PREME Token Analysis Tool

PREME Token Overview

Investment Analysis Results

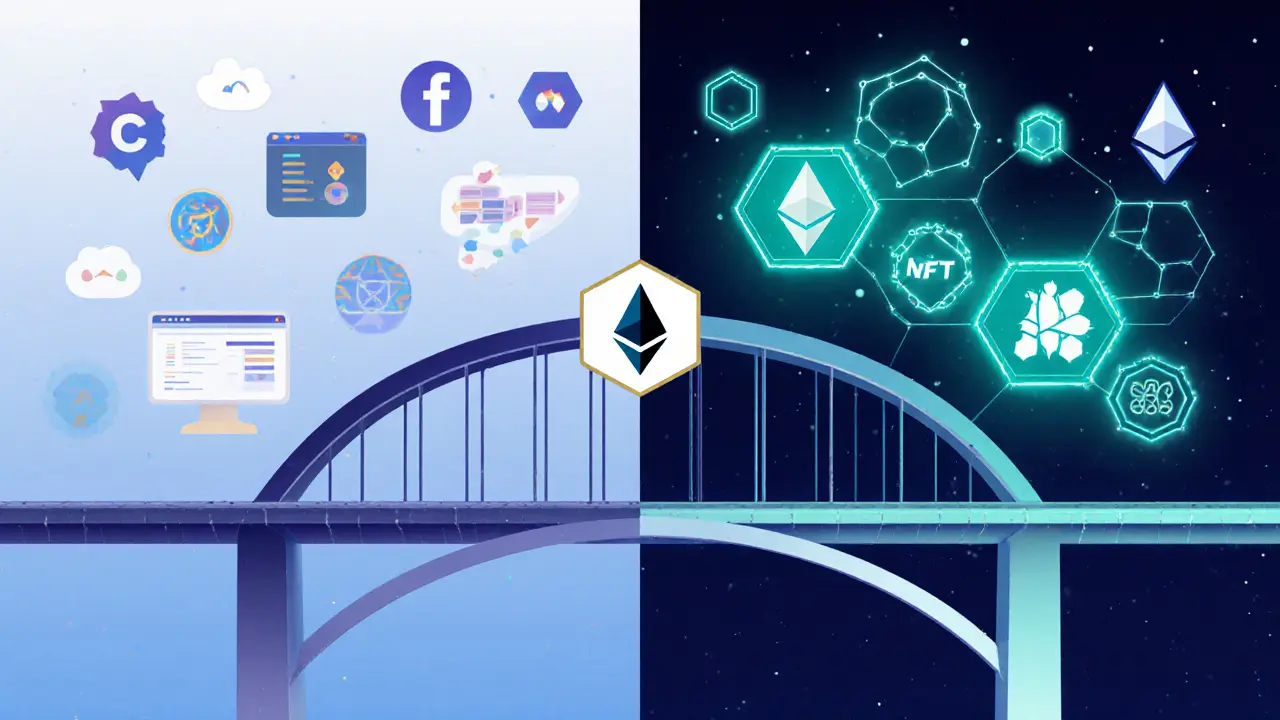

PREME token is a digital asset that markets itself as a bridge from the traditional internet (Web2) to the decentralized world of Web3. Launched on July 18, 2023, it aims to help businesses, artists and entertainers bring their products onto blockchain platforms by using NFTs and other Web3 tools.

How PREME fits on the Ethereum blockchain

The token lives entirely on the Ethereum blockchain, which is the most widely used public ledger for smart contracts. By conforming to the ERC-20 standard, PREME inherits all the basic functions that allow wallets, exchanges and DeFi apps to recognize and move it without any custom code.

Core purpose - a Web3 gateway

According to the project’s own description, PREME’s main job is to act as a Web3 gateway. In practice, that means offering companies a ready‑made way to mint NFTs, accept crypto payments and set up token‑based loyalty programs. The promise is a smoother transition for anyone stuck in the legacy web ecosystem.

Token economics at a glance

| Metric | Value |

|---|---|

| Launch date | July 18, 2023 |

| Total supply | 238,818,274 PREME |

| Circulating supply | 125,970,000 PREME (≈53%) |

| Market cap (USD) | $173,700 |

| Fully diluted valuation | $329,280 |

These numbers place PREME in the micro‑cap corner of the crypto market, far below heavyweight gateway projects like Chainlink or The Graph.

Where you can actually buy PREME

Trading is limited to Decentralized Exchanges (DEXs) because the token never listed on major centralized venues. The most active pool is on Uniswap v2, where daily volume hovers around a few hundred dollars - a clear sign of thin liquidity.

The project recommends using SwapNGo, a front‑end that swaps ETH for PREME directly from a non‑exchange wallet. This approach eliminates the need for an order book but also means you must be comfortable handling private keys and gas fees.

Technical signals and price outlook

Recent technical snapshots show a bearish tilt: the 14‑day RSI sits near 39, the MACD is slightly negative and price volatility has averaged about 17% over two weeks. Forecast models from independent analysts predict a modest high of $0.0025 in early 2025 and a low near $0.0013 by the end of the year. In other words, even an optimistic scenario offers only fractional upside.

Community and adoption reality

Despite its lofty claims, real‑world usage appears minimal. Public data lists roughly 16,000 token holders, but social listening tools find fewer than ten meaningful mentions on platforms like Reddit or Twitter. No documented case studies show a company actually using PREME to launch an NFT collection or a crypto‑payment gateway.

The lack of a whitepaper, developer docs or an active Telegram/Discord channel makes it hard for newcomers to assess credibility. For most users, the extra step of sending ETH from a personal wallet to a niche swap interface adds friction that larger, well‑known tokens simply don’t have.

Risks to keep in mind

- Liquidity risk: Thin trading volume means even small orders can cause slippage.

- Regulatory uncertainty: Low‑cap utility tokens are attracting scrutiny from regulators, and PREME lacks a clear legal framework.

- Adoption gap: No verifiable partnerships or enterprise deployments.

- Technical stagnation: No visible code commits or roadmap updates since launch.

Should you consider PREME?

If you enjoy speculative bets on tiny market caps and are comfortable navigating ETH‑only swaps, PREME could be a curiosity. However, for anyone looking for a reliable Web3 gateway with proven business use cases, the token’s limited liquidity, scarce community support, and bearish price signals suggest it’s a high‑risk proposition.

Frequently Asked Questions

What blockchain does PREME run on?

PREME is an ERC‑20 token built on the Ethereum blockchain, which means it follows Ethereum’s smart‑contract standards and can be stored in any wallet that supports ERC‑20 assets.

How can I buy PREME?

The token is not listed on major exchanges. You need to use a decentralized exchange like Uniswap v2 or the project‑recommended SwapNGo interface, sending ETH from a personal wallet to receive PREME.

What is the total supply of PREME?

The contract defines a fixed total supply of 238,818,274 PREME tokens. About 126 million are currently circulating.

Does PREME have any real‑world use cases?

Publicly available information does not show any verified business integrations. The token’s roadmap mentions NFT and payment solutions, but no concrete deployments have been documented.

Is PREME a good investment?

Given its low market cap, thin liquidity, bearish technical indicators, and lack of adoption, PREME is a high‑risk speculative asset. Only invest what you can afford to lose.

Author

Ronan Caverly

I'm a blockchain analyst and market strategist bridging crypto and equities. I research protocols, decode tokenomics, and track exchange flows to spot risk and opportunity. I invest privately and advise fintech teams on go-to-market and compliance-aware growth. I also publish weekly insights to help retail and funds navigate digital asset cycles.