore exchanges. Tax professionals said the system was too complex to implement without causing chaos. Even the ruling party admitted they didn’t have the infrastructure to handle the paperwork flood.

The compromise? Keep the rules, but give people two more years to prepare. That’s why you’re seeing more crypto tax workshops, software adoption, and even university courses on crypto accounting in Seoul right now.

What Happens If You Don’t Report?

South Korea’s tax authority has blockchain analytics tools. They can trace transactions across exchanges. They’ve already flagged thousands of accounts with suspicious activity.Penalties include:

- Up to 40% in fines on unpaid taxes

- Interest charges on overdue amounts

- Public naming of repeat offenders

- Criminal charges for intentional evasion (rare, but possible)

It’s not like the U.S. where you can file late and pay later. Korea’s system is strict. If you’re caught underreporting, you’ll pay more in penalties than you saved in taxes.

What’s Next?

The 2027 deadline is now official. Most experts believe it won’t be delayed again. The OECD’s Crypto-Asset Reporting Framework (CARF) is coming into force in 2027, and South Korea is committed to aligning with it. That means automatic data sharing with other countries - your transaction history could soon be sent to the IRS, HMRC, or ASIC.Expect more clarity from the National Tax Service in 2026. They’ll likely release sample calculation templates, approved software lists, and maybe even a simplified reporting form for small investors.

For now, the message is clear: If you’re trading crypto in South Korea, start tracking. Even if you’re below the 50 million KRW threshold, you’ll want records in case you cross it next year. And if you’re earning crypto as income - especially over 100 million KRW - talk to a tax pro. That 49.5% rate doesn’t care how smart you think you are.

Author

Ronan Caverly

I'm a blockchain analyst and market strategist bridging crypto and equities. I research protocols, decode tokenomics, and track exchange flows to spot risk and opportunity. I invest privately and advise fintech teams on go-to-market and compliance-aware growth. I also publish weekly insights to help retail and funds navigate digital asset cycles.