Myanmar Crypto Market

When navigating the Myanmar crypto market, the ecosystem of digital assets, exchanges, and regulations in Myanmar, investors often run into crypto licensing, government approvals needed to operate exchanges or offer services, the availability of local crypto exchanges, platforms that let users buy, sell, and trade coins within the country, and emerging regulatory sandbox programs, test‑beds that let startups experiment under lighter rules. Understanding how these pieces fit together is key to moving fast and staying safe.

The first semantic link is simple: Myanmar crypto market encompasses crypto licensing, because without a clear permit framework exchanges can’t legally operate. Crypto licensing in turn requires meeting capital thresholds, submitting AML/KYC policies, and often proving technical security measures. This creates a second triple – crypto licensing requires government approval – which influences who can launch a platform and what fees users pay.

Key components shaping the scene

Local crypto exchanges are the front‑line tools for everyday traders. They differ from global giants by offering Myanmar‑baht pairs, local payment gateways, and sometimes even in‑person verification offices. When an exchange secures a license, it typically gains access to better liquidity providers, which lowers spreads for users. On the flip side, unlicensed platforms may promise higher returns but expose users to theft or sudden shutdowns.

Regulatory sandbox programs act as a catalyst for innovation. By allowing a limited number of projects to test new token models, DeFi protocols, or cross‑border payment solutions, the sandbox reduces compliance costs during the trial phase. This third semantic connection – regulatory sandbox influences market growth – shows why many startups rush to apply once the government opens applications.

Airdrop opportunities add another layer of excitement. Projects targeting Myanmar often design airdrops that reward users who hold local exchange accounts or complete simple KYC steps. While airdrops can boost token distribution, they also bring phishing risks. Knowing how to spot legit airdrops versus scams is essential, especially when local regulations start labeling certain token giveaways as securities.

Putting it all together, the Myanmar crypto market is a dynamic mix of licensing hurdles, exchange options, sandbox incentives, and airdrop buzz. If you’re new, start by checking whether an exchange lists a valid crypto licensing number on its site. Then compare fees and supported fiat pairs – a licensed exchange usually offers tighter spreads. If you’re a developer, explore the sandbox schedule posted by the Ministry of Planning and Finance; early entry can give you a head start on compliance.

For traders focused on short‑term moves, keep an eye on how licensing news impacts price spreads. A sudden approval for a major exchange often triggers a temporary rise in trading volumes and tighter spreads across the board. Conversely, a regulatory crackdown can force liquidity to migrate to offshore platforms, widening gaps and raising slippage.

Overall, the landscape is still forming, but the core entities – licensing, exchanges, sandbox programs, and airdrops – provide a clear roadmap. Below you’ll find a curated list of articles that dig deeper into each area, from step‑by‑step licensing guides to reviews of the most reliable local exchanges and the latest airdrop alerts. Dive in to get the practical knowledge you need to trade confidently in the Myanmar crypto market.

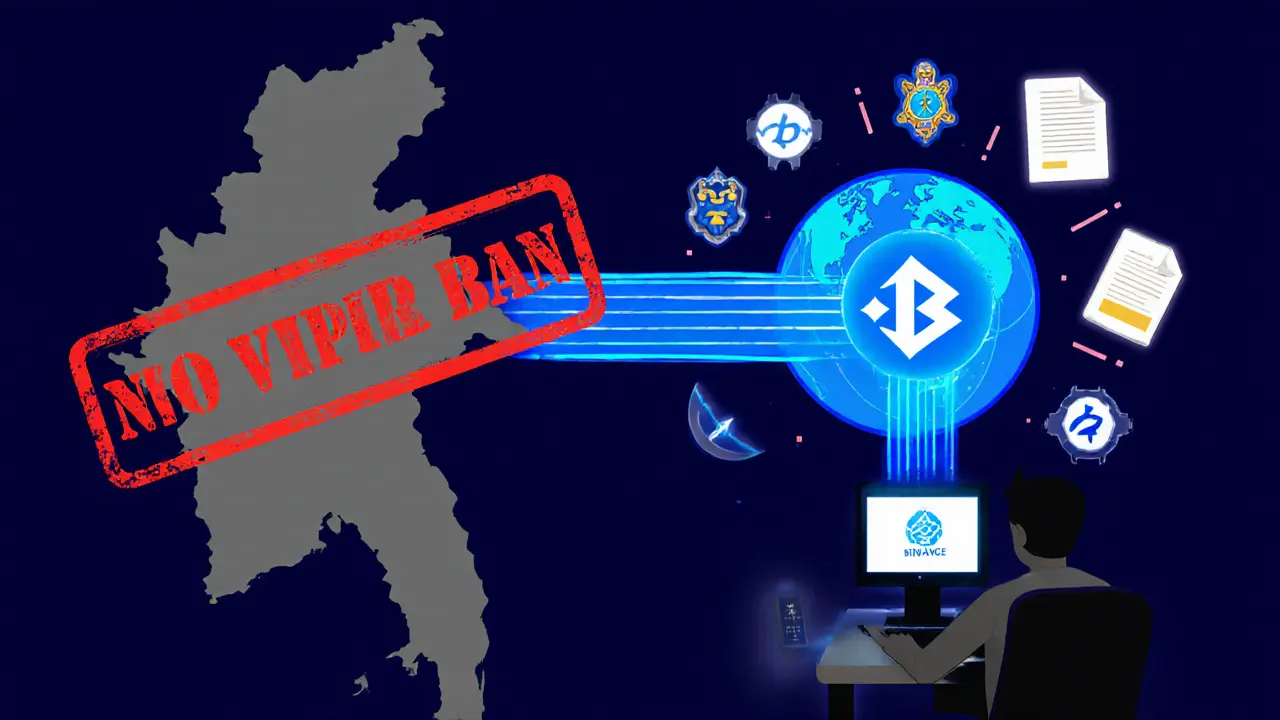

Myanmar's Underground Crypto Market: How It Thrives Under a Total Ban

Aug 2, 2025, Posted by Ronan Caverly

Explore Myanmar's underground crypto market: how traders bypass a total ban, the role of community groups like MCM, real risks, and future outlook under the military regime.

MORESEARCH HERE

Categories

TAGS

- decentralized exchange

- crypto exchange

- crypto exchange review

- crypto coin

- crypto airdrop

- cryptocurrency

- CoinMarketCap airdrop

- cryptocurrency trading

- smart contracts

- tokenomics

- DeFi

- cryptocurrency exchange safety

- crypto airdrop 2025

- cryptocurrency airdrop

- cryptocurrency exchange

- MiCA

- crypto airdrop guide

- blockchain token distribution

- crypto token

- Portugal crypto tax