QuickSwap Review: What It Is, How It Works, and If It's Still Worth Using

When you trade crypto without a middleman, you're using a QuickSwap, a decentralized exchange built on the Polygon network that lets users swap tokens directly from their wallets. Also known as QuickSwap V3, it's one of the most used DEX platforms on Polygon, designed for speed and low fees. Unlike big exchanges like Binance or Coinbase, QuickSwap doesn’t hold your money. You connect your wallet—MetaMask, Trust Wallet, or others—and trade directly with other users through smart contracts. No sign-up. No KYC. Just swap.

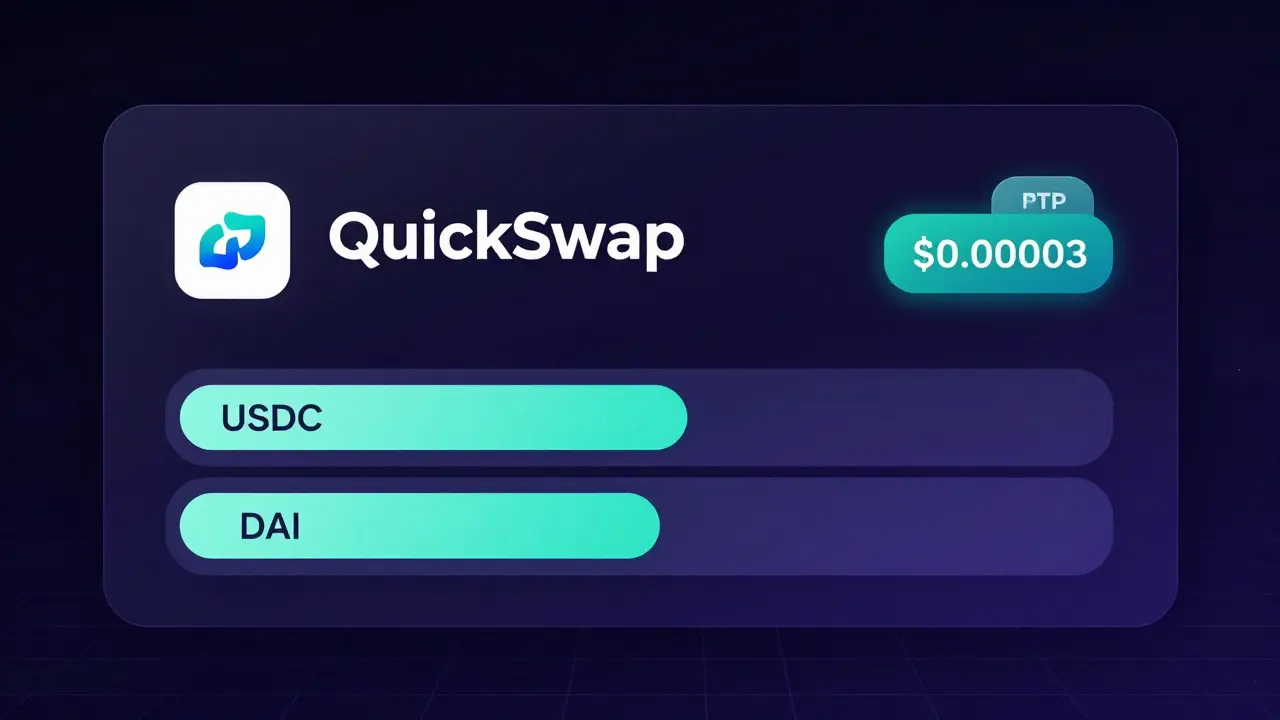

QuickSwap runs on an AMM, an Automated Market Maker system that uses math instead of order books to set prices. Also known as liquidity pool trading, this model lets anyone add tokens to a pool and earn fees from trades. It’s how Uniswap and SushiSwap work too, but QuickSwap is optimized for Polygon, which means transactions cost pennies and finish in seconds. That’s why traders who hate Ethereum’s high gas fees flock here. If you’re swapping MATIC, USDC, or any Polygon-based token, QuickSwap is often the fastest route.

But here’s the catch: QuickSwap isn’t a full exchange. It doesn’t offer fiat on-ramps, margin trading, or staking rewards like some competitors. It’s focused on one thing—swapping tokens fast. That’s great if you’re a DeFi user who already holds crypto. Not so great if you’re just starting out and need to buy crypto with a credit card. Also, while it’s safe from a technical standpoint, you still need to watch out for fake tokens. Scammers create tokens with names like "ETH" or "USDT" and trick users into swapping them. Always check contract addresses before trading.

QuickSwap’s ecosystem includes tools like Polygon, a Layer 2 blockchain built to scale Ethereum with lower fees and faster blocks. Also known as Matic Network, it’s the foundation that makes QuickSwap possible. Without Polygon, QuickSwap would be slow and expensive—just like Uniswap on Ethereum. That’s why QuickSwap thrives here. It’s not trying to compete with centralized exchanges. It’s solving a different problem: giving DeFi users a cheap, fast way to move between tokens.

So is QuickSwap still worth using in 2025? If you’re active in Polygon-based DeFi, yes. If you’re trading popular tokens like USDT, DAI, or MATIC, it’s one of the best options. But if you’re looking for a full-service exchange with staking, futures, or customer support, you’ll need something else. QuickSwap doesn’t do that. It does one thing well: swap tokens fast, cheap, and without permission.

Below, you’ll find real reviews, user experiences, and deep dives into how QuickSwap compares to other DEXs—some working, some dead. No hype. Just what actually happened when people used it.

QuickSwap Crypto Exchange Review: Is It the Best DEX for Polygon Users?

Dec 8, 2025, Posted by Ronan Caverly

QuickSwap is a fast, low-cost decentralized exchange on Polygon - perfect for traders avoiding Ethereum fees. No CookSwap exists. Here's how QuickSwap works, who it's for, and what to watch out for.

MORESEARCH HERE

Categories

TAGS

- decentralized exchange

- crypto exchange

- crypto exchange review

- crypto coin

- crypto airdrop

- cryptocurrency

- CoinMarketCap airdrop

- smart contracts

- tokenomics

- DeFi

- cryptocurrency exchange safety

- crypto airdrop 2025

- cryptocurrency airdrop

- cryptocurrency exchange

- MiCA

- crypto airdrop guide

- blockchain token distribution

- Portugal crypto tax

- crypto scam

- crypto exchange scam