On-Chain Order Book: What It Is and Why It Matters in Crypto Trading

When you trade crypto on a decentralized exchange, you're not just sending money—you're interacting with a live on-chain order book, a real-time list of buy and sell orders recorded directly on the blockchain, visible to anyone, and impossible to manipulate by a single entity. Also known as blockchain order book, it removes the middleman and lets you see exactly what others are willing to pay or accept, without relying on a company’s hidden data. Unlike centralized exchanges like Binance or Coinbase, where order books are stored on private servers, an on-chain order book lives openly on the blockchain. Every bid, every ask, every fill is permanently recorded and verifiable. This isn’t just transparency—it’s trust built into the code.

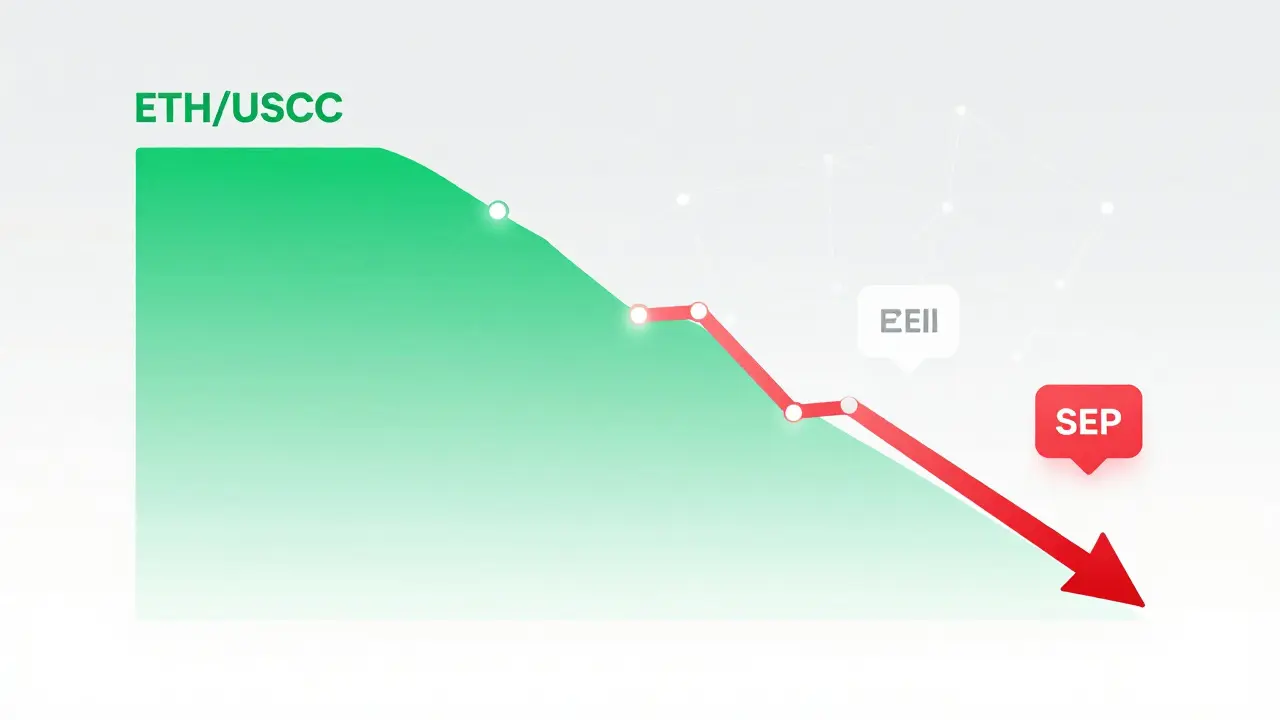

This shift changes everything. If you’ve ever wondered why some DeFi trades feel unpredictable or why prices jump suddenly, the answer often lies in how liquidity is structured. A decentralized exchange, a platform where trades happen directly between users without a central authority, using smart contracts to match orders like Uniswap or Skydrome doesn’t use traditional order books. Instead, it uses automated market makers (AMMs), which pool liquidity and set prices algorithmically. But newer protocols are bringing back the order book model—on-chain. That means you can now see depth, slippage, and large orders before you trade, just like on a traditional exchange, but with full auditability. This is especially powerful when you’re dealing with low-volume tokens like VALI or BEM, where off-chain data is unreliable or fake. Knowing what’s really happening on-chain can save you from getting trapped in a dead project’s liquidity trap.

The blockchain liquidity, the amount of tradable assets available on a decentralized platform, directly visible and measurable through on-chain data isn’t just a number—it’s a story. Look at the EPCOIN x CMC airdrop or the Age of Tanks NFT campaign. People rushed in hoping for quick gains, but without clear on-chain liquidity data, they had no way to tell if the token had real buyers or if it was just a shell. An on-chain order book answers that. It shows you if there are actual buyers waiting at $0.001 or if the price is being pushed up by bots with no real demand behind it. You can spot wash trading, fake volume, and hidden sell walls before you commit your funds.

And it’s not just for traders. Developers building new DEXs, like the ve(3,3) model used by Skydrome, rely on on-chain order book data to design better incentives. Investors tracking projects like Zephyr Protocol or REVOX use it to verify whether the token’s price movement is supported by real market activity—or just hype. Even when a project like UNION Protocol or EDRCoin dies, the on-chain order book remains as a public record of its final moments: zero bids, zero asks, no buyers. That’s not speculation. That’s fact.

What you’ll find below are real-world examples of what happens when traders ignore on-chain data—and what happens when they don’t. From dead tokens with no liquidity to emerging DEXs that are rebuilding trust one order at a time, these posts show you how to read the market the way it was meant to be seen: open, honest, and on the blockchain.

Decentralized Exchange Order Books Explained: How They Work and Why They Matter

Dec 1, 2025, Posted by Ronan Caverly

Decentralized exchange order books let traders buy and sell crypto directly with others, using real-time bid and ask prices. Unlike AMMs, they offer precise control, deeper liquidity for large trades, and transparent market data-ideal for serious traders.

MORESEARCH HERE

Categories

TAGS

- decentralized exchange

- crypto exchange

- crypto exchange review

- crypto coin

- crypto airdrop

- cryptocurrency

- CoinMarketCap airdrop

- smart contracts

- tokenomics

- DeFi

- cryptocurrency exchange safety

- crypto airdrop 2025

- cryptocurrency airdrop

- cryptocurrency exchange

- MiCA

- crypto airdrop guide

- blockchain token distribution

- Portugal crypto tax

- crypto scam

- crypto exchange scam