Cryptocurrency Overview: Tokens, Exchanges, Blockchain & Regulation

When working with cryptocurrency, digital assets that use cryptographic techniques to secure transactions and manage supply. Also known as digital currency, it lets users transfer value without banks. The underlying blockchain, a distributed ledger that records every crypto transaction in a tamper‑proof way provides the trust layer, while a crypto exchange, platforms where you can buy, sell, or trade crypto assets turns those digital tokens into liquid market instruments. Together, these pieces form an ecosystem where cryptocurrency can serve as payment, store of value, or speculative asset. Understanding how tokens, exchanges and the surrounding regulatory environment interact is essential for anyone looking to navigate this fast‑moving space.

Key Topics Covered in This Collection

One major sub‑entity of cryptocurrency is the token, a unit of value issued on a blockchain that can represent assets, voting rights, or utility functions. Tokens range from governance coins like DAO tokens to utility tokens such as those powering DeFi platforms. Each token brings its own risk profile, often tied to the protocol’s design and the team behind it. Regulation, laws and guidelines that dictate how crypto businesses must operate influences both token issuance and exchange compliance, shaping everything from licensing requirements in the US to sandbox programs in the EU. Meanwhile, security considerations—like phishing attacks or exchange scams—directly impact how safely you can hold and move your assets. By linking token mechanics, exchange features, and regulatory frameworks, the articles below give you a practical roadmap for staying ahead of market shifts and compliance hurdles.

Now that you have a solid picture of what cryptocurrency is, how blockchain underpins it, why tokens matter, and what role exchanges and regulation play, you’re ready to dive into the curated posts. Below you’ll find deep dives on DAO coins, licensing guides for US and Thai markets, token‑specific analyses such as SafeMars and PREME, and safety checklists for exchanges like Bitroom and Koinde. Each piece builds on the concepts introduced here, giving you actionable insights whether you’re just starting out or sharpening an existing strategy.

Berrie Dex (BERRIE) Explained: Crypto Token Overview

Oct 16, 2025, Posted by Ronan Caverly

Berrie Dex (BERRIE) is a multi‑chain order‑book DEX token. Learn how it works, its tokenomics, supported chains, risks, and how to start trading.

MORE

Litecoin (LTC) Explained: What It Is, How It Works & Future Outlook

Oct 12, 2025, Posted by Ronan Caverly

Litecoin (LTC) is a fast, low‑fee cryptocurrency created by Charlie Lee. Learn its tech, market status in 2025, MWEB privacy upgrade, and future outlook.

MORE

Inkryptus (INKY) Crypto Coin Explained: Features, Price & How It Works

Oct 3, 2025, Posted by Ronan Caverly

Inkryptus (INKY) is a hybrid privacy‑focused DeFi platform launched in 2020. Learn its features, token economics, price, and how to get started.

MORE

DackieSwap (DACKIE) Explained: What the Crypto Coin and DEX Do

Sep 24, 2025, Posted by Ronan Caverly

Learn what DackieSwap is, how its DACKIE token works, AI routing features, market performance, risks, and step‑by‑step usage for this niche decentralized exchange.

MORE

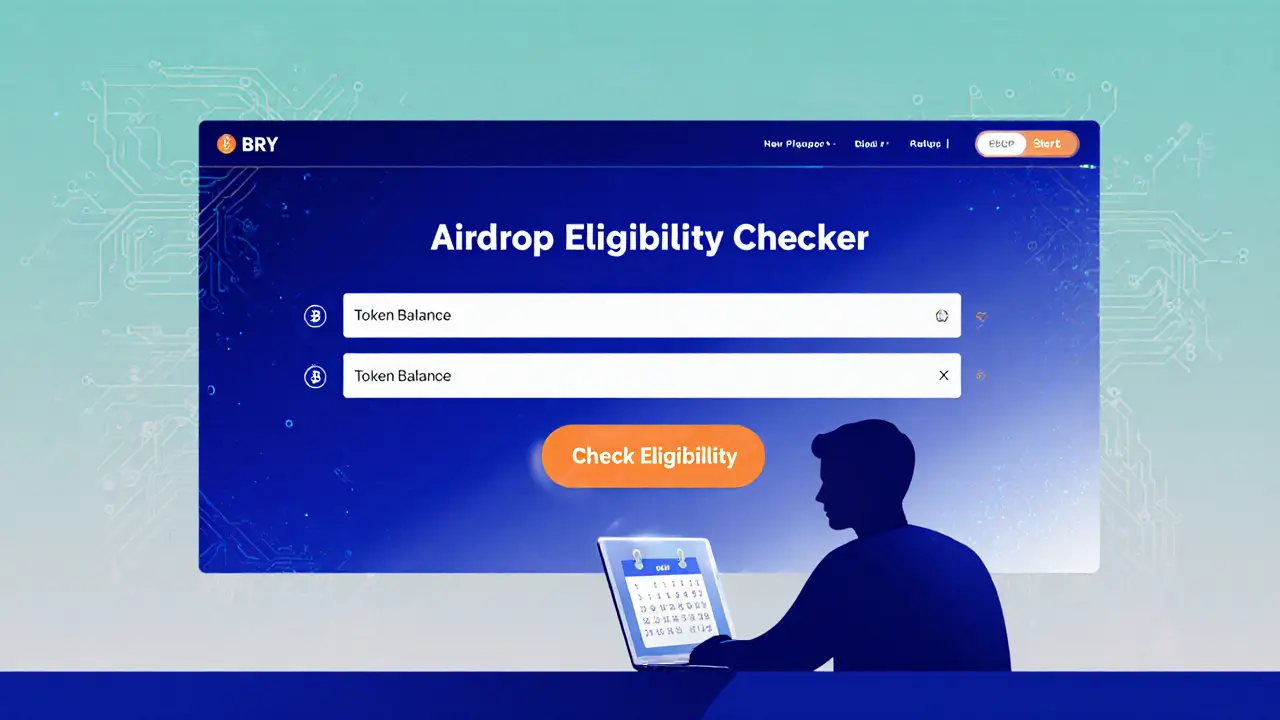

Berry Data (BRY) Airdrop Details: What We Know and How to Stay Ready

Jun 9, 2025, Posted by Ronan Caverly

No official Berry Data airdrop has been announced yet. Learn what Berry Data (BRY) is, price forecasts, how typical airdrops work, and how to stay ready for any future giveaway.

MORESEARCH HERE

Categories

TAGS

- decentralized exchange

- crypto exchange

- crypto exchange review

- crypto coin

- crypto airdrop

- cryptocurrency

- CoinMarketCap airdrop

- cryptocurrency trading

- smart contracts

- tokenomics

- DeFi

- cryptocurrency exchange safety

- crypto airdrop 2025

- cryptocurrency airdrop

- cryptocurrency exchange

- MiCA

- crypto airdrop guide

- blockchain token distribution

- crypto token

- Portugal crypto tax