QuickSwap: What It Is, How It Works, and What You Need to Know

When you trade crypto without a middleman, you’re using a QuickSwap, a decentralized exchange built on the Polygon network that lets users swap tokens directly from their wallets. Also known as QuickSwap V3, it’s one of the most used DEXs on Polygon because it’s cheap, fast, and doesn’t need approval from any company. Unlike centralized exchanges like Binance or Coinbase, QuickSwap runs on code—no passwords, no KYC, no account freezes. You connect your wallet, pick two tokens, and click swap. That’s it.

QuickSwap is built on the same idea as Uniswap, the original automated market maker (AMM) that changed how crypto trading works. But while Uniswap runs on Ethereum, where gas fees can hit $50 per trade, QuickSwap runs on Polygon, a Layer 2 scaling solution that makes transactions 100x cheaper and 10x faster. That’s why people who trade small amounts, test new tokens, or use DeFi daily pick QuickSwap. It’s not just a backup—it’s the default for many because it just works.

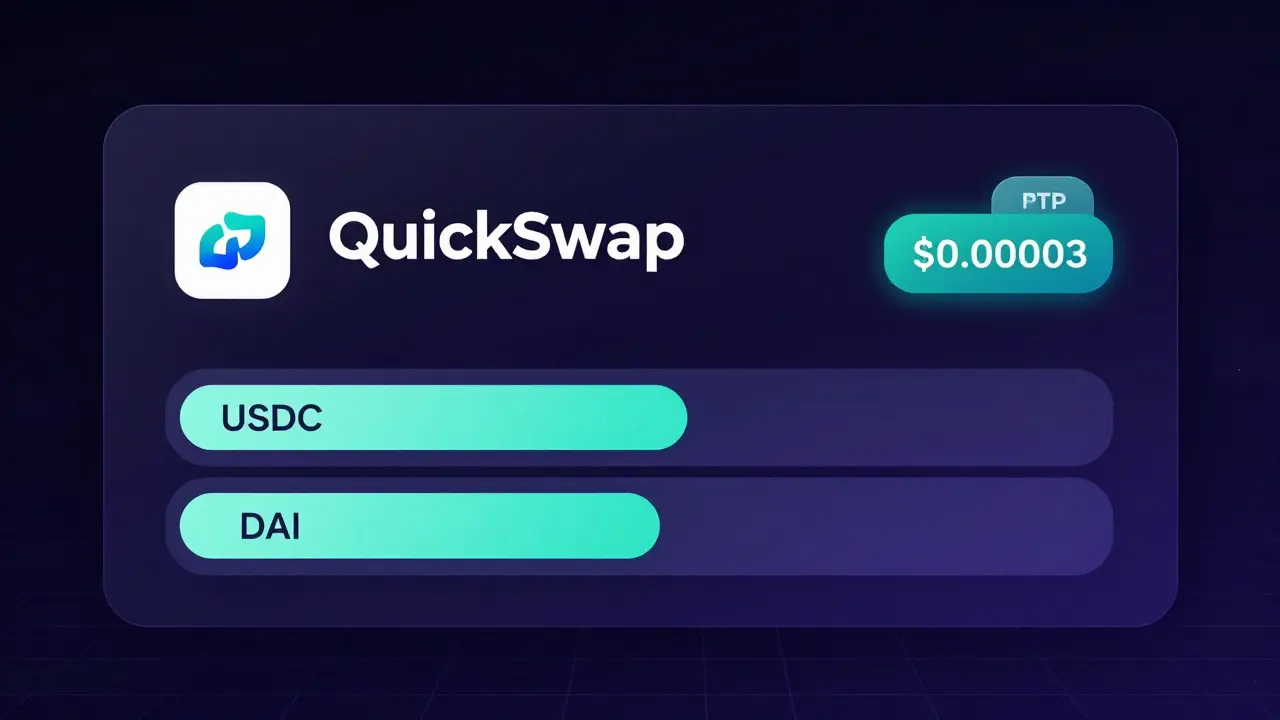

QuickSwap doesn’t use order books. Instead, it uses liquidity pools. Anyone can add tokens to a pool and earn fees from trades. That’s how QuickSwap stays liquid without needing big investors. The most popular pools are for MATIC, USDC, DAI, and wrapped ETH. But you’ll also find hundreds of lesser-known tokens—some are scams, some are real projects trying to grow. That’s the trade-off: more options, more risk.

It’s not perfect. QuickSwap has had smart contract bugs in the past. It’s not insured. If you send tokens to the wrong address, they’re gone forever. And because it’s open to anyone, scammers often list fake tokens with names like "ETH" or "USDT" to trick people. That’s why you always check the contract address before swapping. A quick Google search or a look at the official QuickSwap site will show you the real ones.

QuickSwap is also used by other DeFi apps—lending platforms, yield farms, and staking pools often integrate with it because of its low cost and Polygon’s speed. If you’re using a DeFi project on Polygon, chances are it’s talking to QuickSwap behind the scenes.

What you’ll find in the posts below are real examples of what people actually do with QuickSwap. Some posts show how to avoid losing money on fake tokens. Others explain how to earn fees by adding liquidity. A few dig into how it compares to other Polygon DEXs like SushiSwap or Aave. You’ll also see posts about tokens that were listed on QuickSwap and then vanished—what happened, who got burned, and how to spot the same pattern before it happens to you. No fluff. No hype. Just what works, what doesn’t, and why.

QuickSwap Crypto Exchange Review: Is It the Best DEX for Polygon Users?

Dec 8, 2025, Posted by Ronan Caverly

QuickSwap is a fast, low-cost decentralized exchange on Polygon - perfect for traders avoiding Ethereum fees. No CookSwap exists. Here's how QuickSwap works, who it's for, and what to watch out for.

MORESEARCH HERE

Categories

TAGS

- decentralized exchange

- crypto exchange

- crypto exchange review

- crypto coin

- crypto airdrop

- cryptocurrency

- CoinMarketCap airdrop

- smart contracts

- tokenomics

- DeFi

- cryptocurrency exchange safety

- crypto airdrop 2025

- cryptocurrency airdrop

- cryptocurrency exchange

- MiCA

- crypto airdrop guide

- blockchain token distribution

- Portugal crypto tax

- crypto scam

- crypto exchange scam