DEX vs AMM: What’s the Real Difference and Why It Matters for Crypto Traders

When you trade crypto without a middleman, you’re using a decentralized exchange, a peer-to-peer platform that lets you swap tokens directly from your wallet, without a company holding your funds. Also known as a DEX, it’s the backbone of DeFi—but it doesn’t work alone. Behind every DEX is a machine called an automated market maker, a smart contract system that sets prices and matches trades using math, not order books. Also known as an AMM, it’s what makes DEXs possible.

Think of a DEX as the store, and the AMM as the cashier who never sleeps, never takes a break, and never guesses prices. The AMM uses a formula—usually something like x * y = k—to keep tokens in balance. If more people buy ETH, the price slowly rises because the pool of ETH gets smaller. No human sets that price. No broker takes a cut. It’s all code. That’s why DEXs like Uniswap, SushiSwap, and Skydrome can run without a company behind them. But here’s the catch: not all DEXs use AMMs. Some older ones still use order books, and those are rare now. Almost every DEX you’ll use today runs on an AMM. And not every AMM is built the same. Some use weighted pools, some use stablecoin formulas, and some, like Skydrome’s ve(3,3) model, mix liquidity incentives with governance. The AMM is the engine. The DEX is the car.

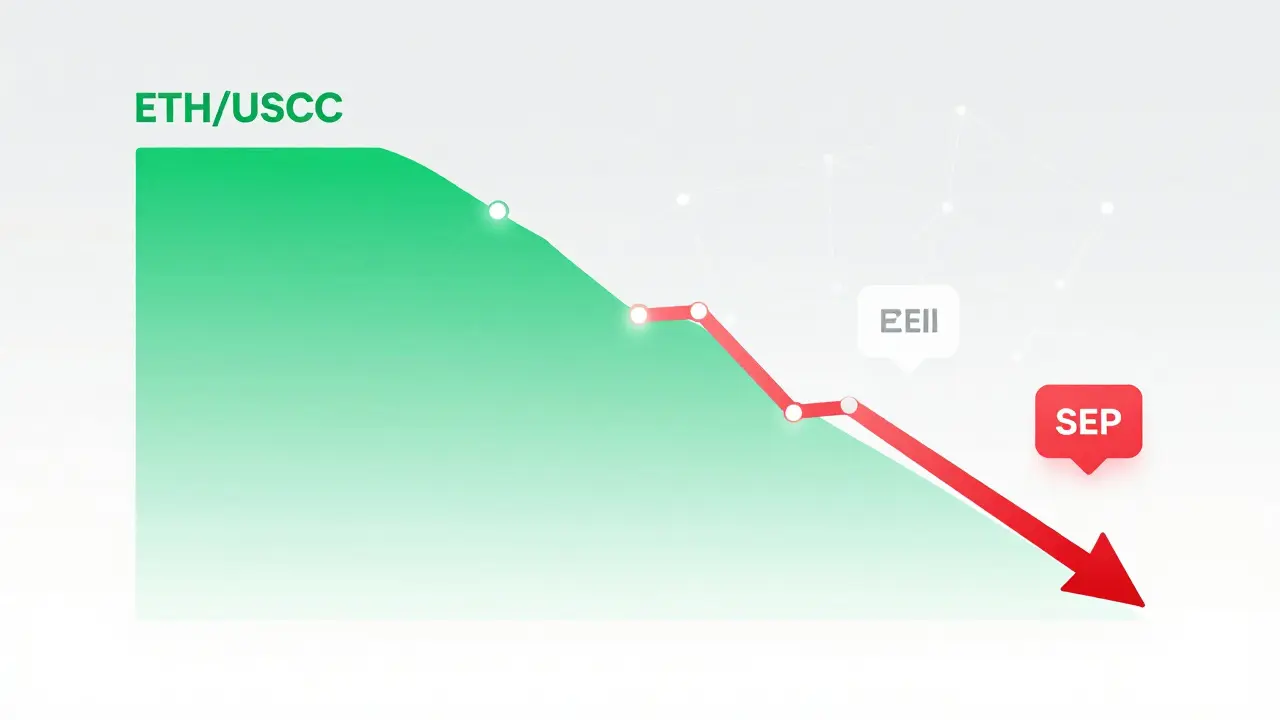

Why does this matter to you? Because if you don’t understand how the AMM works, you’ll get caught by slippage, impermanent loss, or weird price spikes. You might think you’re trading on a DEX like it’s Binance—but it’s not. The liquidity pool can be tiny. A $10,000 trade can move the price 20%. That’s not a glitch. That’s how AMMs behave when there’s not enough money in the pool. Look at the posts below: Zephyr Protocol’s ZSD stablecoin uses an AMM to stay pegged. Uniswap v2 on Avalanche relies on one to keep fees low. Skydrome’s whole design is built around tweaking the AMM model. Even dead tokens like VALI or BEMIL were traded on DEXs powered by AMMs. You can’t avoid this system. You need to understand it.

What you’ll find here aren’t theory lessons. These are real stories—about platforms that worked, platforms that vanished, and tokens that moved because of how the AMM reacted. You’ll see how retroactive airdrops rewarded early users of AMM-powered DEXes. You’ll learn why some stablecoins like MXNt or JPYC never gained traction—because their AMMs had no liquidity. You’ll see how airdrops like EPCOIN or Age of Tanks tie into DEX activity. This isn’t about jargon. It’s about knowing what’s really behind your trades—and why some crypto projects live and others die.

Decentralized Exchange Order Books Explained: How They Work and Why They Matter

Dec 1, 2025, Posted by Ronan Caverly

Decentralized exchange order books let traders buy and sell crypto directly with others, using real-time bid and ask prices. Unlike AMMs, they offer precise control, deeper liquidity for large trades, and transparent market data-ideal for serious traders.

MORESEARCH HERE

Categories

TAGS

- decentralized exchange

- crypto exchange

- crypto exchange review

- crypto coin

- crypto airdrop

- cryptocurrency

- CoinMarketCap airdrop

- smart contracts

- tokenomics

- DeFi

- cryptocurrency exchange safety

- crypto airdrop 2025

- cryptocurrency airdrop

- cryptocurrency exchange

- MiCA

- crypto airdrop guide

- blockchain token distribution

- Portugal crypto tax

- crypto scam

- crypto exchange scam