Order Book DEX: How Decentralized Exchanges Use Order Books to Trade Crypto

When you trade crypto on a order book DEX, a type of decentralized exchange that matches buy and sell orders directly like a traditional stock exchange. Also known as centralized order book DEX, it’s one of the few ways to trade crypto with real-time price discovery—no automated market makers, no liquidity pools guessing your intent. Unlike Uniswap-style DEXes that use pools, an order book DEX shows you actual bids and asks, just like buying stocks on Robinhood. This means you see exactly what price someone is willing to pay or accept—no slippage surprises, no hidden fees from price impact.

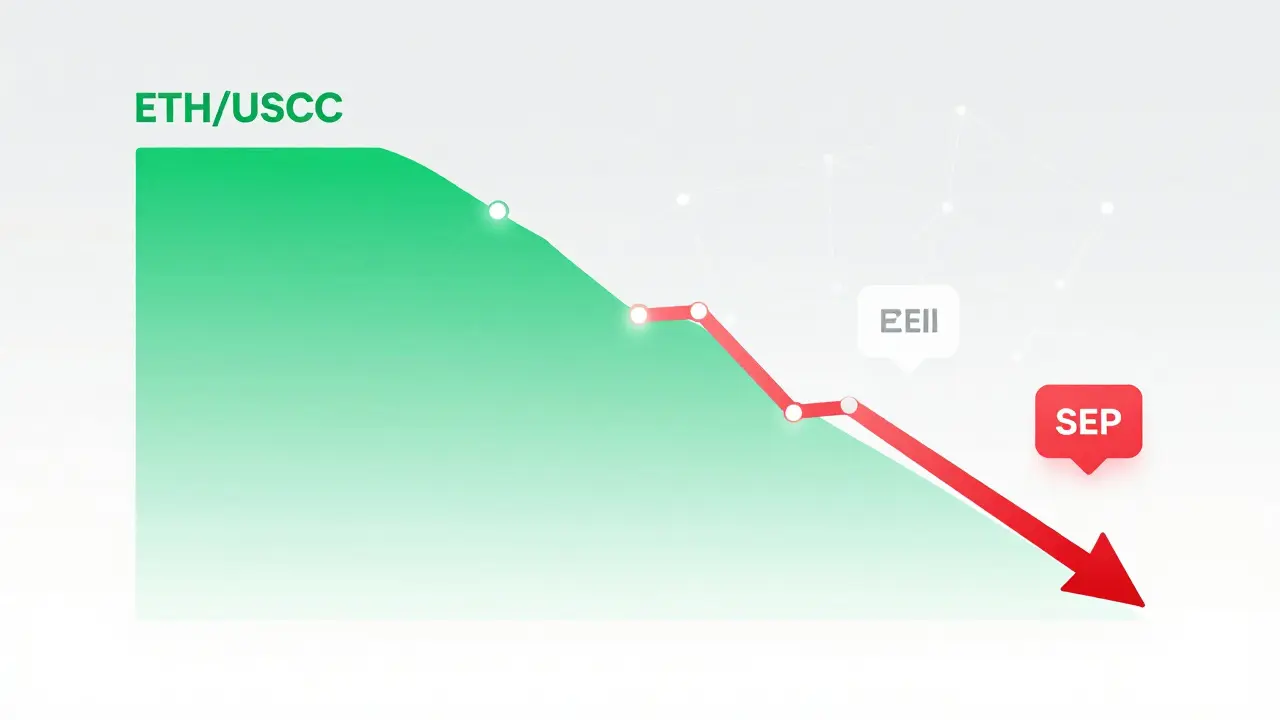

But here’s the catch: most order book DEXes still struggle with liquidity. You’ll find plenty of projects like Skydrome, a niche DEX on Scroll using a ve(3,3) model to combine liquidity and governance or Uniswap v2 on Avalanche, a fast, low-cost DEX that still relies on liquidity pools, not true order books, but few actually run pure order book systems at scale. That’s because building a deep order book requires serious volume—and most retail traders don’t have the capital to keep bids and asks tight. That’s why many DEXes switched to automated market makers (AMMs) like Uniswap. They’re easier to launch, but they sacrifice transparency.

Still, order book DEXes aren’t dead—they’re just waiting for the right moment. When Ethereum layer-2s like Scroll or zkSync get more users, and when institutional traders start moving in, the demand for precise price control will bring order books back. Right now, if you’re trading on a DEX and you see a clear ladder of buy and sell orders—without any automated pricing—you’re on an order book DEX. That’s rare, but it’s powerful. You’re not trusting a formula. You’re trusting real people placing real orders.

That’s why the posts below dive into exactly that: platforms that tried to make order books work, what went wrong, and which ones still have a shot. You’ll see how order book DEX models compare to AMMs, why some failed despite strong tech, and what to look for when you find one that’s actually alive. Some are dead. Some are hiding in plain sight. And a few might be the next big thing—if you know what to watch for.

Decentralized Exchange Order Books Explained: How They Work and Why They Matter

Dec 1, 2025, Posted by Ronan Caverly

Decentralized exchange order books let traders buy and sell crypto directly with others, using real-time bid and ask prices. Unlike AMMs, they offer precise control, deeper liquidity for large trades, and transparent market data-ideal for serious traders.

MORESEARCH HERE

Categories

TAGS

- decentralized exchange

- crypto exchange

- crypto exchange review

- crypto coin

- crypto airdrop

- cryptocurrency

- CoinMarketCap airdrop

- smart contracts

- tokenomics

- DeFi

- cryptocurrency exchange safety

- crypto airdrop 2025

- cryptocurrency airdrop

- cryptocurrency exchange

- MiCA

- crypto airdrop guide

- blockchain token distribution

- Portugal crypto tax

- crypto scam

- crypto exchange scam