Decentralized Exchange

When working with Decentralized Exchange, a peer‑to‑peer platform that lets you trade crypto without a central authority. Also known as DEX, it relies on open‑source code and community governance.

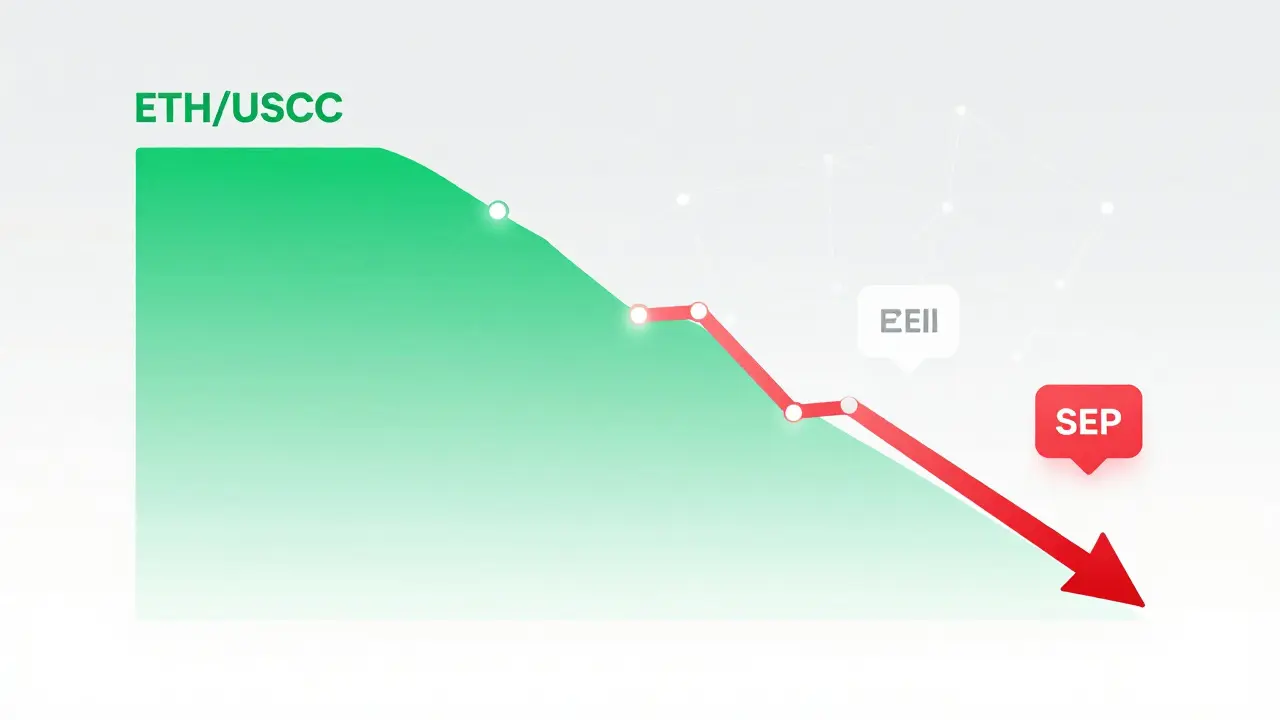

One core component is Liquidity Pools, collections of tokens that traders draw from and deposit into. These pools power an Automated Market Maker (AMM), an algorithm that sets price based on pool ratios instead of order books. Both rely on Smart Contracts, self‑executing code that enforces trade rules without human intervention. Together they enable fast, trustless swaps, and they often connect through Cross‑Chain Bridges, tools that move assets between different blockchains. In short, a decentralized exchange encompasses liquidity pools, requires smart contracts, and leverages AMMs to facilitate trading.

Why Decentralized Exchanges Matter

DEXs give you control over your keys, lower entry barriers, and often lower fees than centralized rivals. But they also bring new risks—code bugs, impermanent loss in pools, and regulatory gray zones. Our collection below tackles those angles: detailed reviews of platforms like Zyberswap v3, Koinde, Bitroom, PrimeBit and DSTOQ; safety checklists; fee breakdowns; and how recent licensing news in the US, EU and Asia can affect your trading strategy. Whether you’re hunting the best swap rates, figuring out airdrop opportunities, or staying compliant with new crypto laws, the articles ahead give you actionable insight.

Ready to dive deeper? Below you’ll find concise guides, expert analysis, and practical tips that cut through the jargon and help you make informed moves on any decentralized exchange.

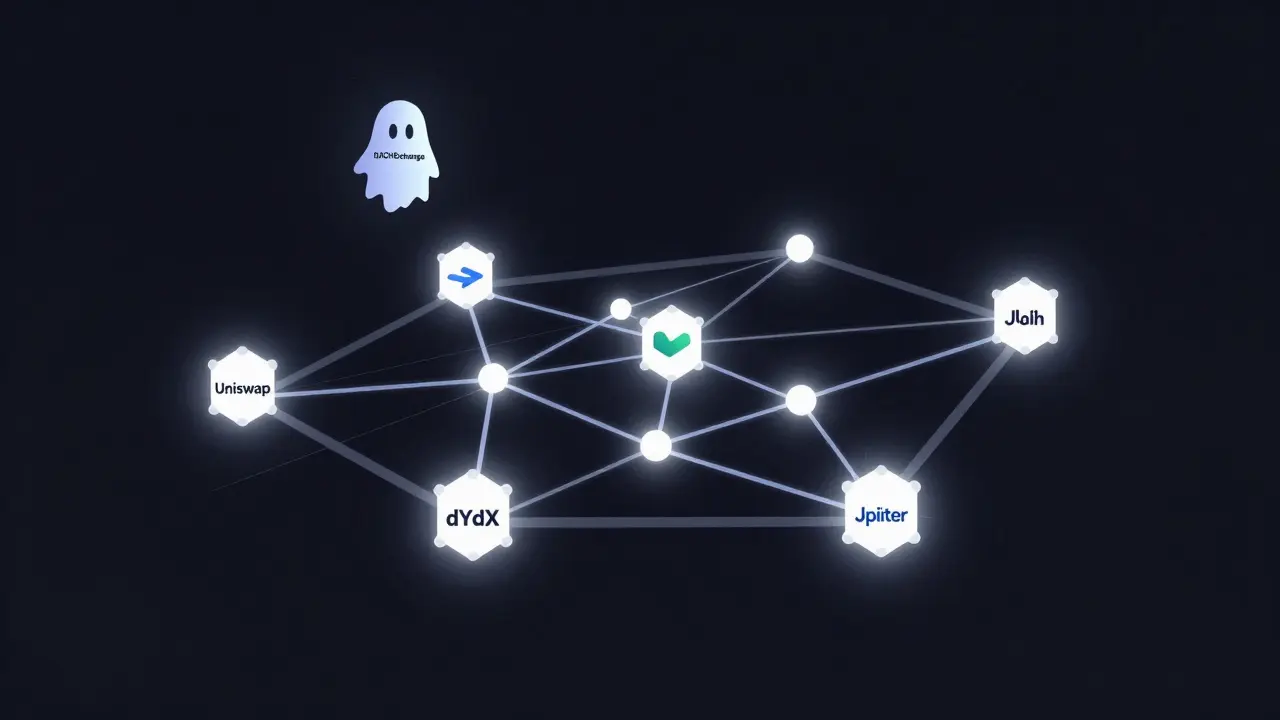

DACHExchange Crypto Exchange Review: What You Need to Know in 2026

Feb 23, 2026, Posted by Ronan Caverly

DACHExchange claims to be a decentralized crypto exchange in 2026, but there's no verifiable data, team, or on-chain activity. Learn why it's a red flag and what real DEXs you should use instead.

MORE

KibbleSwap Crypto Exchange Review: Niche DEX for DogeChain Users

Feb 16, 2026, Posted by Ronan Caverly

KibbleSwap is a niche decentralized exchange built exclusively for DogeChain. It offers low-slippage swaps and $KIB rewards but lacks audits, support, and cross-chain functionality. Only use it if you're already deep in the DogeChain ecosystem.

MORE

Hpdex Crypto Exchange Review: What You Need to Know Before Trading

Jan 27, 2026, Posted by Ronan Caverly

Hpdex is a niche decentralized exchange on the HPB Blockchain with a fixed HPD token supply. No audits, no liquidity data, and minimal community activity make it risky. Only use it if you hold HPB assets.

MORE

Apex Protocol Crypto Exchange Review: Performance, Fees, and Is It Right for You?

Jan 10, 2026, Posted by Ronan Caverly

Apex Protocol is a decentralized crypto exchange offering low-fee perpetual futures with a centralized-like interface. Learn its strengths, limitations, and whether it's right for your trading strategy in 2026.

MORE

Escodex Crypto Exchange Review: Low Fees, No Fiat, and What It Means for Traders

Jan 4, 2026, Posted by Ronan Caverly

Escodex is a low-fee crypto exchange built on BitShares with a flat 0.10% trading fee and no fiat support. Ideal for experienced traders who already own crypto and want to cut costs - but not for beginners.

MORE

PulseX Crypto Exchange Review: Low Fees, High Risk in a Niche DEX

Dec 14, 2025, Posted by Ronan Caverly

PulseX is a low-fee decentralized exchange on PulseChain, ideal for frequent traders tired of Ethereum gas costs. But with thin liquidity and bridge risks, it's best for experienced users who understand the trade-offs.

MORE

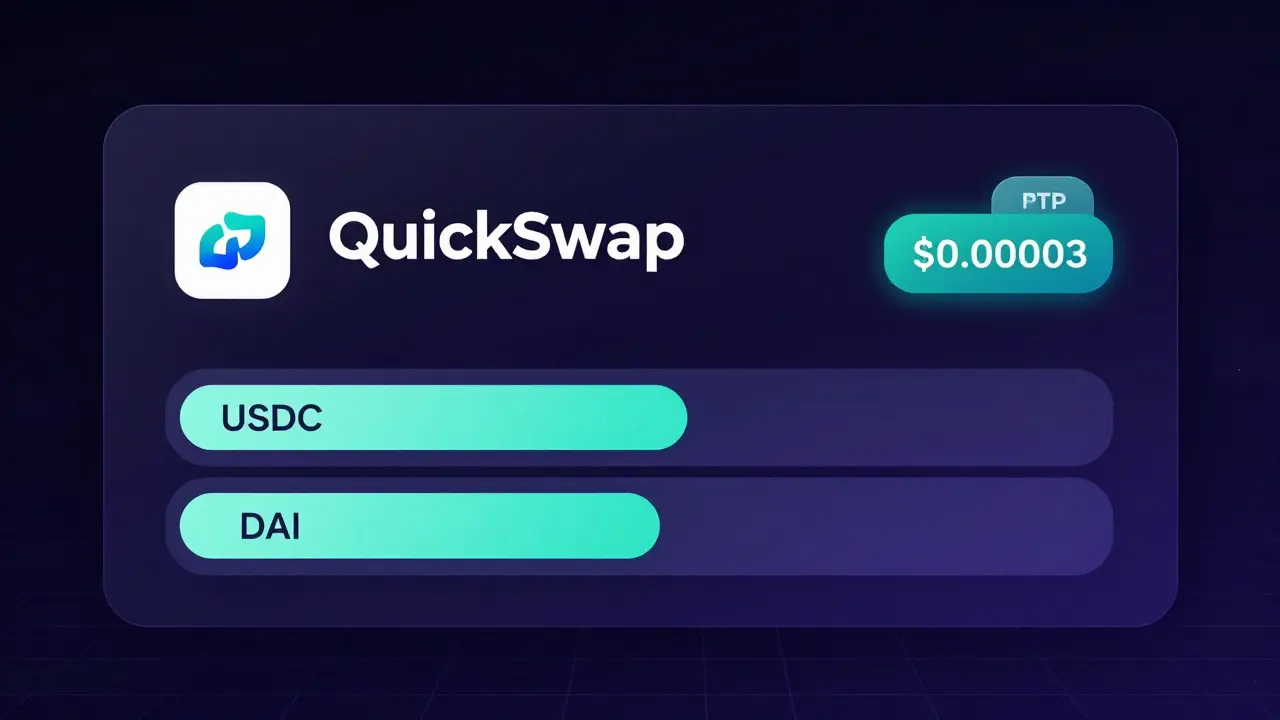

QuickSwap Crypto Exchange Review: Is It the Best DEX for Polygon Users?

Dec 8, 2025, Posted by Ronan Caverly

QuickSwap is a fast, low-cost decentralized exchange on Polygon - perfect for traders avoiding Ethereum fees. No CookSwap exists. Here's how QuickSwap works, who it's for, and what to watch out for.

MORE

Decentralized Exchange Order Books Explained: How They Work and Why They Matter

Dec 1, 2025, Posted by Ronan Caverly

Decentralized exchange order books let traders buy and sell crypto directly with others, using real-time bid and ask prices. Unlike AMMs, they offer precise control, deeper liquidity for large trades, and transparent market data-ideal for serious traders.

MORE

Skydrome (Scroll) Crypto Exchange Review: Is It Worth Using in 2025?

Nov 15, 2025, Posted by Ronan Caverly

Skydrome is a niche decentralized exchange on Scroll, using a unique ve(3,3) model to combine liquidity and governance. But with almost no SKY token trading volume and no exchange listings, it's high-risk and only for serious DeFi users.

MORE

Berrie Dex (BERRIE) Explained: Crypto Token Overview

Oct 16, 2025, Posted by Ronan Caverly

Berrie Dex (BERRIE) is a multi‑chain order‑book DEX token. Learn how it works, its tokenomics, supported chains, risks, and how to start trading.

MORE

DackieSwap (DACKIE) Explained: What the Crypto Coin and DEX Do

Sep 24, 2025, Posted by Ronan Caverly

Learn what DackieSwap is, how its DACKIE token works, AI routing features, market performance, risks, and step‑by‑step usage for this niche decentralized exchange.

MORE

Ubeswap V2 (UBE) Explained: Crypto Token & Celo DEX Overview

Aug 10, 2025, Posted by Ronan Caverly

Learn what Ubeswap V2 (UBE) is, how its Celo‑based DEX works, token mechanics, liquidity situation, and how to start swapping or earning rewards.

MORESEARCH HERE

Categories

TAGS

- decentralized exchange

- crypto exchange

- crypto exchange review

- crypto coin

- crypto airdrop

- cryptocurrency

- CoinMarketCap airdrop

- cryptocurrency trading

- smart contracts

- tokenomics

- DeFi

- cryptocurrency exchange safety

- crypto airdrop 2025

- cryptocurrency airdrop

- cryptocurrency exchange

- MiCA

- crypto airdrop guide

- blockchain token distribution

- crypto token

- Portugal crypto tax