SafeMars (SMARS) Tax Calculator

Transaction Tax Breakdown

SafeMars charges a 4% transaction tax on every buy/sell. This tax is split evenly between reflections, liquidity, and burning.

Tax Distribution Results

About SafeMars (SMARS)

SafeMars is a deflationary cryptocurrency built on Binance Smart Chain. It distributes a portion of every transaction back to holders and adds liquidity automatically.

Imagine earning crypto just by holding a token in your wallet, no farming, no staking, and no constant trading. That’s the promise behind SafeMars, a micro‑cap DeFi token that relies on automatic reflections and liquidity generation to reward its community.

SafeMars (SMARS) is a deflationary cryptocurrency built on the Binance Smart Chain (BSC) that distributes a portion of every transaction back to holders and adds liquidity automatically. Launched as a fair‑launch, community‑driven project, SafeMars employs a 4% transaction tax split evenly between reflections and liquidity pool funding.

How the 4% Transaction Tax Works

- 2% Reflection: Every time SMARS is bought or sold, half of the tax is instantly and gaslessly sent to all existing wallets. Holders see their balances grow without any manual claim.

- 2% Liquidity: The other half is paired with BNB (Binance Coin) and added to the Liquidity Pool on PancakeSwap. This continuously raises the price floor and improves market depth.

- Burn Mechanism: A small portion of each transaction is also burned, slowly reducing total supply and creating scarcity over time.

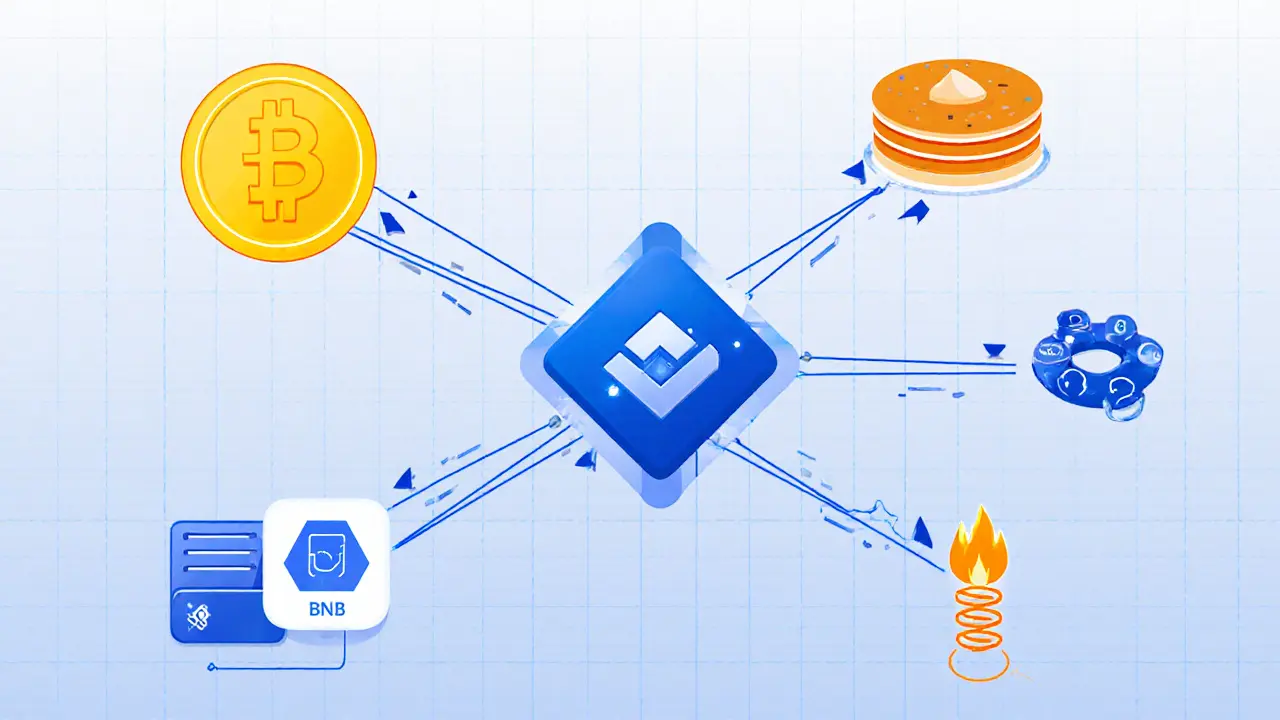

Key Components of the SafeMars Ecosystem

Understanding the surrounding infrastructure helps you gauge the token’s long‑term viability.

- Binance Smart Chain (BSC): The low‑fee, high‑throughput blockchain that powers SMARS transactions.

- BNB: The native BSC coin used to pay gas fees and to pair with SMARS for liquidity.

- PancakeSwap: The primary decentralized exchange where SMARS trades, mainly in the SMARS/WBNB pair.

- Reflection Token Model: A tokenomics style, popularized by projects like SafeMoon, where automatic rewards replace traditional farming.

- DeFi Token Classification: SMARS falls under the broader DeFi token umbrella, meaning it operates without a central authority.

Market Performance Snapshot (September2025)

As of 18September2025, SMARS is priced around $0.00000000619, with a 24‑hour volume of roughly $52,300 and a market‑cap ranking near 4,527. The token has shown a 10.9% price rise in the last day and a 70.43% gain over the past year, indicating high volatility typical of micro‑cap assets.

Historical Price Peaks & Valleys

- All‑time high: 0.28888e‑5USDT on 11May2021.

- Lowest point: 0.22e‑8USDT on 12May2022.

- Early‑2024 dip: Dropped below $0.00000000312 for the first time since 2021.

What Analysts Are Saying

Predictions vary, but most bullish forecasts target a breach of $0.0000000114 by the end of 2025, with some conservative models placing SMARS between $0.0000000056 and $0.0000000069. Longer‑term models suggest a potential rise to $0.0000000380 by 2030, contingent on community growth and broader BSC adoption.

Comparison with Similar Reflection Tokens

| Feature | SafeMars (SMARS) | SafeMoon | Reflecto |

|---|---|---|---|

| Blockchain | Binance Smart Chain | Binance Smart Chain | Ethereum (ERC‑20) |

| Transaction Tax | 4% (2% reflection, 2% liquidity) | 10% (5% reflection, 5% liquidity) | 5% (2% reflection, 3% liquidity) |

| Liquidity Pair | SMARS/WBNB on PancakeSwap | SafeMoon/WBNB on PancakeSwap | Reflecto/ETH on Uniswap |

| Current Price (Sept2025) | $0.00000000619 | $0.0000000152 | $0.0000000028 |

| Market Cap Rank | ~4,527 | ~2,300 | ~12,000 |

How to Buy & Store SafeMars Safely

- Set up a BSC‑compatible wallet (MetaMask, Trust Wallet, or Binance Chain Wallet).

- Fund the wallet with BNB to cover gas fees.

- Visit PancakeSwap, select the SMARS/WBNB pair, and adjust slippage tolerance (typically 5‑7%).

- Confirm the swap, then verify the SMARS balance appears in your wallet.

- Enable “auto‑receive reflections” - no extra steps needed; the protocol handles it.

Tip: Because SMARS trades at ultra‑low prices, use the “custom token address” feature to avoid selection errors.

Risks & Red Flags to Watch

- Extreme Volatility: Prices can swing 100%+ in a day; small trades may be wiped out by gas costs.

- Liquidity Constraints: Most volume flows through a single pair; large sell orders can cause steep price impact.

- Regulatory Uncertainty: Automatic reflections may be deemed securities‑like in certain jurisdictions.

- Limited Utility: Apart from passive rewards, SMARS offers little functional use case.

- Community‑Driven Governance: No formal roadmap means future development depends on volunteer contributors.

Future Outlook & Development Possibilities

For SMARS to survive beyond speculation, the community would need to add real‑world utility-perhaps integrating with NFT marketplaces or staking platforms. Ongoing maintenance of the smart contract, periodic audits, and clear communication can also boost investor confidence.

Frequently Asked Questions

What is SafeMars (SMARS) and how does it differ from SafeMoon?

SafeMars is a deflationary token on Binance Smart Chain that uses a 4% tax (2% reflection, 2% liquidity). SafeMoon applies a higher 10% tax and operates with a larger community. Both reward holders automatically, but SafeMars has a lower fee structure and a smaller market footprint.

Do I need to claim SMARS reflections?

No. Reflections are distributed instantly on each transaction, directly to every wallet that holds SMARS. You just keep the token in your address.

What wallets are compatible with SafeMars?

Any wallet that supports Binance Smart Chain works - MetaMask (configured for BSC), Trust Wallet, Binance Chain Wallet, and Ledger hardware wallets are the most common choices.

Is SafeMars a good long‑term investment?

It’s high risk. The token’s growth depends on community activity, liquidity, and possible regulatory actions. Consider it speculative and allocate only money you can afford to lose.

How can I reduce the impact of BNB gas fees when trading SMARS?

Trade during low‑traffic periods, bundle multiple transactions, or use a wallet that lets you set a custom gas price. Keep enough BNB in your wallet to cover fees before swapping.

Author

Ronan Caverly

I'm a blockchain analyst and market strategist bridging crypto and equities. I research protocols, decode tokenomics, and track exchange flows to spot risk and opportunity. I invest privately and advise fintech teams on go-to-market and compliance-aware growth. I also publish weekly insights to help retail and funds navigate digital asset cycles.