DeFi Protocol: What It Is and How It’s Changing Crypto

When you hear DeFi protocol, a system on a blockchain that lets people lend, borrow, or trade crypto without banks or brokers. Also known as decentralized finance, it’s not just a buzzword—it’s how real people are moving money today, using tools like smart contracts and decentralized exchanges. You don’t need a bank account. You don’t need to fill out forms. You just need a wallet and an internet connection.

Most DeFi protocol, a system on a blockchain that lets people lend, borrow, or trade crypto without banks or brokers. Also known as decentralized finance, it’s not just a buzzword—it’s how real people are moving money today, using tools like smart contracts and decentralized exchanges. run on Ethereum, but now they’re popping up on BNB Chain, Solana, and even lesser-known chains. These systems use smart contracts, self-executing code on a blockchain that automatically follows rules without human intervention to handle loans, swaps, and rewards. No middleman. No delays. But also no customer service if something goes wrong. That’s why some DeFi protocols fail—like Caduceus CMP, which promised a metaverse but vanished. Others, like Berrie Dex, keep trading alive by letting users swap tokens directly on-chain.

DeFi isn’t just about trading. It’s tied to cryptocurrency, digital money that works without central control, using blockchain to record every transaction airdrops, privacy tools, and even underground markets. The GMEE and TAUR airdrops? They’re built on DeFi platforms that reward users for holding tokens or providing liquidity. Stablecoins like USDC and DAI? They’re the backbone of DeFi—keeping value steady so you can lend without losing half your money to volatility. And when countries ban crypto, like in Nigeria or Iran, DeFi protocols become the only way people still trade. Even Russia uses custom tokens to dodge sanctions, all powered by the same open-source code that runs your favorite DeFi app.

But here’s the thing: DeFi isn’t magic. It’s code. And code can break. That’s why you need to know what you’re getting into. A DeFi protocol might promise 20% returns, but if it’s not audited, or if the team walks away, your money vanishes. That’s why posts on BTC Sprint dig into real cases—like the GEO airdrop that collapsed, or VLXPAD’s fake "grand airdrop" scam. You’ll see how DAOs use governance tokens to vote on protocol changes, how privacy tools like Tornado Cash hide your trades, and why small DeFi coins are easy targets for 51% attacks. This isn’t theory. It’s what’s happening right now.

Below, you’ll find real stories about DeFi protocols in action—the good, the bad, and the outright scams. No fluff. No hype. Just what worked, what didn’t, and what you should watch out for next.

What is Zephyr Protocol (ZEPH) Crypto Coin? Privacy, Stability, and How It Works

Nov 20, 2025, Posted by Ronan Caverly

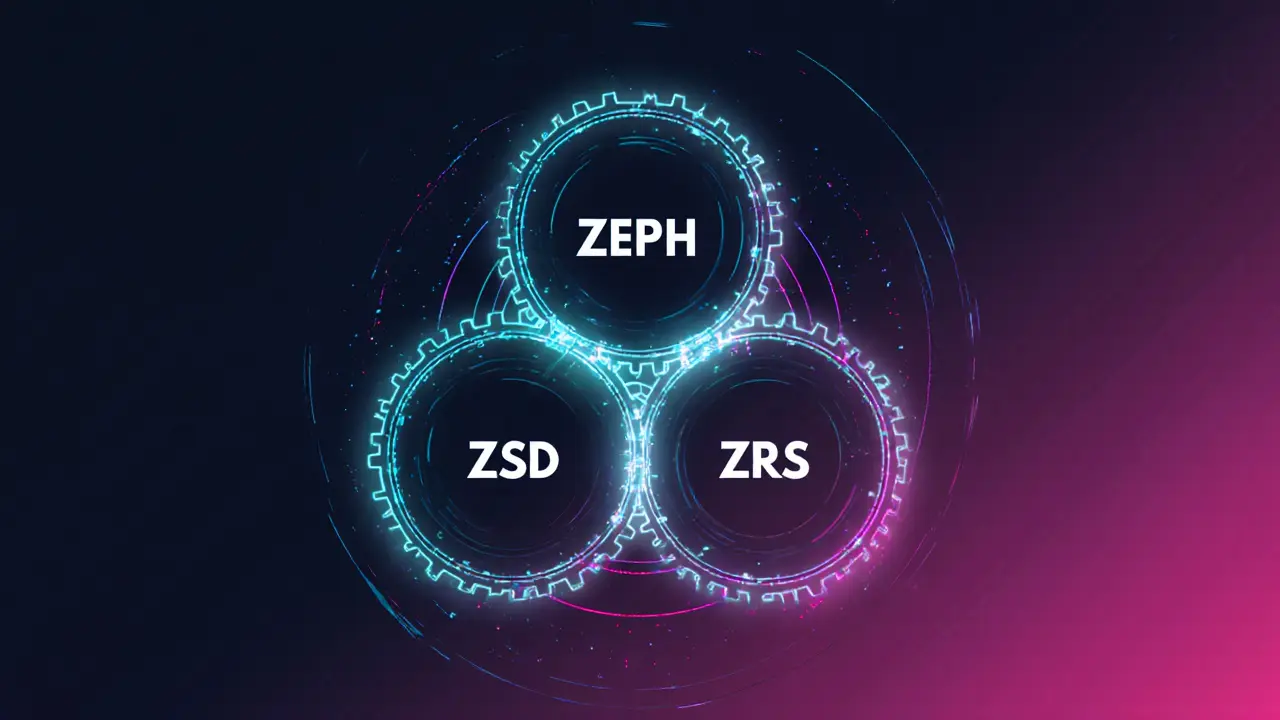

Zephyr Protocol (ZEPH) is a privacy-focused DeFi project that creates a crypto-backed stablecoin called ZSD. Unlike USDT or USDC, it’s fully anonymous, over-collateralized, and decentralized-no banks involved.

MORE

What is World Liberty Financial (WLFI) Crypto Coin? Token, Use Case, and Controversies Explained

Nov 1, 2025, Posted by Ronan Caverly

World Liberty Financial (WLFI) is a controversial DeFi protocol tied to Donald Trump, offering a USD1 stablecoin and tradable governance token. With $3.38B market cap and political scandals, it's crypto's most polarizing project.

MORESEARCH HERE

Categories

TAGS

- decentralized exchange

- crypto exchange

- crypto exchange review

- crypto coin

- crypto airdrop

- cryptocurrency

- CoinMarketCap airdrop

- cryptocurrency trading

- smart contracts

- tokenomics

- DeFi

- cryptocurrency exchange safety

- crypto airdrop 2025

- cryptocurrency airdrop

- cryptocurrency exchange

- MiCA

- crypto airdrop guide

- blockchain token distribution

- crypto token

- Portugal crypto tax