IRS Crypto Reporting: What You Need to Know

When dealing with IRS crypto reporting, the process of disclosing cryptocurrency transactions to the Internal Revenue Service. Also known as crypto tax reporting, it determines whether you owe taxes on trades, mining income, or airdrop receipts. IRS crypto reporting isn’t optional – the agency treats every digital asset like property, so each sale, exchange, or giveaway can trigger a capital‑gain event.

Key Pieces That Shape Your Reporting Landscape

Understanding the reporting puzzle starts with a few core entities. First, crypto licensing, the set of state and federal permissions required for exchanges and service providers sets the baseline for which platforms are legally allowed to collect and share transaction data with the IRS. Next, crypto regulation, the evolving body of rules from the Treasury, SEC, and FinCEN that define reporting obligations determines what information you must keep and when you need to file. Finally, tax compliance, the practice of accurately calculating and submitting tax liabilities ties everything together, ensuring that your capital gains, income, and deductions match the numbers the IRS expects.

These three entities intersect in clear ways: crypto licensing enables crypto regulation to be enforced, and both drive the standards for tax compliance. For example, an exchange that holds a BitLicense must issue Form 1099‑K to users, which then feeds directly into the taxpayer’s Form 8949. If the exchange isn’t licensed, the IRS may still request transaction records under subpoena, putting the burden of record‑keeping on you.

Another important link is between crypto regulation and the specific forms you file. The IRS requires every crypto transaction to be reported on Form 8949, which rolls up into Schedule D of your 1040. Failure to attach a completed Form 8949 can trigger an audit flag, especially if the total crypto sales exceed $10,000. In practice, that means you need to track every buy, sell, swap, and receipt – even a tiny airdrop can create a taxable event if its fair market value at receipt is above $0.01.

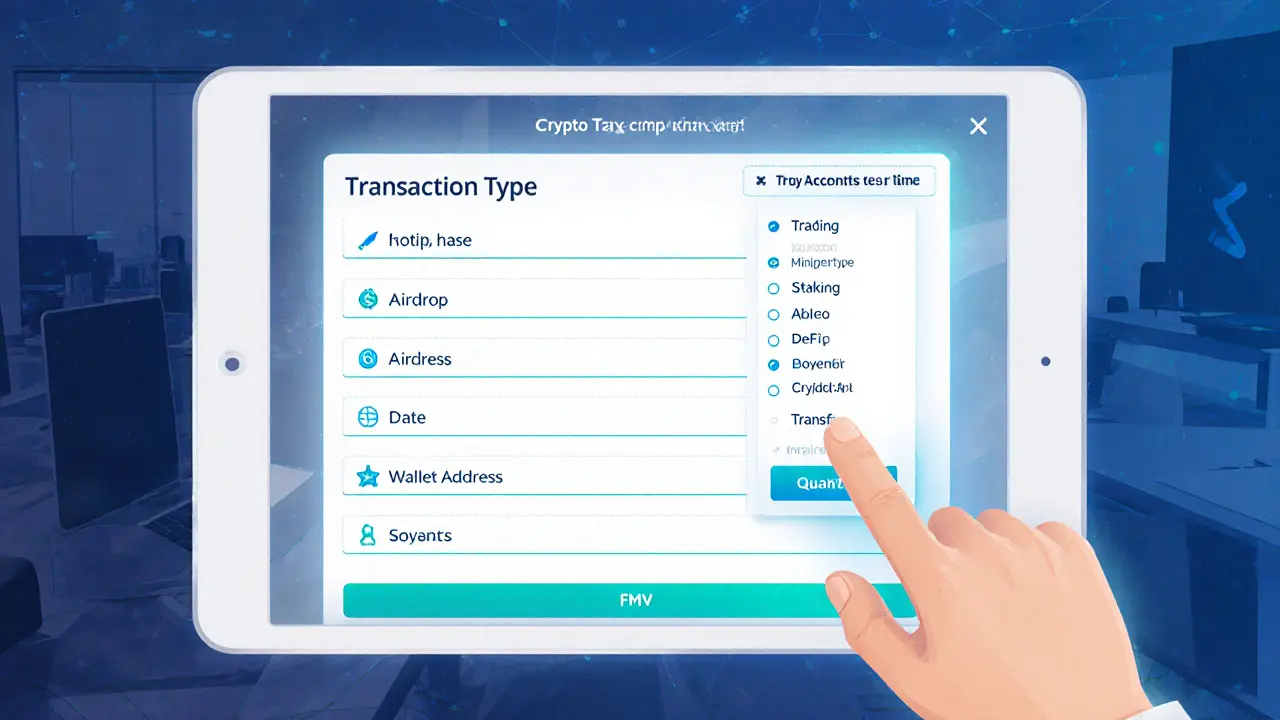

Putting these pieces into action starts with solid record‑keeping. Use a crypto tax software that pulls data from licensed exchanges, wallets, and DeFi protocols. The software will calculate cost basis, short‑ and long‑term gains, and generate a ready‑to‑file Form 8949. Many tools also flag transactions that fall under the IRS’s “like‑kind” exclusion – a loophole that existed before 2018 but is now closed for crypto, so you should treat every swap as a taxable event.

Once your numbers are in hand, the filing process is straightforward but detail‑heavy. Enter each transaction line on Form 8949, include the date acquired, date sold, proceeds, cost basis, and gain or loss. If you have more than 100 lines, you can attach a CSV spreadsheet instead of typing each entry. After completing Form 8949, transfer the totals to Schedule D, then add any crypto‑related income (like mining rewards) to Schedule 1. Don’t forget to attach a statement if you used the “crypto tax software” method – the IRS now acknowledges these reports as valid supporting documentation.

Staying ahead of IRS crypto reporting also means watching the regulatory environment. The Treasury’s proposed “crypto tax reporting” rule aims to require brokers to report transactions above $600, similar to the 1099‑B threshold for stocks. While the rule is still in comment phase, early adopters are already updating their compliance frameworks. By understanding the interplay between licensing, regulation, and compliance now, you’ll avoid scrambling when the new thresholds take effect.

In short, mastering IRS crypto reporting is about three things: 1) knowing which platforms are properly licensed, 2) understanding the regulatory mandates that dictate what you must report, and 3) using reliable tools to keep your tax compliance on point. The articles below dive deeper into each of these areas, from detailed licensing guides to step‑by‑step tax filing tutorials. Explore them to build a complete picture of how you can stay compliant, minimize surprises, and keep your crypto journey on the right side of the law.

Crypto Tax Record Keeping: Complete Guide to Stay IRS-Compliant

Dec 20, 2024, Posted by Ronan Caverly

Learn how to keep flawless crypto tax records under the new 2025 IRS rules, including Form 1099-DA, wallet-by-wallet accounting, and tools to stay audit‑ready.

MORESEARCH HERE

Categories

TAGS

- decentralized exchange

- crypto exchange

- crypto exchange review

- crypto coin

- crypto airdrop

- cryptocurrency

- CoinMarketCap airdrop

- cryptocurrency trading

- smart contracts

- tokenomics

- DeFi

- cryptocurrency exchange safety

- crypto airdrop 2025

- cryptocurrency airdrop

- cryptocurrency exchange

- MiCA

- crypto airdrop guide

- blockchain token distribution

- crypto token

- Portugal crypto tax