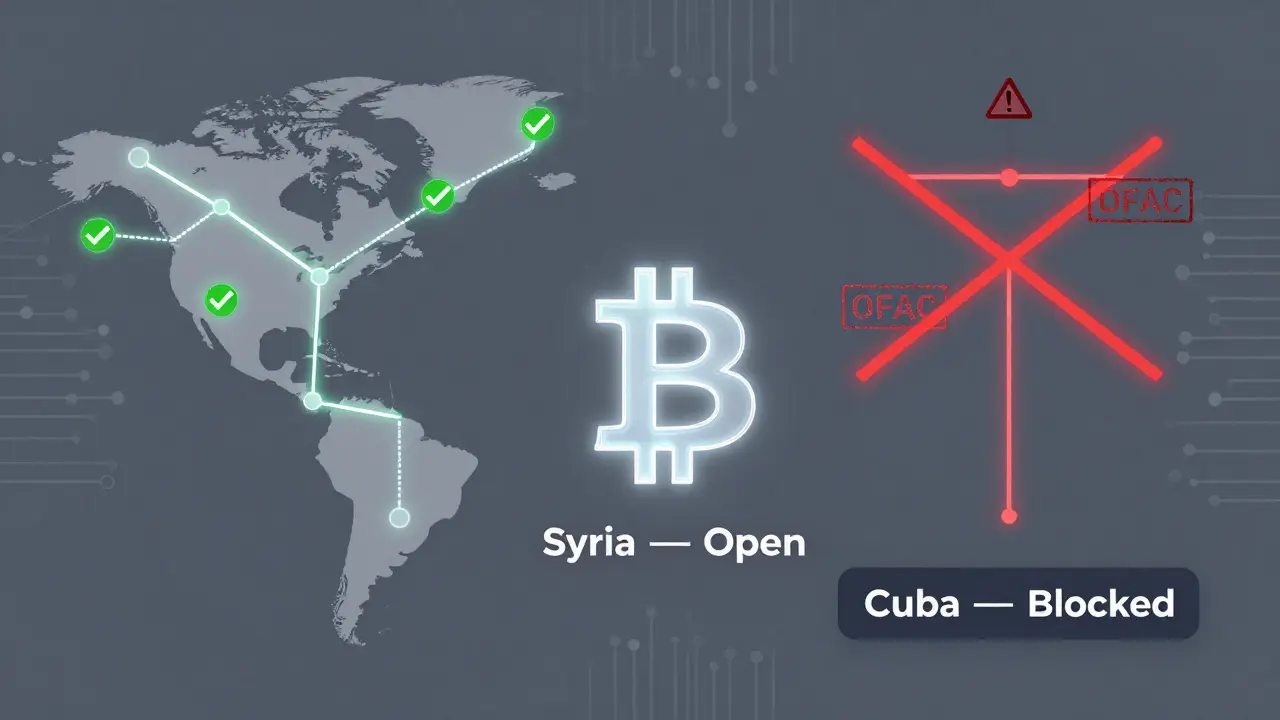

On July 1, 2025, something unexpected happened in global finance: Syria was effectively removed from the U.S. sanctions list. Not partially. Not conditionally. The entire comprehensive embargo that had been in place since 2004 was wiped clean. The Central Bank of Syria was taken off the SDN List. U.S. banks could now open accounts there. Financial services could be exported without a license. For the first time in over two decades, Syria was no longer a financial black hole.

But while Syria got a lifeline, Cuba got slammed harder than ever.

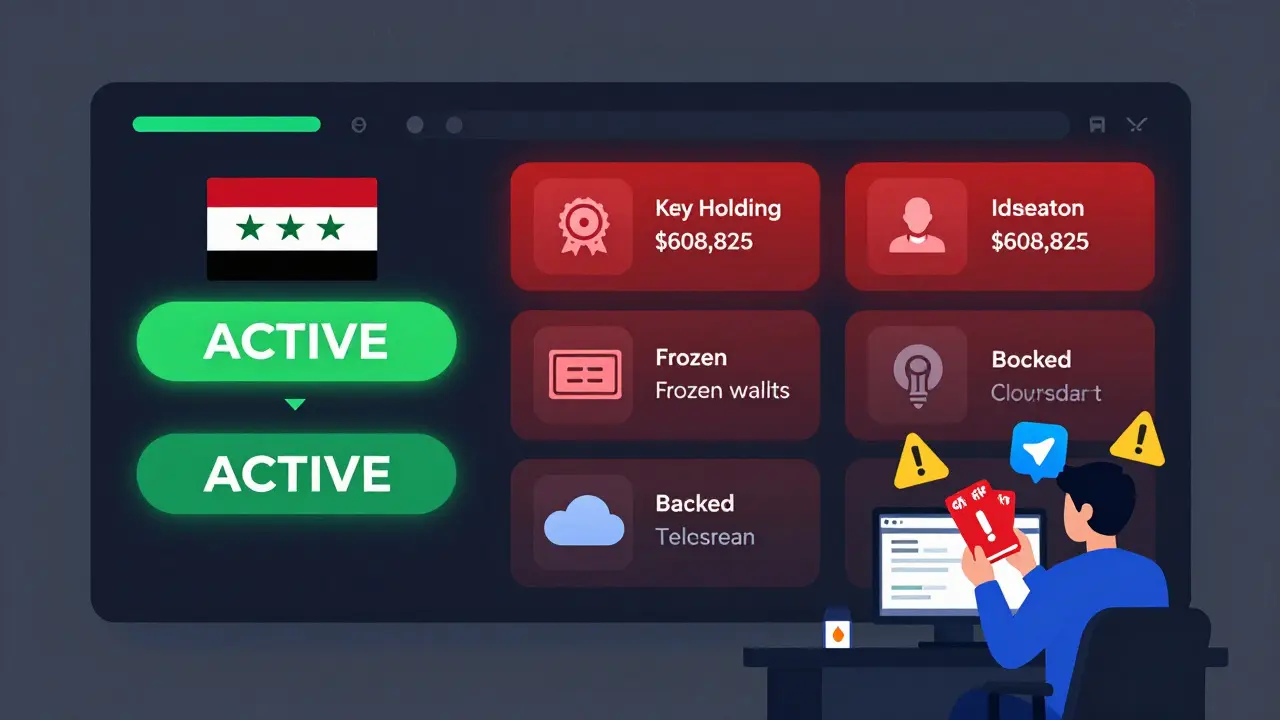

Just days after lifting sanctions on Syria, the Trump administration doubled down on Cuba with National Security Presidential Memorandum 5. It didn’t just keep the old rules - it made them stricter. U.S. companies were barred from doing business with Cuban entities, even through third countries. Non-U.S. subsidiaries of American firms were now explicitly targeted. And enforcement? It became brutal. In July 2025, a Delaware logistics company, Key Holding, LLC, paid over $600,000 just for shipping freight from Colombia to Cuba - a violation that was voluntarily disclosed. That’s not a warning. That’s a message.

What Changed in Syria?

Executive Order 14312 didn’t just tweak Syria’s status - it erased the legal foundation of the sanctions. Six executive orders dating back to 2004 were revoked. The national emergency declared after 9/11 that justified the crackdown was terminated. The Office of Foreign Assets Control (OFAC) removed every Syrian bank, company, and official from the Specially Designated Nationals (SDN) List - except for a few.

Who’s still banned? The Assad family. Former regime officials tied to human rights abuses. People involved in the captagon drug trade. Anyone threatening regional stability. That’s it. Everything else? Open for business.

For Syrian entrepreneurs, this meant new access to international payment systems. For diaspora communities sending money home, remittances became faster and cheaper. For crypto users, it was a game-changer. Before July 2025, Binance and other exchanges blocked Syrian users due to compliance fears. After? The blocks came down. Trading volumes spiked. Syrians could now buy Bitcoin, Ethereum, and stablecoins without needing a middleman.

But here’s the catch: Syria still has no crypto laws.

No licensing. No regulation. No clear rules on who can mine, trade, or hold digital assets. That means while access improved, legal clarity didn’t. Businesses dealing with Syrian partners now face a paradox: the U.S. says they can do business - but banks, payment processors, and fintechs still hesitate. Why? Because they’re scared of accidentally transacting with someone still on the targeted sanctions list. One wrong transfer, and your institution gets fined.

How Crypto Works in Syria Today

There’s no official crypto exchange in Syria. No central bank digital currency. No legal framework. But that doesn’t mean crypto isn’t used - it’s thriving in the shadows.

Most Syrians access crypto through peer-to-peer (P2P) platforms like LocalBitcoins and Paxful. Others use Binance P2P, which became fully operational in Syria after July 2025. USDT (Tether) is the most popular stablecoin - it’s used to buy goods, pay for services, and even salary workers in sectors like tech and construction.

Some businesses have started using Lightning Network solutions like Lightspark’s Grid Switch. It lets them receive cross-border payments in fiat through local Syrian banks, while the underlying settlement happens via Bitcoin’s Lightning Network. No crypto touches the user’s wallet - but the speed and cost savings are real.

Still, the lack of regulation creates risks. If the U.S. changes its mind again - and history says it might - those who used crypto to bypass old sanctions could be retroactively penalized. There’s no legal shield. No safe harbor. Just trust in current policy.

Cuba: The Opposite Outcome

If Syria was freed, Cuba was locked tighter.

The Cuba Assets Control Regulations (CACR) were never repealed. They were reinforced. NSPM-5 made it clear: even indirect involvement with Cuba is dangerous. A U.S. company can’t ship goods to Cuba through a Mexican warehouse. A German firm can’t provide cloud services to a Cuban startup if a U.S. citizen owns part of it. The rules are extra-territorial - and they’re enforced.

Key Holding’s $608,825 fine wasn’t an outlier. It was a template. OFAC is now auditing every shipment, every software license, every cloud contract that touches Cuba. The message is simple: if you’re American or have American ties, don’t even think about it.

And crypto? It’s not just restricted - it’s treated as a high-risk tool for evasion.

U.S. exchanges like Coinbase and Kraken still block Cuban users. Even if someone in Havana buys crypto on a non-U.S. exchange, transferring it to a wallet linked to a Cuban IP address triggers compliance alerts. Some Cubans use VPNs and offshore wallets - but that’s risky. OFAC has already tracked crypto transactions linked to Cuban military entities. In 2025, they froze a wallet that received $2.3 million in Bitcoin from a Russian exchange, traced back to a Cuban defense contractor.

For ordinary Cubans, crypto is less about freedom and more about survival. Remittances from the U.S. are nearly impossible. So they rely on friends abroad to buy gift cards, send them via Telegram, and cash them out through black-market traders. It’s messy. It’s slow. But it works.

Why the Double Standard?

Why lift sanctions on Syria but tighten them on Cuba?

The answer isn’t about human rights - it’s about geopolitics.

President Trump’s team framed Syria’s sanctions relief as a reward for cooperation. In early 2025, the Syrian government, under President Ahmed al-Sharaa, dissolved the former rebel group Hay’at Tahrir al-Sham (HTS), which the U.S. had labeled a terrorist organization. They handed over intelligence on Iranian-backed militias. They allowed U.S. diplomats back into Damascus. In return, they got economic access.

Cuba? No such deal. The Cuban government refused to negotiate on political prisoners. It kept its military ties with Russia and Iran. It didn’t change its stance on dissent. So the U.S. didn’t budge. In fact, it punished even symbolic gestures - like a Cuban tech startup offering free coding classes to Venezuelan refugees. OFAC called it “material support.”

This isn’t about democracy or freedom. It’s about leverage. Syria was a bargaining chip. Cuba was a symbol.

What This Means for Crypto Users

If you’re in Syria: you can now use crypto more freely than ever. But you’re still operating in a legal gray zone. Don’t assume protection. Don’t trust banks. Use P2P. Use stablecoins. Keep records. Assume the rules can change again tomorrow.

If you’re in Cuba: crypto is still a high-risk lifeline. Avoid U.S. platforms. Don’t link your wallet to any U.S.-based exchange. Use non-custodial wallets. Use privacy tools like Tor. But understand: if you’re caught, you won’t get a warning. You’ll get a freeze.

If you’re a business or fintech: Syria is open for service providers - if you do your due diligence. Screen every counterparty against the remaining targeted sanctions list. Use tools like Chainalysis or Elliptic to monitor transactions. Don’t rely on “Syria is open” as a blanket green light.

Cuba? Don’t even try. The risk isn’t worth the reward. OFAC doesn’t negotiate. They fine. And they’re watching.

The Bigger Picture

This isn’t just about Syria and Cuba. It’s about how the U.S. uses sanctions as a living, breathing weapon.

Iran? Still under maximum pressure. Russia? Sanctions expanded again in June 2025. Venezuela? Still blocked. China? New rules targeting AI chips and crypto mining equipment exports.

And crypto? It’s becoming the frontline. Not because it’s illegal - but because it’s hard to control. Governments can’t shut down a wallet. They can’t block a decentralized exchange. So they’re forcing exchanges to become enforcers. They’re pressuring banks to cut off anyone who touches sanctioned countries - even if the transaction is legal.

The result? A world where access to money depends on where you live - and who your government is friends with.

For Syrians, 2025 brought a rare chance to rebuild. For Cubans, it brought deeper isolation. And for crypto? It proved it’s not a tool of liberation - it’s a tool of power. Whoever controls the rules controls the flow.

Can I still use Binance in Syria after the sanctions were lifted?

Yes. After July 1, 2025, Binance lifted all restrictions on Syrian users. You can now trade, deposit, and withdraw without needing special permission. However, you must still avoid transacting with individuals or entities on OFAC’s targeted sanctions list - like members of the Assad family or captagon traffickers. Binance still performs automated screening, so unusual activity may trigger a review.

Is cryptocurrency legal in Cuba?

Cuba doesn’t have a law banning cryptocurrency, but U.S. sanctions make it nearly impossible to use legally. U.S.-based exchanges block Cuban users. International exchanges may freeze accounts linked to Cuban IPs. Any crypto transaction that involves a U.S. person, bank, or service is considered a violation of the Cuba Assets Control Regulations. While individuals still use crypto informally, doing so carries serious legal risk.

What happens if I send crypto to someone in Syria who’s on the sanctions list?

Even though broad Syria sanctions are gone, targeted sanctions still apply. If you send crypto to a sanctioned individual - like a former Assad regime official or someone tied to the captagon trade - your transaction could be flagged by blockchain analytics firms. U.S. financial institutions or crypto exchanges that process the transaction could face fines up to $1 million per violation. You could also be investigated for aiding a sanctioned person, even if you didn’t know their identity.

Can a U.S. company do business with a Cuban startup?

No. Under NSPM-5, U.S. persons - including companies, subsidiaries, and even contractors - are prohibited from engaging in any transaction involving Cuba, even indirectly. That includes cloud services, software licenses, consulting, or payment processing. The Key Holding case proves that even non-egregious violations result in six-figure penalties. There are no exceptions for small businesses or humanitarian work.

Are there any safe ways to send money to Cuba right now?

There are no safe, legal ways for U.S. citizens or companies to send money directly to Cuba. Some Cubans rely on third-country relatives to send cash via Western Union or MoneyGram through non-U.S. branches - like in Mexico or Spain. Others use gift cards or physical items mailed through unofficial channels. Crypto is risky and monitored. Any method involving U.S. infrastructure is legally dangerous. The only truly safe option is to avoid any transaction that touches U.S. systems.

Author

Ronan Caverly

I'm a blockchain analyst and market strategist bridging crypto and equities. I research protocols, decode tokenomics, and track exchange flows to spot risk and opportunity. I invest privately and advise fintech teams on go-to-market and compliance-aware growth. I also publish weekly insights to help retail and funds navigate digital asset cycles.