BitLicense: Your Guide to Crypto Exchange Licensing and Regulation

When working with BitLicense, the New York State Department of Financial Services' charter that lets crypto businesses operate legally in New York. Also known as NYDFS BitLicense, it sets the bar for capital, AML/KYC, and cybersecurity standards. NYDFS, the regulator that issues the BitLicense plays a pivotal role, while the European Union's MiCA, the Markets in Crypto‑Assets framework offers a parallel licensing model. Together, these entities form a global compliance landscape where BitLicense serves as a benchmark for market‑ready crypto firms.

Why the BitLicense Matters for Exchanges

The BitLicense demands at least $1 million in net worth, ongoing audit trails, and a dedicated compliance officer. Those requirements force exchanges to adopt robust AML/KYC programs, which in turn reduces fraud and boosts user confidence. In practice, BitLicense encompasses legal permission, operational controls, and consumer protection. Compared with MiCA’s lighter capital thresholds, the New York charter is stricter, yet many investors treat it as a trust seal. This dynamic influences where firms choose to launch: a startup might first join a regulatory sandbox, a controlled environment that lets innovators test services under relaxed rules before committing to a full BitLicense.

Sandbox programs directly affect BitLicense pathways because they provide a testbed for compliance tech, AML tooling, and risk‑management frameworks. Regulatory sandbox programs influence BitLicense compliance strategies by offering feedback loops with NYDFS auditors. Successful sandbox graduates often receive expedited reviews, cutting months off the licensing timeline. This link explains why many of the articles on our site—like the Bitroom review that flagged missing licensing, or the Koinde exchange deep‑dive—stress the importance of sandbox participation as a stepping stone.

From an operator’s viewpoint, the BitLicense shapes product design. Developers must embed transaction monitoring, set transaction limits, and publish clear privacy policies. Exchanges that ignore these rules face penalties, as seen in the Bitroom case where lack of a BitLicense led to a “scam” label. On the flip side, platforms that secure the charter—such as those highlighted in our global exchange CEO review—gain access to New York’s massive market and enjoy higher liquidity.

Overall, understanding the BitLicense helps you gauge which exchanges are trustworthy, which projects are ready for scaling, and how regulatory trends like MiCA or sandbox initiatives will impact the crypto landscape. Below you’ll find a curated set of guides, reviews, and analyses that break down tokenomics, exchange safety, and licensing nuances—giving you the practical insight you need to navigate today’s fast‑moving market.

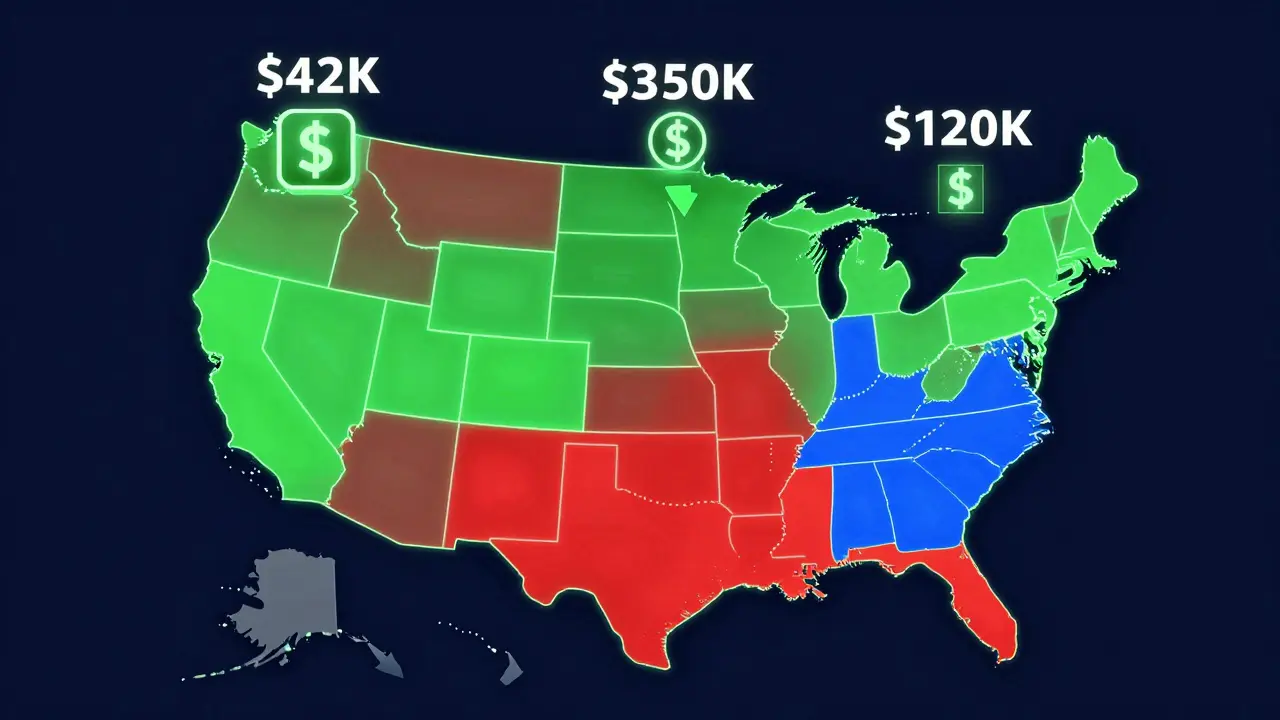

US Crypto Regulations by State: Complete Guide for 2026

Feb 24, 2026, Posted by Ronan Caverly

As of 2026, U.S. crypto regulations vary wildly by state - from New York's strict BitLicense to Wyoming's bank-like crypto framework. This guide breaks down what each state requires, who wins, who loses, and what's coming next.

MORE

Crypto Licensing Requirements: US MSB, BitLicense & Money Transmitter Guide

Oct 10, 2025, Posted by Ronan Caverly

A clear, step‑by‑step guide on US crypto licensing, covering MSB registration, BitLicense, state permits, costs, and a practical compliance checklist.

MORESEARCH HERE

Categories

TAGS

- decentralized exchange

- crypto exchange

- crypto exchange review

- crypto coin

- crypto airdrop

- cryptocurrency

- CoinMarketCap airdrop

- cryptocurrency trading

- smart contracts

- tokenomics

- DeFi

- cryptocurrency exchange safety

- crypto airdrop 2025

- cryptocurrency airdrop

- cryptocurrency exchange

- meme coin

- MiCA

- crypto airdrop guide

- blockchain token distribution

- crypto token