Privacy Coin: What It Is and Why It Matters

When talking about privacy coin, a digital currency built to hide transaction details and protect user anonymity. Also known as anonymous cryptocurrency, it uses special cryptographic methods to keep sender, receiver, and amount hidden from public view. Privacy coin encompasses technology, law, and user goals, making it a unique part of the crypto landscape.

Key Players and the Tech Behind Them

Two of the most talked‑about examples are Monero, a privacy‑focused coin that relies on ring signatures and stealth addresses and Zcash, which offers optional shielded transactions powered by zero‑knowledge proofs. Both illustrate how a privacy coin requires advanced cryptography to mask data. Ring signatures blend a user's signature with others, making it impossible to tell who signed. Zero‑knowledge proofs let a transaction be verified without revealing any details. These tools enable a privacy coin to provide true anonymity while still operating on a public ledger.

Beyond Monero and Zcash, the broader category of blockchain privacy includes concepts like confidential transactions, mixing services, and decentralized mixers. Each solution adds layers of obscurity, but they also raise questions about usability and compliance. For instance, mixing services can be fast and cheap, yet they sometimes attract regulatory scrutiny because they can be misused for illicit activity. Understanding the trade‑off between privacy strength and legal risk is essential for anyone considering these coins.

Regulatory bodies treat privacy coins differently around the world. In the United States, the Financial Crimes Enforcement Network (FinCEN) may classify them as “money transmitters,” which means exchanges need a BitLicense or MSB registration to handle them. Europe’s MiCA framework is still shaping how anonymous tokens can be offered across borders. These licensing requirements influence which platforms list privacy coins and affect overall market liquidity. A privacy coin therefore sits at the crossroads of technology and law, and its success often depends on how well it navigates both.

From a user perspective, the main appeal of a privacy coin is financial freedom. Whether you want to keep your savings hidden from a hostile regime, protect against corporate data mining, or simply enjoy the peace of mind that comes with untraceable payments, the value proposition is clear. However, the anonymity also means you must be vigilant about security. Private keys become even more critical because losing them means losing access to funds you can’t trace or recover. Good wallet practices, hardware storage, and regular backups are non‑negotiable for privacy‑coin holders.

Developers and projects building on privacy coins face their own set of challenges. Implementing zero‑knowledge proofs, for example, demands heavy computational resources and expertise. This can lead to higher transaction fees or slower confirmation times compared to mainstream coins like Bitcoin. Yet the community continually pushes improvements—recent updates to Monero’s RingCT and Zcash’s Sapling upgrades have shaved seconds off verification and lowered costs. Watching these technical milestones helps investors gauge the long‑term viability of the ecosystem.

On the market side, privacy coins often experience price swings that are amplified by regulatory news. When a country bans a privacy coin, its price can dip sharply, only to rebound when a major exchange adds support. This volatility creates both risk and opportunity for traders. Our collection of articles below dives into specific licensing guides, exchange reviews, and airdrop alerts that directly impact the privacy‑coin space, giving you the data you need to make informed decisions.

Below you’ll find a curated set of posts that cover everything from compliance checklists for handling privacy coins, to deep dives on tokenomics of emerging anonymous tokens, and real‑world use cases that illustrate how privacy tech is reshaping finance. Use these resources to sharpen your strategy, stay ahead of regulatory shifts, and understand the practical steps needed to safely trade or hold privacy‑focused cryptocurrencies.

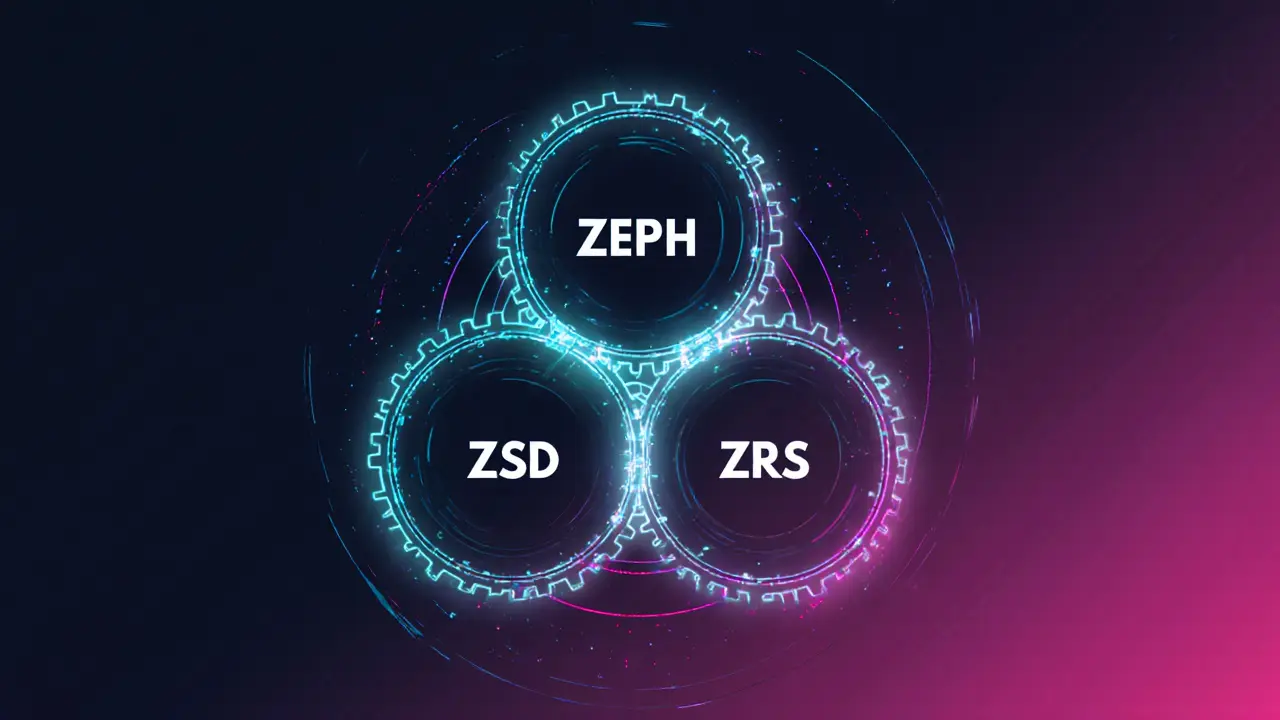

What is Zephyr Protocol (ZEPH) Crypto Coin? Privacy, Stability, and How It Works

Nov 20, 2025, Posted by Ronan Caverly

Zephyr Protocol (ZEPH) is a privacy-focused DeFi project that creates a crypto-backed stablecoin called ZSD. Unlike USDT or USDC, it’s fully anonymous, over-collateralized, and decentralized-no banks involved.

MORE

Inkryptus (INKY) Crypto Coin Explained: Features, Price & How It Works

Oct 3, 2025, Posted by Ronan Caverly

Inkryptus (INKY) is a hybrid privacy‑focused DeFi platform launched in 2020. Learn its features, token economics, price, and how to get started.

MORESEARCH HERE

Categories

TAGS

- decentralized exchange

- crypto exchange

- crypto exchange review

- crypto coin

- crypto airdrop

- cryptocurrency

- CoinMarketCap airdrop

- cryptocurrency trading

- smart contracts

- tokenomics

- DeFi

- cryptocurrency exchange safety

- crypto airdrop 2025

- cryptocurrency airdrop

- cryptocurrency exchange

- MiCA

- crypto airdrop guide

- blockchain token distribution

- crypto token

- Portugal crypto tax