Bitcoin Trading Platform

When working with Bitcoin trading platform, a service that lets you buy, sell, and hold Bitcoin alongside other assets. Also known as crypto exchange, it offers order books, wallets, and real‑time market data for traders of all levels. If you’ve ever wondered where the price you see on a chart actually moves, this is the place where thousands of orders meet. Understanding the core functions helps you pick the right service and avoid common pitfalls.

One of the most critical related concepts is the crypto exchange, the broader ecosystem that hosts Bitcoin trading platforms and other digital asset markets. Exchanges differ in security measures, fee structures, and the range of coins they list. For example, a platform that only supports Bitcoin and a few major altcoins will feel simpler, while a full‑service exchange lets you dabble in DeFi tokens, NFTs, and even tokenized stocks. Knowing which exchange fits your risk tolerance and trading style is essential before you open an account.

Once you’ve landed on a platform, the next piece of the puzzle is your trading strategy, the plan you follow to enter and exit positions based on market signals. Whether you prefer day‑trading, swing‑trading, or a long‑term hold, each approach demands different tools and discipline. A day‑trader might rely on minute‑level charts and tight stop‑loss orders, while a long‑term investor focuses on fundamentals and larger time‑frames. Crafting a clear strategy prevents emotional decisions and keeps you aligned with your financial goals.

Good strategy needs solid data, which is where market analysis, the process of evaluating price trends, volume, and news to forecast future movements comes in. Technical analysis gives you patterns like support and resistance, while fundamental analysis looks at Bitcoin’s adoption, regulatory news, and network health. Combining both gives a more balanced view, especially on a platform that provides deep charting tools and on‑chain metrics. Without proper analysis, even the best platform can’t protect you from costly mistakes.

Extra Opportunities: Airdrops and Rewards

Many Bitcoin trading platforms now sprinkle extra value through airdrop, free token distributions that users receive for meeting certain criteria. While airdrops are more common with newer altcoins, some platforms reward active traders with bonuses, lower fees, or exclusive tokens. Keeping an eye on these promotions can boost your portfolio without additional investment. Just remember to verify the legitimacy of any airdrop—scammers love to mimic official announcements.

All these pieces—platform choice, exchange ecosystem, strategy, analysis, and occasional airdrops—fit together like a puzzle. Below you’ll find a curated list of articles that dive deeper into each topic, from how to spot a trustworthy Bitcoin trading platform to step‑by‑step guides on crafting a winning trading strategy. Ready to explore the details and start trading with confidence?

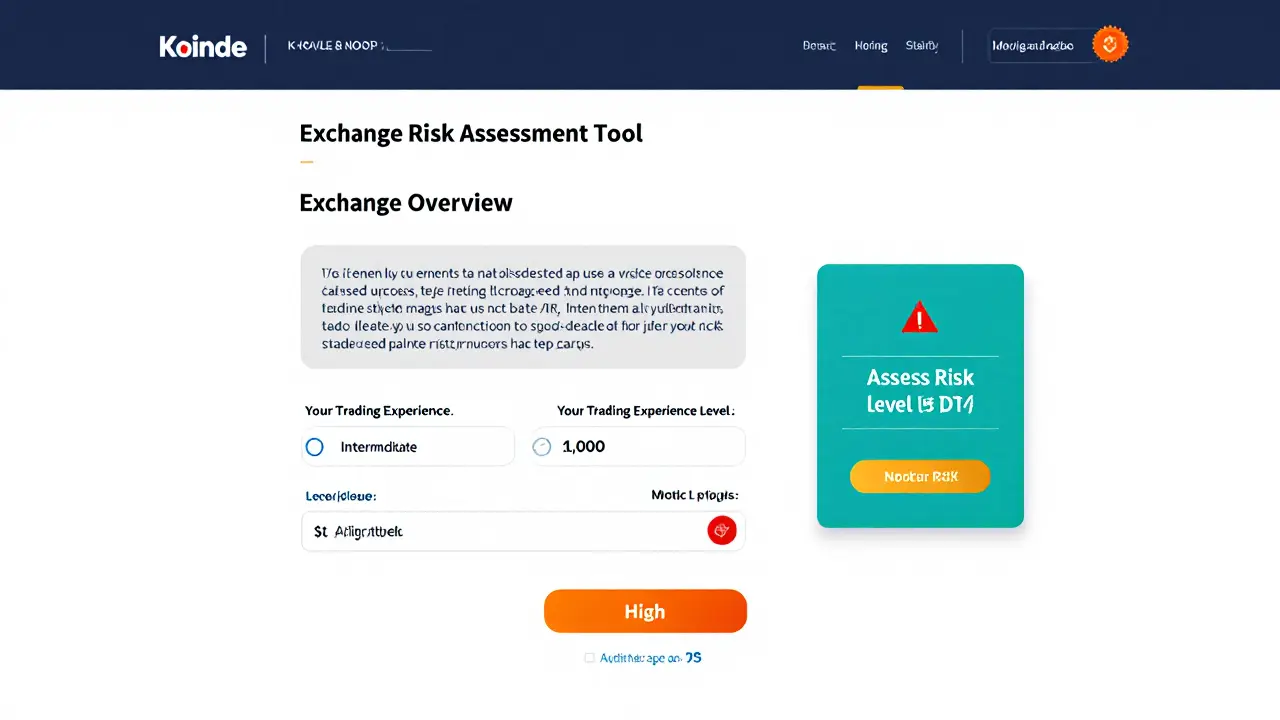

Koinde Crypto Exchange Review - Safety, Fees, and Who It’s Best For

Oct 5, 2025, Posted by Ronan Caverly

A detailed review of Koinde crypto exchange, covering fees, security, usability, and who should consider using this BTC‑only platform.

MORESEARCH HERE

Categories

TAGS

- decentralized exchange

- crypto exchange

- crypto exchange review

- crypto coin

- crypto airdrop

- cryptocurrency

- CoinMarketCap airdrop

- cryptocurrency trading

- smart contracts

- tokenomics

- DeFi

- cryptocurrency exchange safety

- crypto airdrop 2025

- cryptocurrency airdrop

- cryptocurrency exchange

- MiCA

- crypto airdrop guide

- blockchain token distribution

- crypto token

- Portugal crypto tax