Zephyr Collateral Calculator

Zephyr Protocol requires 400% collateral ratio. For every $1 of ZSD you mint, you need to lock $4 worth of ZEPH tokens.

Result

400% Collateral Ratio

Zephyr requires 4x the value of ZSD as ZEPH collateral. If you want $100 in ZSD, you need to lock $400 worth of ZEPH.

Most stablecoins like USDT or USDC are backed by bank deposits or corporate reserves. They’re fast, widely used, and trusted-but they’re not private. If you send USDT, the transaction is visible on the blockchain. Your balance, your recipient, your history-all traceable. What if you wanted a stablecoin that kept your financial activity hidden, like Monero, but without the price swings? That’s where Zephyr Protocol comes in.

What Exactly Is Zephyr Protocol?

Zephyr Protocol is a decentralized finance (DeFi) project launched on May 29, 2023. It’s not another meme coin or a copycat stablecoin. It’s built from the ground up to solve a real problem: how to have a stable, private digital currency that doesn’t rely on banks or centralized companies. The protocol’s native token, ZEPH, powers a system that creates Zephyr Stable Dollars (ZSD)-a crypto-backed stablecoin that holds its value at $1, while keeping every transaction completely private. Unlike USDC, which is backed by cash and short-term U.S. government bonds held by a company, Zephyr uses only cryptocurrency as collateral. Specifically, it uses ZEPH tokens. And here’s the twist: you need to lock up at least four times the value of ZSD you want to mint. That’s a 400% collateral ratio. If you want $100 in ZSD, you have to lock up $400 worth of ZEPH. This over-collateralization makes ZSD far more resistant to crashes than algorithmic stablecoins like Terra’s UST, which collapsed in 2022 because it had no real backing.How Zephyr’s Three-Token System Works

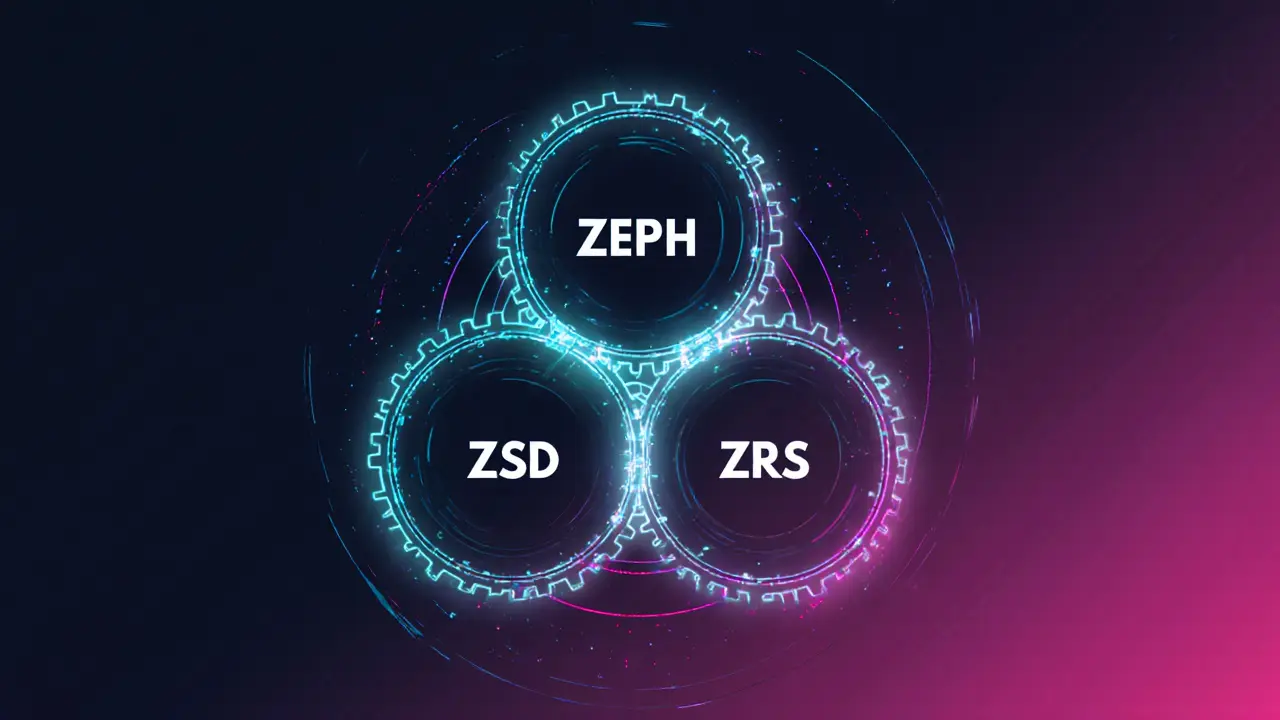

Zephyr doesn’t just have one token. It has three, and they all work together like gears in a machine:- ZEPH is the base token. It’s the collateral. Right now, there are just over 10 million ZEPH in circulation, with no hard cap-meaning more can be created over time.

- ZSD is the stablecoin. It’s pegged to $1 and designed to stay there. You mint ZSD by locking ZEPH. You can redeem ZSD back for ZEPH anytime.

- ZRS (Zephyr Reserve Shares) represent ownership in the protocol’s reserve. When the collateral ratio rises above 400%, the extra value flows into ZRS. If the price of ZEPH drops and the ratio falls, ZRS holders absorb some of the loss. Think of ZRS as a share in the protocol’s safety net.

Why Privacy Matters in Stablecoins

Zephyr runs on a blockchain built from Monero’s code. That means every transaction is private by default. No one can see how much ZSD you have. No one can track where you sent it. Even the amount you minted or redeemed is hidden. This isn’t optional privacy like some coins offer-it’s baked into the protocol. That’s a big deal for people in countries with capital controls, high inflation, or surveillance-heavy banking systems. Imagine sending money to a family member overseas without your government knowing. Or paying for services without exposing your income. ZSD makes that possible. Compare that to USDT. Even if you use a non-KYC exchange, your transaction history is still public. Anyone can look up your wallet address and see every move you’ve ever made. Zephyr changes that. It’s not just a stablecoin-it’s a financial privacy tool.

How It Compares to Other Stablecoins

Here’s how Zephyr stacks up against the most common alternatives:| Feature | Zephyr Protocol (ZSD) | USDT / USDC | DAI | Monero (XMR) |

|---|---|---|---|---|

| Backing | Over-collateralized with ZEPH (400%+) | Centralized cash and bonds | Over-collateralized crypto (mostly ETH) | None (volatile asset) |

| Privacy | Full anonymity (Monero-based) | No privacy | No privacy | Full anonymity |

| Stability | Pegged to $1 | Pegged to $1 | Pegged to $1 | Highly volatile |

| Decentralization | Community-run, no VC funding | Centralized (Tether, Circle) | Decentralized | Decentralized |

| TVL (Dec 2023) | $1.7 million | $118 billion | $780 million | $2.1 billion |

Who Uses Zephyr and Where?

Zephyr’s user base is small but growing-and very specific. According to blockchain analytics from Q4 2023, 43% of Zephyr activity comes from European Union countries. That’s no accident. The EU has some of the strictest financial privacy laws in the world, and many users there are wary of centralized surveillance. Another 29% of users are from North America, often people who’ve had bad experiences with banks freezing accounts or reporting transactions. The remaining 28% come from Asia, particularly countries with capital controls like India and Vietnam. Users aren’t just holding ZSD-they’re using it. One user on Bitcointalk reported sending ZSD across borders for a freelance payment and said it was the first time they’d ever done a cross-border transaction without a third party knowing the details. Another user on Reddit said the minting process took 45 minutes the first time, but after learning the system, they now use ZSD for weekly payments to a contractor in a country with strict currency controls.

The Challenges: Complexity and Liquidity

Zephyr isn’t easy. It’s not designed for beginners. Getting started requires downloading a Monero-compatible wallet, understanding collateral ratios, and learning how ZRS works. Community surveys estimate users need 8 to 12 hours of study before they can safely use the protocol. The biggest complaint? Managing three tokens. Most people are used to holding one or two. Three is confusing. Many users don’t understand how ZRS gains or loses value when the collateral ratio changes. That’s why tools like the Zephyr Calculator (a community-built web app) have become essential. Over 80% of active users rely on it to avoid mistakes. Liquidity is another issue. Zephyr’s total value locked is just $1.7 million. Daily trading volume hovers around $287,500. That’s tiny compared to USDT’s $100+ billion. If you need to sell $10,000 worth of ZEPH quickly, you’ll likely move the price. That’s why Zephyr isn’t for day traders. It’s for long-term users who prioritize privacy over speed.What’s Next for Zephyr Protocol?

The Zephyr team has a roadmap-and it’s community-driven. In January 2024, users voted to lower the minimum collateral ratio from 400% to 350%. That change passed with 78% approval. It makes the system more capital-efficient, which could attract more users. They’re also planning to integrate with Beam, another privacy-focused blockchain, by late 2024. That could open up new use cases and improve cross-chain compatibility. On the regulatory front, Zephyr is engaging with global bodies like the Financial Action Task Force (FATF), which is trying to balance privacy and anti-money laundering rules. Their approach? Prove that over-collateralization makes their system safer and more compliant than algorithmic stablecoins. It’s a smart move. If regulators see Zephyr as a responsible privacy tool-not a money-laundering risk-it could gain legitimacy.Is ZEPH Worth It?

If you’re looking for a quick crypto flip, ZEPH isn’t for you. Its price is volatile, its market cap is tiny, and it’s not listed on most major exchanges. But if you care about financial privacy, hate centralized control, and want a stablecoin that actually respects your right to anonymity-then Zephyr Protocol might be the most important thing you’ve never heard of. It’s not perfect. It’s complex. It’s slow. But it’s the only stablecoin that combines privacy, decentralization, and real collateral. And in a world where every transaction is tracked, that’s rare. Right now, Zephyr is a niche project. But niche projects can become mainstream. Bitcoin was once a fringe experiment. Monero was dismissed as a darknet coin. Zephyr is following the same path: built by users, for users, without venture capital. It doesn’t need approval from Wall Street to exist. If privacy is a right, not a feature, then Zephyr Protocol is one of the few projects actually fighting for it.Is ZEPH a good investment?

ZEPH isn’t designed as a speculative asset. Its value is tied to the health of the Zephyr Protocol. If more people use ZSD for private transactions, demand for ZEPH as collateral rises. But if the protocol fails to gain adoption, ZEPH could lose value. Don’t buy ZEPH hoping to get rich fast. Buy it if you believe in private, decentralized finance.

Can I buy ZEPH on Coinbase or Binance?

No. ZEPH is not listed on major exchanges like Coinbase or Binance. It’s available on smaller platforms like MEXC and Bitget. You’ll need to use a Monero-compatible wallet to hold it, such as the official Zephyr wallet or a compatible Monero GUI wallet.

How do I get Zephyr Stable Dollars (ZSD)?

To mint ZSD, you need to lock ZEPH tokens in the protocol’s smart contract. You must deposit at least 400% of the ZSD value you want. For example, to get $100 in ZSD, you need $400 worth of ZEPH. The process is done through the Zephyr web interface, but it requires technical knowledge. There are step-by-step guides on their GitHub and Discord.

Is Zephyr Protocol safe?

Yes, if you understand how it works. The 400% collateralization means ZSD is far less likely to depeg than algorithmic stablecoins. The code has been audited by independent developers, and the protocol has survived market downturns like the March 2024 crash. But like all DeFi, it’s not risk-free. Smart contract bugs or extreme ZEPH price drops could cause issues. Always start small.

What happens if ZEPH’s price crashes?

If ZEPH’s price drops sharply, the collateral ratio falls. If it drops below 400%, the system automatically triggers liquidations to restore balance. ZRS holders absorb losses first. This protects ZSD’s peg. Users with under-collateralized positions may have their collateral partially seized. That’s why monitoring your ratio is critical.

Can I redeem ZSD for cash?

No. ZSD can only be redeemed for ZEPH tokens, not fiat currency. To get cash, you’d need to sell ZEPH on an exchange that supports it. Zephyr doesn’t offer fiat on-ramps. It’s designed as a crypto-native privacy tool, not a bank replacement.

Author

Ronan Caverly

I'm a blockchain analyst and market strategist bridging crypto and equities. I research protocols, decode tokenomics, and track exchange flows to spot risk and opportunity. I invest privately and advise fintech teams on go-to-market and compliance-aware growth. I also publish weekly insights to help retail and funds navigate digital asset cycles.