Crypto Trading: How to Navigate Volatility, Airdrops, and Real Platforms

When you start crypto trading, the act of buying and selling digital assets like Bitcoin, Ethereum, or niche tokens to profit from price movements. Also known as digital asset trading, it’s not about luck—it’s about knowing what’s real and what’s just noise. Most people think it’s all about charts and timing, but the real game is spotting the difference between a working project and a ghost token. Look at the posts below—half of them are about coins that vanished, exchanges that disappeared, or airdrops that never paid out. If you don’t know how to filter the dead weight, you’ll lose money before you even click buy.

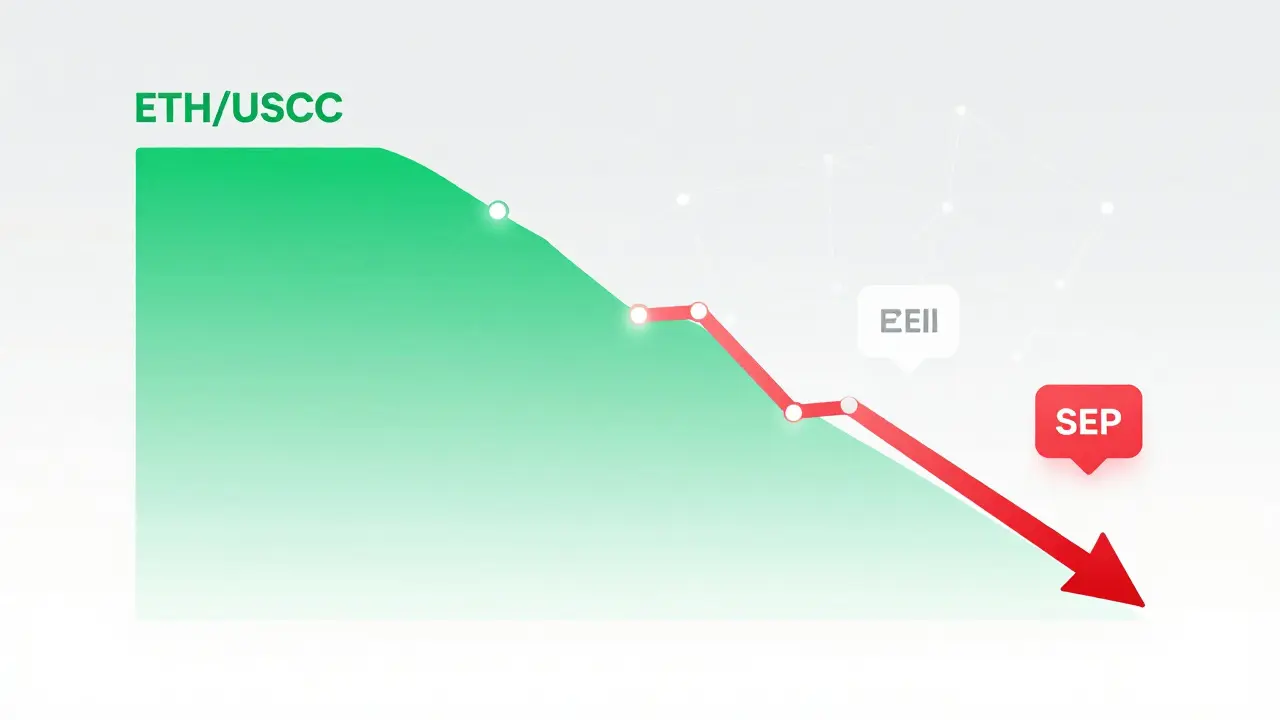

One of the biggest traps in crypto trading, the act of buying and selling digital assets like Bitcoin, Ethereum, or niche tokens to profit from price movements. Also known as digital asset trading, it’s not about luck—it’s about knowing what’s real and what’s just noise. is chasing hype. You see a coin with a flashy name and a promise of quick gains, but if it has zero trading volume, no updates in years, or no exchange listings, it’s not an investment—it’s a tombstone. Take EDOGE, UNN, or VALI—these were once talked about, now they’re digital ghosts. Meanwhile, the smart traders are watching staking rewards, earnings generated by locking up crypto to support a blockchain network, often measured in APY. Also known as yield farming, it’s a way to earn passive income without selling your holdings. or learning how stablecoins, cryptocurrencies pegged to real-world assets like the U.S. dollar to reduce volatility. Also known as digital fiat, they’re the backbone of safe trading in wild markets. keep prices steady during crashes. And when it comes to crypto airdrop, free token distributions given to users for past activity or participation, often used to bootstrap new networks. Also known as token giveaways, they’re not free money unless you know which ones are legit., most are scams. But retroactive airdrops from Uniswap or Arbitrum? Those paid real cash to early users who just held and used the platform. That’s the difference between playing a lottery and playing the game right.

There’s no magic formula, but there are clear signs: check trading volume, look for active development, and ask who’s behind it. If a project has no team, no roadmap, and no liquidity, walk away. The best traders don’t chase every new coin—they focus on what’s working now, what’s transparent, and what’s actually being used. Below, you’ll find real breakdowns of failed tokens, how to calculate staking returns, which airdrops still have value, and why some stablecoins are safer than others. No fluff. No promises. Just what you need to trade smarter.

Decentralized Exchange Order Books Explained: How They Work and Why They Matter

Dec 1, 2025, Posted by Ronan Caverly

Decentralized exchange order books let traders buy and sell crypto directly with others, using real-time bid and ask prices. Unlike AMMs, they offer precise control, deeper liquidity for large trades, and transparent market data-ideal for serious traders.

MORESEARCH HERE

Categories

TAGS

- decentralized exchange

- crypto exchange

- crypto exchange review

- crypto coin

- crypto airdrop

- cryptocurrency

- CoinMarketCap airdrop

- smart contracts

- tokenomics

- DeFi

- cryptocurrency exchange safety

- crypto airdrop 2025

- cryptocurrency airdrop

- cryptocurrency exchange

- MiCA

- crypto airdrop guide

- blockchain token distribution

- Portugal crypto tax

- crypto scam

- crypto exchange scam