BTC/TRY Exchange Rate – Real‑Time Bitcoin to Turkish Lira Insights

When tracking BTC/TRY, the market price of Bitcoin expressed in Turkish Lira, you’re really looking at how Bitcoin, the world’s first decentralized digital currency trades against Turkish Lira, Turkey’s official fiat currency. This pair also depends on the crypto exchange, platforms that enable buying, selling and converting crypto to fiat you use, because fees, liquidity and local regulations shape the final rate you see. In plain terms, BTC/TRY tells you how many liras you need to buy one Bitcoin right now. The number moves with Bitcoin’s global volatility, Turkish inflation reports, and the supply of TRY on the market. For a trader, a sudden rise in BTC/TRY could signal growing local demand for crypto as a hedge against a weakening lira, while a dip might indicate capital controls or reduced buying power. Understanding the three‑way relationship—Bitcoin price, fiat currency strength, and exchange infrastructure—lets you predict short‑term swings and decide when to enter or exit a position.

Why BTC/TRY matters for traders and investors

The BTC/TRY rate captures three core dynamics. First, Bitcoin’s inherent volatility (subject, influences price swings) sets the baseline for any fiat conversion. Second, the Turkish Lira’s inflation trends and monetary policy (context, affects) can either amplify or dampen those swings, especially when the central bank adjusts interest rates or intervenes in foreign exchange markets. Third, regional exchange rules (requires, compliance) can restrict or enable crypto flow, meaning that a platform’s licensing status, KYC procedures, and fee structure directly impact the price you actually pay. Knowing how these elements interact helps you time purchases, hedge against fiat devaluation, or spot arbitrage windows across global markets. For example, a surge in local demand for crypto payments often pushes the BTC/TRY price above the global average, while tighter capital controls can compress the spread and create opportunities on peer‑to‑peer platforms. Additionally, the rise of Turkish‑based exchanges that offer lower withdrawal fees can make BTC/TRY more attractive for everyday users, whereas international exchanges might show a slightly higher rate due to conversion fees.

In the collection below you’ll find practical guides on crypto licensing, exchange reviews, airdrop alerts, and market analysis that all tie back to the BTC/TRY landscape. Whether you’re checking the latest regulatory sandbox in Turkey, comparing exchange fees for converting Bitcoin to TRY, or learning how mining difficulty affects Bitcoin’s supply, these articles give you the tools to navigate the pair with confidence. Dive in and see how each piece fits into the bigger picture of Bitcoin‑to‑Turkish‑Lira trading, providing actionable insights that can improve your trading decisions and keep you ahead of market shifts.

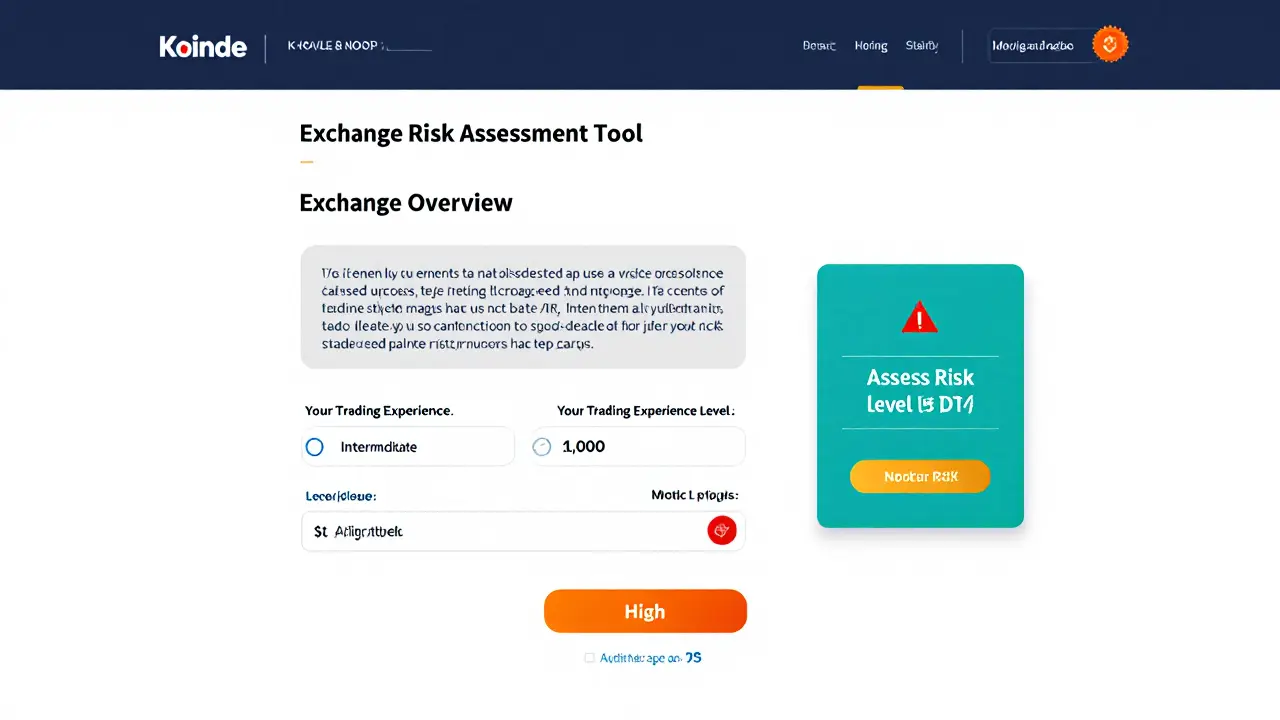

Koinde Crypto Exchange Review - Safety, Fees, and Who It’s Best For

Oct 5, 2025, Posted by Ronan Caverly

A detailed review of Koinde crypto exchange, covering fees, security, usability, and who should consider using this BTC‑only platform.

MORESEARCH HERE

Categories

TAGS

- decentralized exchange

- crypto exchange

- crypto exchange review

- crypto coin

- crypto airdrop

- cryptocurrency

- CoinMarketCap airdrop

- cryptocurrency trading

- smart contracts

- tokenomics

- DeFi

- cryptocurrency exchange safety

- crypto airdrop 2025

- cryptocurrency airdrop

- cryptocurrency exchange

- MiCA

- crypto airdrop guide

- blockchain token distribution

- crypto token

- Portugal crypto tax