Wallet Accounting: Track, Report, and Optimize Your Crypto Finances

When dealing with Wallet Accounting, the practice of recording, categorizing, and analyzing every movement of digital assets. Also called crypto finance tracking, it sits at the intersection of several key tools. A Crypto Wallet, the software or hardware where you store coins generates the raw data. Transaction Tracking, the systematic logging of each send, receive, or swap turns that data into a usable ledger. Meanwhile, Tax Reporting, the process of converting on‑chain activity into compliant tax forms ensures you stay legal. Finally, Blockchain Analytics, advanced tools that label and enrich transaction data adds context that makes accounting smarter.

Why Wallet Accounting Matters for Every Crypto User

Wallet accounting encompasses transaction tracking, which in turn influences your tax reporting obligations. If you ignore the link between a crypto wallet and its transactions, you’ll miss the data needed for accurate tax filings. On the flip side, robust blockchain analytics can flag unusual flows, helping you spot errors or fraud before they hurt your balance sheet. This chain of relationships—wallet → transactions → analytics → tax—creates a safety net that protects both casual traders and institutional players. The posts in this collection, like the US MSB licensing guide or the Thailand exchange licensing overview, all hinge on solid accounting foundations; regulators expect clear records, and investors demand transparency.

Practical wallet accounting starts with choosing the right tools. Many users rely on built‑in export features from major wallets, but third‑party platforms add categorization, fiat conversion, and automated tax form generation. When a new token like PREME or SafeMars lands in your wallet, a good analytics suite will instantly label it, pull its tokenomics, and flag any special tax treatment—something you’d have to research manually otherwise. Aligning your wallet data with exchange activity (think Koinde, Bitroom, or DSTOQ) also ensures you capture the full picture of buys, sells, and fees, which the licensing guides stress as essential for compliance.

Beyond compliance, wallet accounting helps you optimize performance. By reviewing transaction costs, you can spot patterns—like repeatedly paying high network fees on a specific blockchain—and switch to cheaper alternatives. Detailed reports also reveal which assets generate real returns versus speculative noise, guiding better portfolio decisions. The “Crypto Regulatory Sandbox” article shows how innovators can prototype new financial products, but they still need clean accounting to convince regulators and investors alike.

Ready to dive deeper? Below you’ll find a curated set of articles that walk through licensing steps, token deep‑dives, exchange reviews, and more—all tied together by the common thread of solid wallet accounting. Whether you’re filing taxes, preparing for a regulator audit, or just trying to make your crypto holdings work harder, these resources give you the practical insights you need.

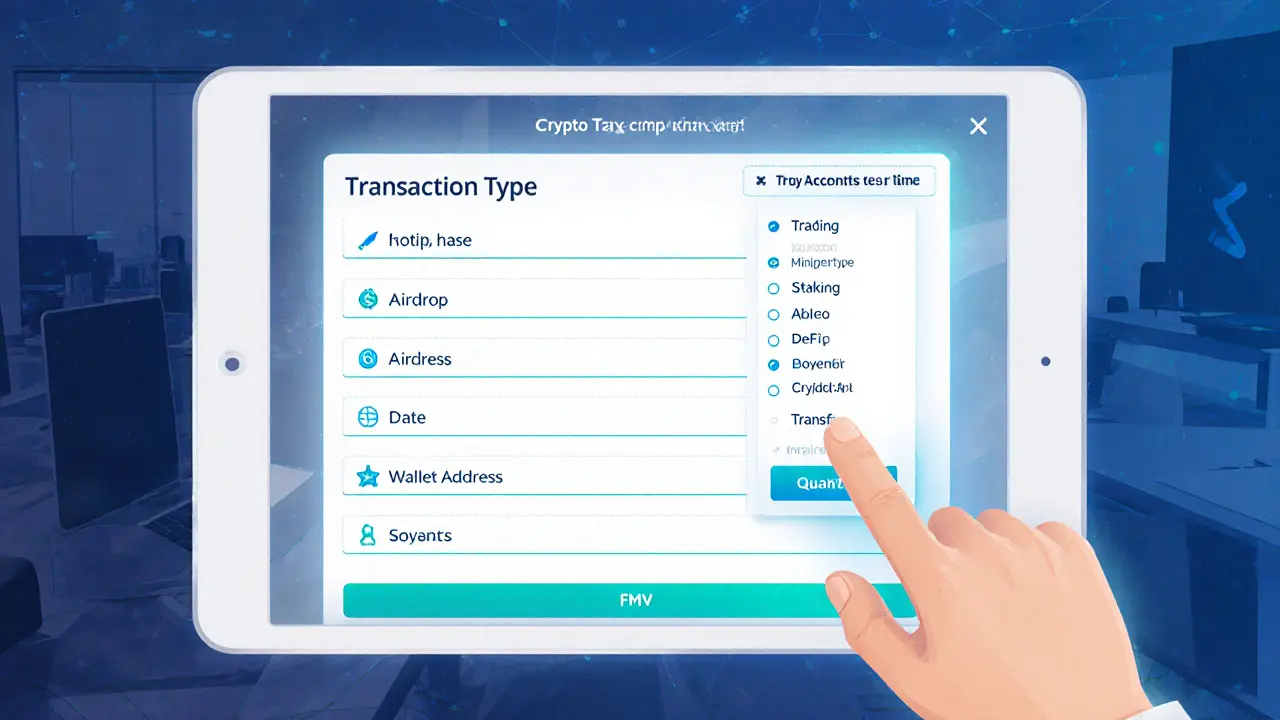

Crypto Tax Record Keeping: Complete Guide to Stay IRS-Compliant

Dec 20, 2024, Posted by Ronan Caverly

Learn how to keep flawless crypto tax records under the new 2025 IRS rules, including Form 1099-DA, wallet-by-wallet accounting, and tools to stay audit‑ready.

MORESEARCH HERE

Categories

TAGS

- decentralized exchange

- crypto exchange

- crypto exchange review

- crypto coin

- crypto airdrop

- cryptocurrency

- CoinMarketCap airdrop

- cryptocurrency trading

- smart contracts

- tokenomics

- DeFi

- cryptocurrency exchange safety

- crypto airdrop 2025

- cryptocurrency airdrop

- cryptocurrency exchange

- MiCA

- crypto airdrop guide

- blockchain token distribution

- crypto token

- Portugal crypto tax