Don’t be fooled by the name. Kalata Protocol isn’t a crypto exchange. It’s a decentralized finance (DeFi) protocol built on Binance Smart Chain that lets users farm yield by locking up tokens. But calling it a “protocol” doesn’t make it safe. In fact, if you’re looking to trade or store crypto, Kalata Protocol is one of the riskiest things you could touch right now.

What Kalata Protocol Actually Is (And Isn’t)

Kalata Protocol, or KALA, is a token that runs on Binance Smart Chain (BSC). It doesn’t let you buy Bitcoin, sell Ethereum, or swap altcoins like a real exchange would. Instead, it’s a yield farming platform. You deposit BUSD, BNB, or other tokens into its pools, and it rewards you with KALA tokens in return. Sounds simple? That’s the trap. The project launched in late 2023 with no known team. No names. No LinkedIn profiles. No registered company. Just a GitHub repo with three outdated files and a Telegram group that takes days to respond. That’s not unusual in crypto - but when combined with other red flags, it’s a warning sign you can’t ignore.The Numbers Don’t Lie: Tiny Liquidity, Huge Risk

As of November 2025, Kalata Protocol’s total value locked (TVL) is $87,342. That’s less than what a single liquidity pool on PancakeSwap holds. For comparison, Uniswap moves over $3 billion in volume every day. Kalata struggles to hit $200,000 in daily trading. Why does this matter? Because low liquidity means massive slippage. If you try to sell $5,000 worth of KALA, you could lose nearly 9% of your value just from the trade itself. On a real exchange like Binance or Kraken, that same trade would cost you 0.1% or less. Kalata isn’t built for trading. It’s built for quick pumps and dumps. The KALA token’s market cap sits at just over $1 million. That’s 0.00067% of the entire DeFi market. You’re not investing in a project - you’re betting on a micro-cap gamble that could vanish overnight.Security Risks You Can’t Afford to Ignore

Kalata’s smart contract was verified on BscScan, but that’s the bare minimum. There’s been no full audit from OpenZeppelin, CertiK, or any reputable firm. Blockchain researcher Alex Svanevik from Nansen flagged it as a critical vulnerability - and he’s not the only one. Security firm F-Secure found code similarities between Kalata and known scam projects. They also noted the presence of admin keys that could theoretically mint unlimited KALA tokens. No one’s done it yet - but the capability exists. That’s like leaving the keys to your bank vault on the counter and hoping no one picks them up. Even worse, the contract still uses the dangerousapprove() function that was patched in most legitimate DeFi projects over a year ago. This flaw lets malicious contracts drain your wallet if you interact with them accidentally. Reddit user u/DeFi_Safety_Audit confirmed this in November 2025 - and PeckShield, a top blockchain monitor, backed it up.

Yield Farming Returns? Too Good to Be True

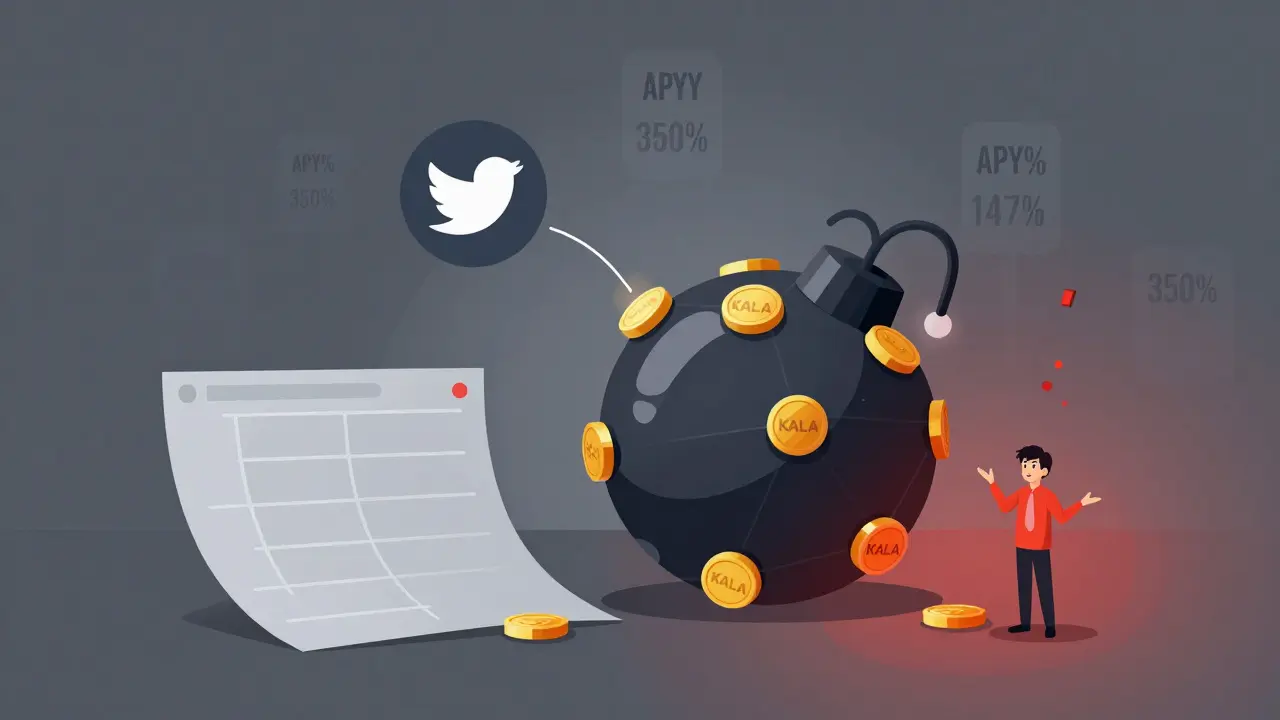

Kalata’s yield farming pools promise returns up to 147% APY. Sounds amazing, right? But those numbers are collapsing. At launch, they were over 350%. That’s not sustainable - it’s a classic pump-and-dump setup. The returns are fueled by new users buying KALA, not real revenue. When the flow of new money slows down, the rewards dry up. And they already have. The pool for KALA-BNB pairs dropped from 350% to 147% in under six months. That’s not a feature - it’s a countdown. Compare that to Aave or Compound, which offer stable, audited interest rates based on real borrowing demand. Kalata’s yields are pure speculation. You’re not earning interest - you’re gambling on whether more people will join before the rug pull.Who’s Using It? And Why?

There are only 2,841 unique wallets that have interacted with Kalata in the last six months. Over 70% of those hold less than $50 in KALA. This isn’t a community - it’s a collection of small-time speculators. On ProBit Exchange, 58% of voters gave positive ratings. But those are anonymous votes from people who haven’t tried to withdraw. On Trustpilot, there are 17 verified reviews with a 1.9/5 average. Complaints? Withdrawals taking over 72 hours. Customer support that never replies. Transactions failing and burning your gas fees. One Reddit user reported earning $37.50 over 30 days with a $150 investment. That’s a 25% return - but only because they didn’t try to cash out. The moment you try to sell, you hit the liquidity wall. That’s the game.

Why It Won’t Get Listed on Real Exchanges

Kalata Protocol won’t ever be on Coinbase, Kraken, or Binance. Why? Because their listing requirements are strict. You need a transparent team, third-party audits, ongoing development, and a clear use case. Kalata has none of those. Coinbase’s 2025 asset framework explicitly bars projects without verified teams or audits. Kraken’s policy is even stricter. Kalata’s Twitter account hasn’t posted since May 2025. Their roadmap promised mobile apps and cross-chain bridges by mid-2024 - none were delivered. No updates. No explanations. This isn’t a project in development. It’s a project in stasis. And in crypto, stasis equals death.Expert Opinions: Almost All Say Avoid

Galaxy Digital analyst Christine Kim gave Kalata a 2.1/5 rating. Her verdict: “No team doxxing, no audits, and yield farming designed to pump and dump.” JPMorgan’s blockchain team labeled it “non-investible.” TokenInsight predicts a 12-month abandonment window. Even Crypto Wendy, a retail-focused YouTuber who gave it a 3.8/5, warned users to only risk under $500. The only people cheering it on are those who already bought in early and are hoping to sell to someone else. That’s not investing. That’s playing hot potato with your money.Bottom Line: Don’t Risk More Than You Can Afford to Lose

Kalata Protocol isn’t a scam in the traditional sense - no one’s stolen your funds yet. But it’s a ticking time bomb. Low liquidity. No audits. No team. No updates. No future. If you’re a beginner looking to try DeFi, go to PancakeSwap or Uniswap. Use wallets you trust. Stick to projects with real documentation and active development. If you’re thinking of putting money into KALA, ask yourself this: Would you invest in a company with no CEO, no financial statements, and a product that barely works? Of course not. Then why are you considering this? The only safe use case for Kalata Protocol is if you’re willing to lose $50 for the thrill of a high-risk gamble. Anything more than that is just throwing money into a black hole.Is Kalata Protocol a real crypto exchange?

No, Kalata Protocol is not a crypto exchange. It’s a DeFi yield farming protocol built on Binance Smart Chain. It doesn’t allow users to buy, sell, or trade cryptocurrencies directly. Instead, it lets users deposit tokens into liquidity pools to earn KALA rewards. If you’re looking for an exchange, platforms like Binance, Kraken, or PancakeSwap are legitimate options.

Can I trust Kalata Protocol with my crypto?

No, you should not trust Kalata Protocol with more than you can afford to lose. The project has no verified team, no third-party security audits, and critical smart contract vulnerabilities. It also has extremely low liquidity, meaning you may not be able to withdraw your funds without massive losses. Multiple security firms, including F-Secure and Nansen, have flagged it as high-risk.

Why are the APY rates so high on Kalata?

The high APY rates (up to 147%) are unsustainable and designed to attract new users quickly. These returns are funded by new token purchases, not real revenue. As the number of new investors slows down, the rewards drop - which is exactly what happened after launch, when APY fell from over 350% to under 150%. This is a classic pump-and-dump structure common in micro-cap DeFi projects.

Has Kalata Protocol ever been hacked?

As of January 2026, Kalata Protocol has not been hacked. However, it has multiple known vulnerabilities that make it an easy target. The contract still uses the outdated and dangerous approve() function, and it has admin keys that could allow the developers to mint unlimited tokens. These flaws have been confirmed by blockchain security researchers, but no exploit has occurred yet - which doesn’t mean it won’t.

Why isn’t Kalata listed on major exchanges?

Major exchanges like Coinbase and Kraken require projects to have transparent teams, verified smart contracts, regular development updates, and third-party audits. Kalata Protocol meets none of these criteria. It has no public team, no audits, no mobile app, no API, and no meaningful development since early 2024. As a result, it’s excluded from all reputable exchanges by design.

What should I do if I already invested in KALA?

If you’ve already invested, don’t panic - but don’t add more. Monitor your position closely. If you’re holding a small amount under $100, consider withdrawing your earnings and exiting before liquidity dries up further. Use a wallet like MetaMask with BSC network enabled, and be prepared for slow or failed transactions. If you’re holding more than $500, consult a crypto financial advisor - you’re at serious risk of losing everything.

Are there safer alternatives to Kalata Protocol?

Yes. For yield farming, use platforms like PancakeSwap, Aave, or Compound - all have been audited, have transparent teams, and hold billions in total value locked. For trading, use Binance, Kraken, or Coinbase. These platforms offer lower fees, better liquidity, and real customer support. Kalata offers none of these. Stick to projects with a track record, not hype.

Is KALA token worth buying as a long-term investment?

No, KALA is not a viable long-term investment. With a market cap under $1.1 million, no development activity since 2024, and zero institutional interest, the token has no fundamental value. Its price is driven entirely by speculation and short-term yield farming. Experts from Galaxy Digital, JPMorgan, and TokenInsight all classify it as high-risk or non-investible. Long-term holding is a recipe for total loss.

Author

Ronan Caverly

I'm a blockchain analyst and market strategist bridging crypto and equities. I research protocols, decode tokenomics, and track exchange flows to spot risk and opportunity. I invest privately and advise fintech teams on go-to-market and compliance-aware growth. I also publish weekly insights to help retail and funds navigate digital asset cycles.