ZSD Stablecoin: What It Is, Why It Matters, and What You Need to Know

When you think of stablecoins, you probably think of ZSD stablecoin, a digital currency designed to maintain a 1:1 peg with the U.S. dollar. Also known as ZSD token, it’s built to give users a stable anchor in the wild world of crypto—no price swings, no panic sells, just a digital dollar you can send, trade, or hold. But not all stablecoins are created equal. While USDC and DAI have clear audits, transparent reserves, and real-world backing, ZSD stablecoin operates in a quieter corner of the market. Fewer exchanges list it. Fewer users talk about it. And that’s not always a bad thing—it just means you need to dig deeper before you trust it with your money.

Stablecoins like ZSD are meant to solve one big problem: volatility. If you’re trading altcoins that drop 30% in a day, you need a safe harbor. That’s where stablecoins come in. But here’s the catch—some are backed by cash and bonds, others by algorithms, and some… well, nobody really knows. ZSD stablecoin claims to be collateralized, but public reports on its reserves are scarce. Compare that to USDC, a stablecoin issued by Circle and regulated in the U.S., fully backed by reserves, or DAI, a decentralized stablecoin backed by crypto collateral and governed by smart contracts. ZSD doesn’t have that kind of visibility. That doesn’t mean it’s fake—but it does mean you’re taking on more risk by using it.

People use ZSD stablecoin mostly in niche DeFi platforms and smaller exchanges that don’t support the big names. It’s often found in trading pairs with obscure tokens, where liquidity is thin and volatility is high. If you’re holding ZSD, you’re likely either trying to avoid Bitcoin’s swings or chasing yield on a platform that only accepts it. But here’s what you should watch: Is it still being minted? Are there red flags in its smart contract? Has anyone audited it? The posts below dig into exactly that—real cases where stablecoins like ZSD either worked as promised or vanished overnight. You’ll see what happened to other obscure tokens, how airdrops fooled people into holding dead coins, and why transparency isn’t just nice—it’s necessary. Whether you’re holding ZSD, considering it, or just curious, what follows isn’t theory. It’s real stories from people who got burned—or got lucky—because they didn’t ask the right questions first.

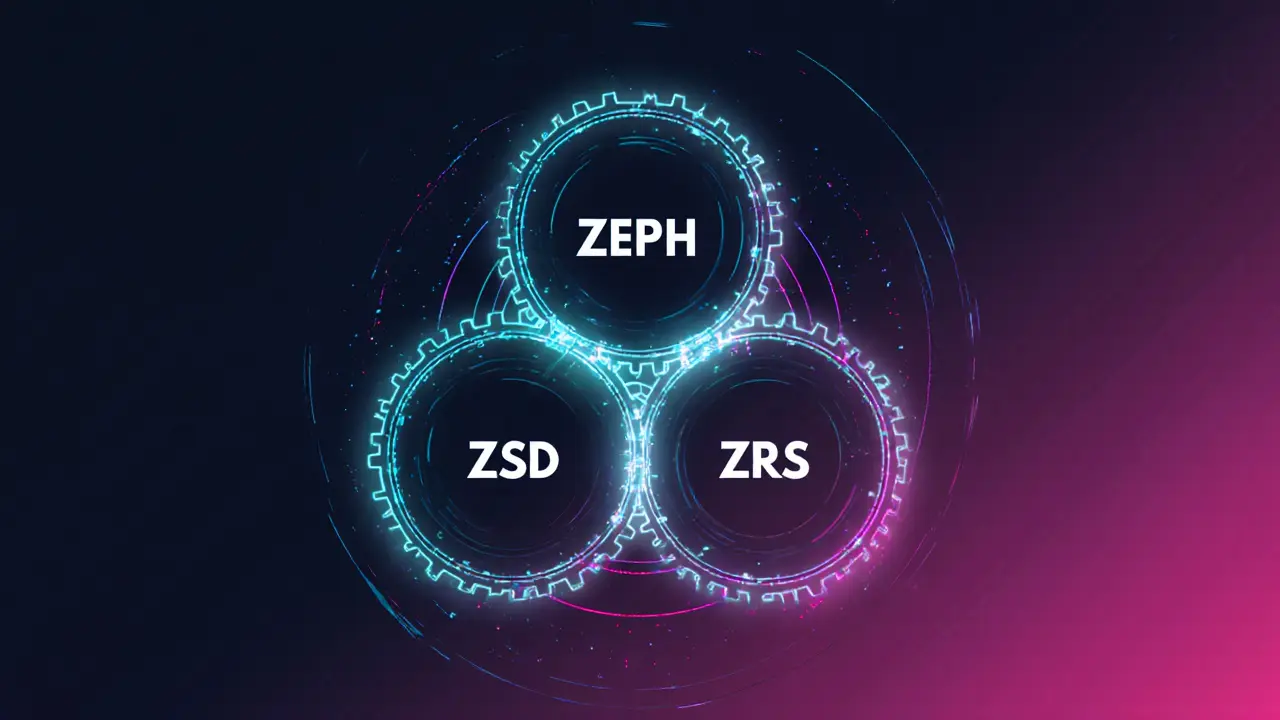

What is Zephyr Protocol (ZEPH) Crypto Coin? Privacy, Stability, and How It Works

Nov 20, 2025, Posted by Ronan Caverly

Zephyr Protocol (ZEPH) is a privacy-focused DeFi project that creates a crypto-backed stablecoin called ZSD. Unlike USDT or USDC, it’s fully anonymous, over-collateralized, and decentralized-no banks involved.

MORESEARCH HERE

Categories

TAGS

- decentralized exchange

- crypto exchange

- crypto exchange review

- crypto coin

- crypto airdrop

- cryptocurrency

- CoinMarketCap airdrop

- cryptocurrency trading

- smart contracts

- tokenomics

- DeFi

- cryptocurrency exchange safety

- crypto airdrop 2025

- cryptocurrency airdrop

- cryptocurrency exchange

- MiCA

- crypto airdrop guide

- blockchain token distribution

- crypto token

- Portugal crypto tax