Crypto Tax Record Keeping: Essential Guides and Tools

When talking about Crypto Tax Record Keeping, the systematic tracking, categorizing, and reporting of every crypto transaction for tax purposes. Also known as crypto tax compliance, it helps individuals and businesses avoid penalties and make the most of deductions.

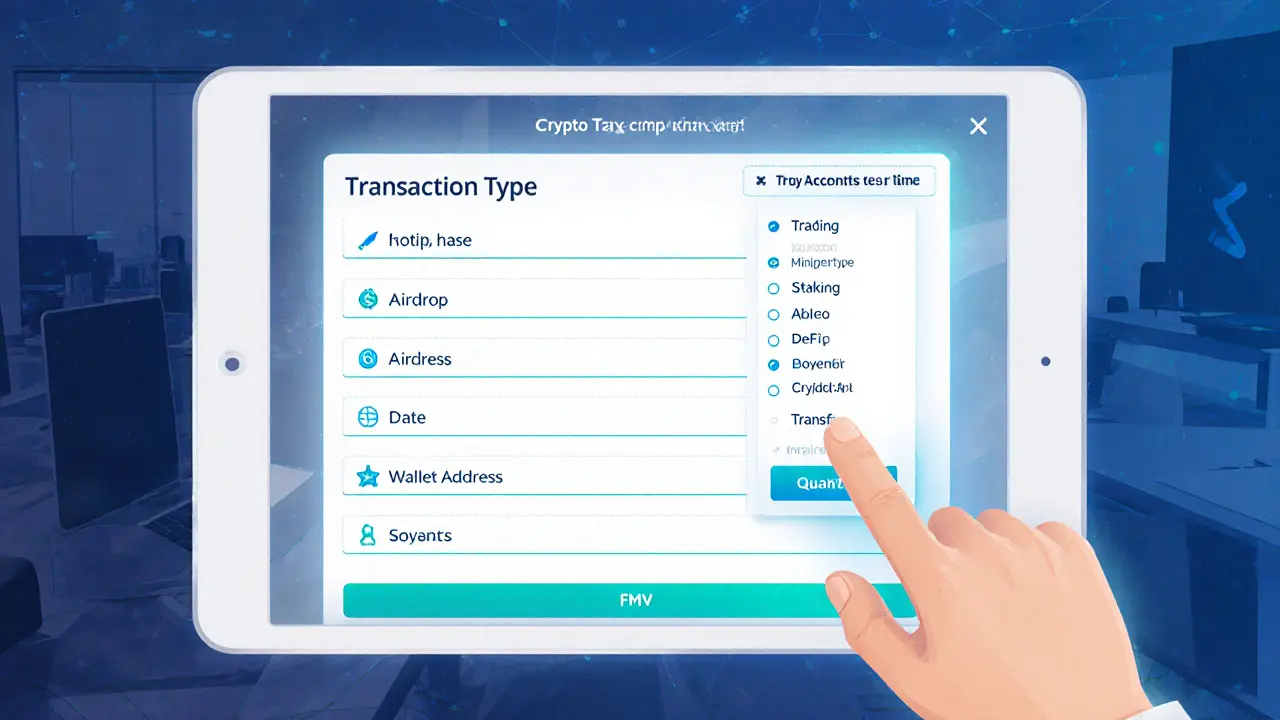

One of the biggest hurdles is gathering raw transaction data from multiple wallets and exchanges. That's where crypto accounting software, specialized platforms that import trades, calculate gains, and generate tax reports comes in handy. Programs like CoinTracker or Koinly automate the heavy lifting, turning a mess of CSVs into clear profit‑and‑loss statements. By feeding accurate data into the software, you simplify the next step: filing the right IRS forms.

Key Documents and Practices

For U.S. taxpayers the critical form is IRS Form 8949, the schedule used to report capital gains and losses from crypto trades. Each line represents a single transaction, so precise transaction tracking, the process of recording dates, amounts, cost basis, and counterparties is essential. Missing even a few swaps can trigger an audit, while a well‑documented ledger can lower your tax bill through loss harvesting or holding periods.

Effective crypto tax record keeping also ties into broader compliance. Knowing the difference between short‑term and long‑term gains influences your tax bracket, and understanding wash‑sale rules can prevent accidental disallowed losses. Most seasoned traders keep a master spreadsheet that mirrors the software output—this double‑check habit catches import errors before they reach the IRS.

Beyond the basics, the tag collection below dives into related areas that often intersect with tax work. You’ll find step‑by‑step licensing guides, exchange safety reviews, airdrop tracking tips, and regulatory updates—all the pieces that shape a solid tax compliance strategy. Explore the articles to see how proper record keeping empowers smarter trading and smoother filing.

Crypto Tax Record Keeping: Complete Guide to Stay IRS-Compliant

Dec 20, 2024, Posted by Ronan Caverly

Learn how to keep flawless crypto tax records under the new 2025 IRS rules, including Form 1099-DA, wallet-by-wallet accounting, and tools to stay audit‑ready.

MORESEARCH HERE

Categories

TAGS

- decentralized exchange

- crypto exchange

- crypto exchange review

- crypto coin

- crypto airdrop

- cryptocurrency

- CoinMarketCap airdrop

- cryptocurrency trading

- smart contracts

- tokenomics

- DeFi

- cryptocurrency exchange safety

- crypto airdrop 2025

- cryptocurrency airdrop

- cryptocurrency exchange

- MiCA

- crypto airdrop guide

- blockchain token distribution

- crypto token

- Portugal crypto tax