Low Fee DEX: The Fast, Cheap Way to Trade Crypto

When working with Low fee DEX, a platform that lets you swap tokens with minimal transaction costs. Also known as cheap DEX, it is a specialized form of Decentralized Exchange, an exchange that operates without a central authority and runs on smart contracts. A low fee DEX encompasses cheap token swaps, requires efficient routing algorithms, and relies on community‑driven liquidity. By cutting out middlemen and optimizing gas consumption, these platforms let you keep more of your crypto while still accessing deep markets. If you’ve ever been shocked by high fees on traditional DEXs, this is the kind of solution you’ve been waiting for. low fee DEX brings the power of decentralization together with cost‑effective trading, making it ideal for both casual users and seasoned arbitrageurs.

How Automated Market Makers Keep Fees Low

The heart of any low fee DEX is its Automated Market Maker, a smart‑contract‑based pricing engine that automatically provides liquidity and sets prices according to a mathematical formula. This technology influences trade pricing by constantly rebalancing pools, which eliminates the need for order books and reduces overhead. Because AMMs calculate optimal routes across multiple pools, they can find the cheapest path for a swap, dramatically dropping the effective fee per trade. The relationship can be summed up as: Low fee DEX utilizes Automated Market Makers to achieve low slippage and cheap execution. In practice, you’ll see lower fee tiers, sometimes under 0.1%, especially when the platform bundles transactions or leverages layer‑2 solutions. The result is a smoother experience where users spend less on gas and more on the assets they actually want.

Behind the scenes, Liquidity Providers, users who deposit assets into AMM pools in exchange for a share of trading fees, play a crucial role. Their willingness to lock capital creates the depth needed for low slippage, while fee‑sharing incentives keep the pools healthy. At the same time, Gas fees, the cost paid to miners or validators for processing transactions on a blockchain, are kept in check by using efficient contract designs or by operating on cheaper networks like Polygon or Optimism. The synergy works like this: Liquidity Providers supply the capital, Automated Market Makers price the swaps, and low gas fees make the whole process affordable. As a trader, you’ll notice faster confirmations and smaller deductions from each trade. Below, you’ll find a curated list of articles that dive deeper into licensing, tokenomics, exchange reviews, and real‑world use cases—all tied to the low‑cost world of DEX trading.

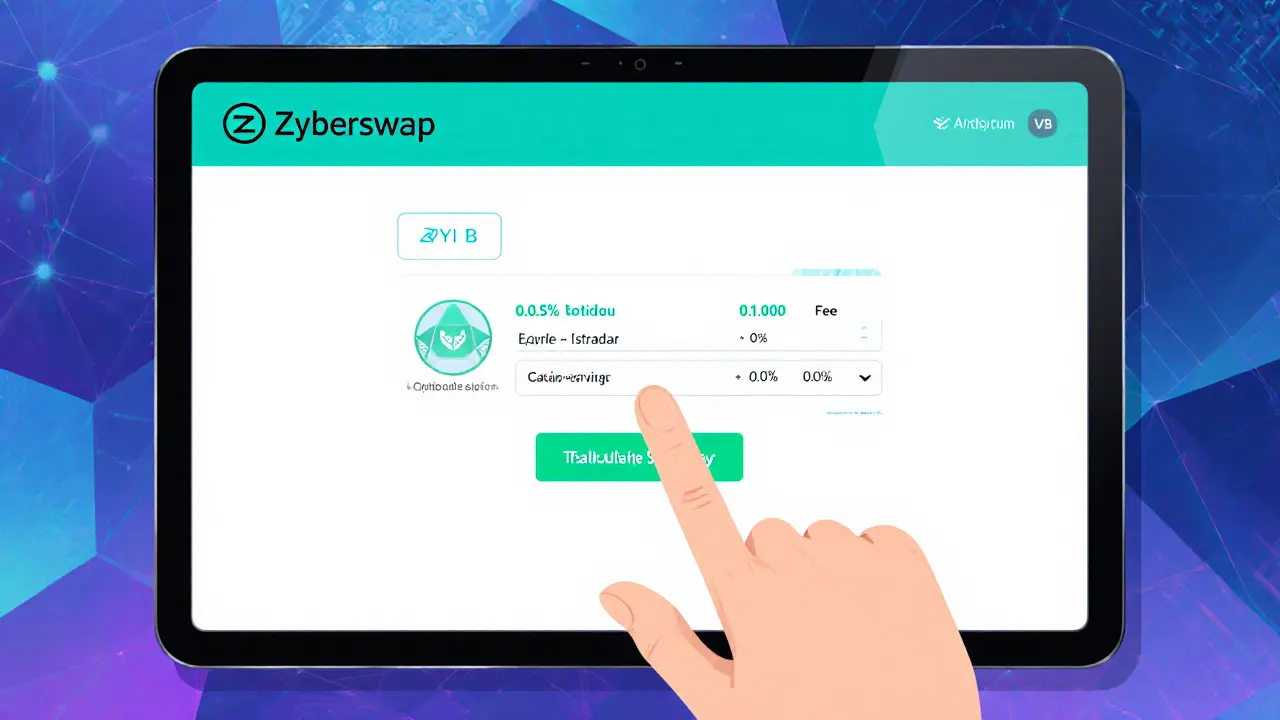

Zyberswap v3 Review: Fees, Features, and How It Stacks Up

Nov 18, 2024, Posted by Ronan Caverly

In‑depth review of Zyberswap v3 covering fees, liquidity, tokenomics, security and how it compares to major DEXs on Arbitrum.

MORESEARCH HERE

Categories

TAGS

- decentralized exchange

- crypto exchange

- crypto exchange review

- crypto coin

- crypto airdrop

- cryptocurrency

- CoinMarketCap airdrop

- cryptocurrency trading

- smart contracts

- tokenomics

- DeFi

- cryptocurrency exchange safety

- crypto airdrop 2025

- cryptocurrency airdrop

- cryptocurrency exchange

- MiCA

- crypto airdrop guide

- blockchain token distribution

- crypto token

- Portugal crypto tax