Dotblox (DTBX) isn’t another meme coin. It’s a utility token built for real-world blockchain applications, but most people don’t know what it actually does - or why its price has crashed 91% from its peak. If you’ve seen DTBX pop up on a crypto tracker and wondered if it’s worth looking into, here’s the straight answer: it’s a project with technical ambition, serious market problems, and almost no transparency.

What Exactly Is Dotblox (DTBX)?

Dotblox is a blockchain platform that launched its native token, DTBX, in 2021. Unlike Bitcoin or Ethereum, DTBX isn’t meant to be a store of value or a peer-to-peer cash system. It’s a utility token designed to power transactions, governance, and DeFi services within the DotBlox ecosystem. Think of it like a digital key that unlocks access to specific tools and services on the platform.

The core idea behind DotBlox is simple: use blockchain to fix inefficiencies in industries like healthcare and finance. For example, imagine a hospital system that uses DTBX to securely share patient records across clinics without a central database. Or a small lender using smart contracts to automate loan approvals. That’s the kind of real-world use case DotBlox claims to enable.

But here’s the catch: no one knows who runs it. The founders are anonymous. There’s no public team page, no LinkedIn profiles, no press releases from a registered company. That’s not unusual in crypto - but when a project claims to serve enterprise clients, anonymity becomes a red flag.

How Does DTBX Actually Work?

DTBX operates on a hybrid consensus model: Proof of Stake (PoS) and Delegated Proof of Stake (DPoS). This isn’t just jargon - it’s a technical choice that affects speed, security, and who controls the network.

- Proof of Stake means validators (the people who verify transactions) are chosen based on how many DTBX tokens they hold and are willing to "stake" as collateral.

- Delegated Proof of Stake adds another layer: token holders can vote for trusted validators to act on their behalf. This makes the network faster and more scalable than Bitcoin’s energy-heavy mining system.

This hybrid approach lets DotBlox process transactions quickly while keeping the network secure. Validators who misbehave lose part of their stake - a strong incentive to stay honest. The system also supports smart contracts and decentralized applications (dApps), which let developers build tools on top of the platform.

DTBX has three main uses:

- Payments - Used to pay for services inside the DotBlox ecosystem, like data storage or API access.

- Staking - Holders can lock up DTBX to earn rewards and vote on upgrades to the platform.

- DeFi & NFT Integration - The token is designed to work with lending protocols, liquidity pools, and NFT marketplaces built on the network.

Token Supply: The Numbers Don’t Add Up

Tokenomics is where things get messy. DotBlox claims a total supply of 100 billion DTBX tokens. But here’s the problem: different exchanges report wildly different circulating supplies.

On CoinMarketCap, the circulating supply is listed as 100 billion - meaning every single token is already in circulation. But HTX, another exchange, previously reported only 3 billion in circulation. That’s a 3,233% difference. Which one’s right? No one knows.

Why does this matter? If 97 billion tokens are still locked up or held by insiders, the real market supply could be tiny. That means a small amount of selling pressure could crash the price even further. Or worse - if those tokens suddenly hit the market, the price could collapse.

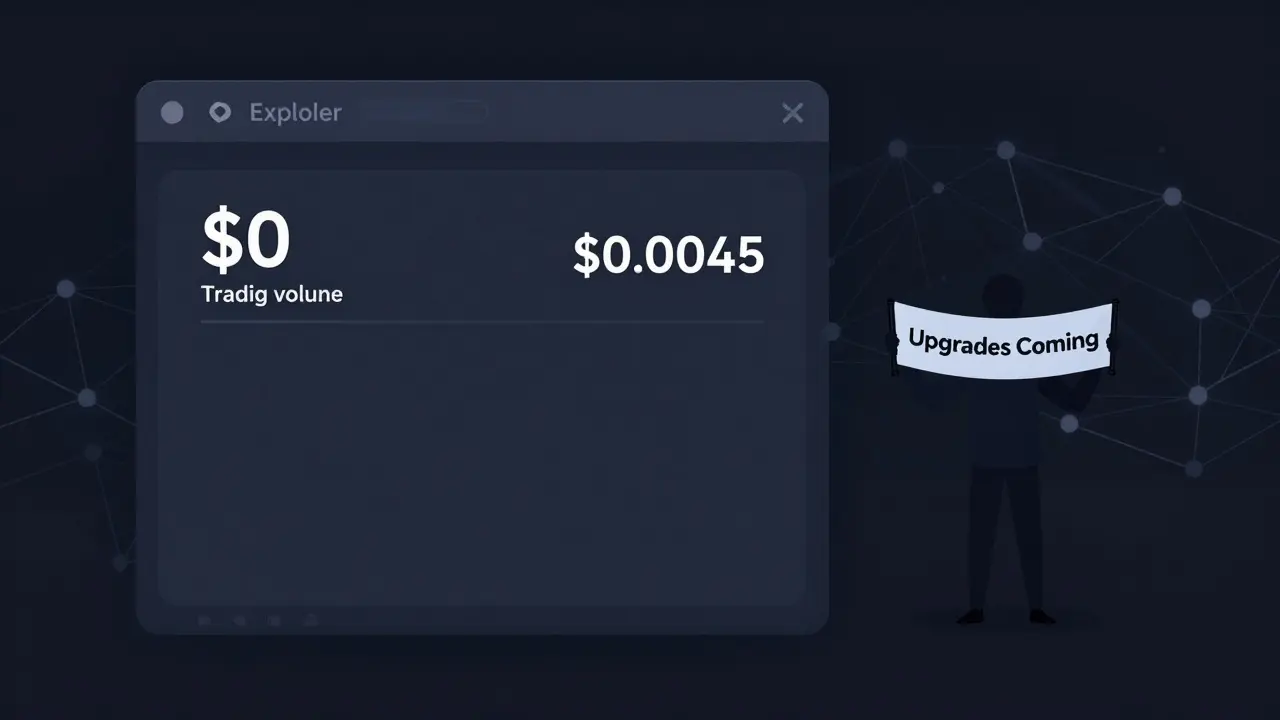

As of February 2026, the market cap stands at $457.06 million, according to CoinMarketCap. But with a price around $0.0045-$0.0052, that only makes sense if the circulating supply is near 100 billion. If it’s lower, the market cap is inflated.

Price History: From Price History: From $0.78 to $0.0045

.78 to Price History: From $0.78 to $0.0045

.0045

DTBX had a wild ride. It hit an all-time high of $0.78 on HTX - a price that would have made it a top-100 crypto. But that number doesn’t match up with other platforms. CoinLore and Coinpaprika report an ATH of $0.054-$0.055, which is still 91% higher than today’s price.

Right now, DTBX trades at $0.004571 (CoinMarketCap) and $0.0052 (HTX). That’s down over 90% from its peak. The all-time low is $0.00012 on HTX, but Coinpaprika says it hit $0.00000000 - meaning it briefly traded for practically nothing.

Here’s the kicker: 24-hour trading volume is $0 across major platforms. Zero. That means almost no one is buying or selling DTBX right now. Either it’s dead - or it’s being held tightly by a small group of wallets.

Technical indicators don’t help. The 14-day RSI is 18.32 - way below 30, which usually means the asset is oversold and due for a bounce. But the Fear & Greed Index says "Greed" at 70. That’s a disconnect. People are acting like this coin is a sure thing, even though it’s been falling for over a year.

Who Is Dotblox For?

DotBlox isn’t trying to compete with Bitcoin or Ethereum. It’s targeting businesses that need secure, transparent, and automated systems.

Think:

- A medical records network that uses DTBX to track who accessed a patient’s file.

- A supply chain platform that logs shipments on-chain so no one can fake delivery dates.

- A small business loan system that auto-approves applications using smart contracts.

The project claims to be building partnerships in healthcare and finance. But there’s zero public proof. No named clients. No case studies. No press releases from hospitals or banks using the system.

If you’re a developer or a company looking to integrate blockchain, DotBlox sounds promising - on paper. But without transparency, it’s hard to trust. Would you build a critical system on a platform run by anonymous people?

What’s Next for Dotblox?

The team says they’re working on big upgrades:

- A decentralized governance model - letting DTBX holders vote on future features.

- New DeFi integrations - like lending pools and yield farms.

- Expanded NFT functionality - for digital assets tied to real-world services.

These sound good. But without a roadmap update, a public team, or even a blog post since late 2024, it’s hard to believe they’re still active.

There’s also no sign of a token burn, buyback, or supply reduction plan. With 100 billion tokens in circulation (or so they say), inflation is a real risk. If more DTBX gets issued without demand, the price will keep falling.

Should You Buy DTBX?

Let’s be clear: DTBX is not a good investment for most people.

Here’s why:

- No transparency - Who’s behind it? Unknown.

- Zero trading volume - You can’t buy or sell it easily.

- Price down 91% - It’s lost almost all value since its peak.

- Supply confusion - Nobody agrees on how many tokens are out there.

If you’re a crypto trader looking for a speculative play, you might take a tiny position - but treat it like a lottery ticket. Don’t invest money you can’t afford to lose.

If you’re a business considering using DotBlox for your operations - walk away. You need accountability. You need partners you can contact. You need audits and documentation. DotBlox offers none of that.

DTBX might be a technically sound token. But without trust, transparency, or activity, it’s just a blockchain with no users.

Is Dotblox (DTBX) a scam?

There’s no proof Dotblox is a scam - but there’s also no proof it’s legitimate. The team is anonymous, trading volume is zero, and supply numbers conflict across exchanges. These aren’t signs of a healthy project. They’re red flags. Many crypto projects fade away quietly - Dotblox may be one of them.

Can I stake DTBX tokens?

According to the project’s whitepaper, yes - DTBX is designed for staking to earn rewards and vote on governance. But as of February 2026, there are no public staking portals, no official wallet integrations, and no community-run staking pools. Until you can actually stake DTBX on a verified platform, treat this feature as unconfirmed.

Where can I buy DTBX?

DTBX is listed on a few smaller exchanges like HTX and Binance, but liquidity is near zero. You might find buyers or sellers, but trades are rare. Don’t expect to enter or exit your position easily. Most major platforms like Coinbase and Kraken don’t support it.

Why is the trading volume $0?

There are two likely reasons. First, most DTBX tokens are held in long-term wallets and not being traded. Second, exchanges may not be reporting trades correctly - especially if volume is low. Either way, a $0 volume means the market is inactive. That’s dangerous for anyone holding the token.

Is Dotblox still being developed?

The team announced upcoming upgrades in late 2024, including governance and DeFi integrations. But since then, there’s been zero public update, no GitHub commits, no social media activity, and no community engagement. Without evidence of ongoing work, it’s impossible to say if development is still happening.

Final Thoughts

Dotblox (DTBX) has a clear technical vision: use blockchain to solve real industry problems. But vision alone doesn’t build a project. Trust does. Activity does. Transparency does.

Right now, DTBX is a ghost in the crypto market - a token with a high market cap, no trading, and no answers. If you’re curious, keep an eye on it. But don’t invest. Don’t build on it. And don’t assume it’s coming back.

Until someone steps forward to prove DotBlox is real, it’s just a name on a blockchain explorer - and nothing more.

Author

Ronan Caverly

I'm a blockchain analyst and market strategist bridging crypto and equities. I research protocols, decode tokenomics, and track exchange flows to spot risk and opportunity. I invest privately and advise fintech teams on go-to-market and compliance-aware growth. I also publish weekly insights to help retail and funds navigate digital asset cycles.